Does Merck KGaA’s 19% Drop Signal Opportunity Amid Changing Pharma Landscape?

Reviewed by Bailey Pemberton

- Wondering if Merck KGaA's recent price dip is actually presenting a hidden value opportunity? You’re not alone. Knowing how to spot these moments is what separates the casual observer from the informed investor.

- It’s been a choppy ride lately, with the stock down 1.4% over the last week, 5.8% over the past month, and a notable 19.2% slide so far this year.

- These moves haven’t happened in a vacuum. Shifts in the German pharmaceutical sector and regulatory changes have been stirring up investor expectations, while ongoing strategic partnerships in biotech have kept industry watchers closely tuned in. The market narrative around Merck KGaA is evolving, reflecting both emerging optimism and fresh uncertainty.

- Right now, Merck KGaA scores a 5 out of 6 on our undervaluation checks, indicating there’s more to the story than price charts alone can show. Let's break down how traditional valuation tools stack up here, and stick around because there is a smarter approach to pricing a stock that we'll explore by the end of this article.

Find out why Merck KGaA's -25.0% return over the last year is lagging behind its peers.

Approach 1: Merck KGaA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to today's value. This provides an objective way to judge whether a stock is priced attractively.

For Merck KGaA, the DCF analysis starts with its current Free Cash Flow, which stands at approximately €1.82 billion. Over the next decade, analyst estimates and model projections suggest this figure could more than double, reaching about €4.22 billion by 2035. Analysts provide estimates for the first five years, while the following years are extrapolated using long-term growth assumptions.

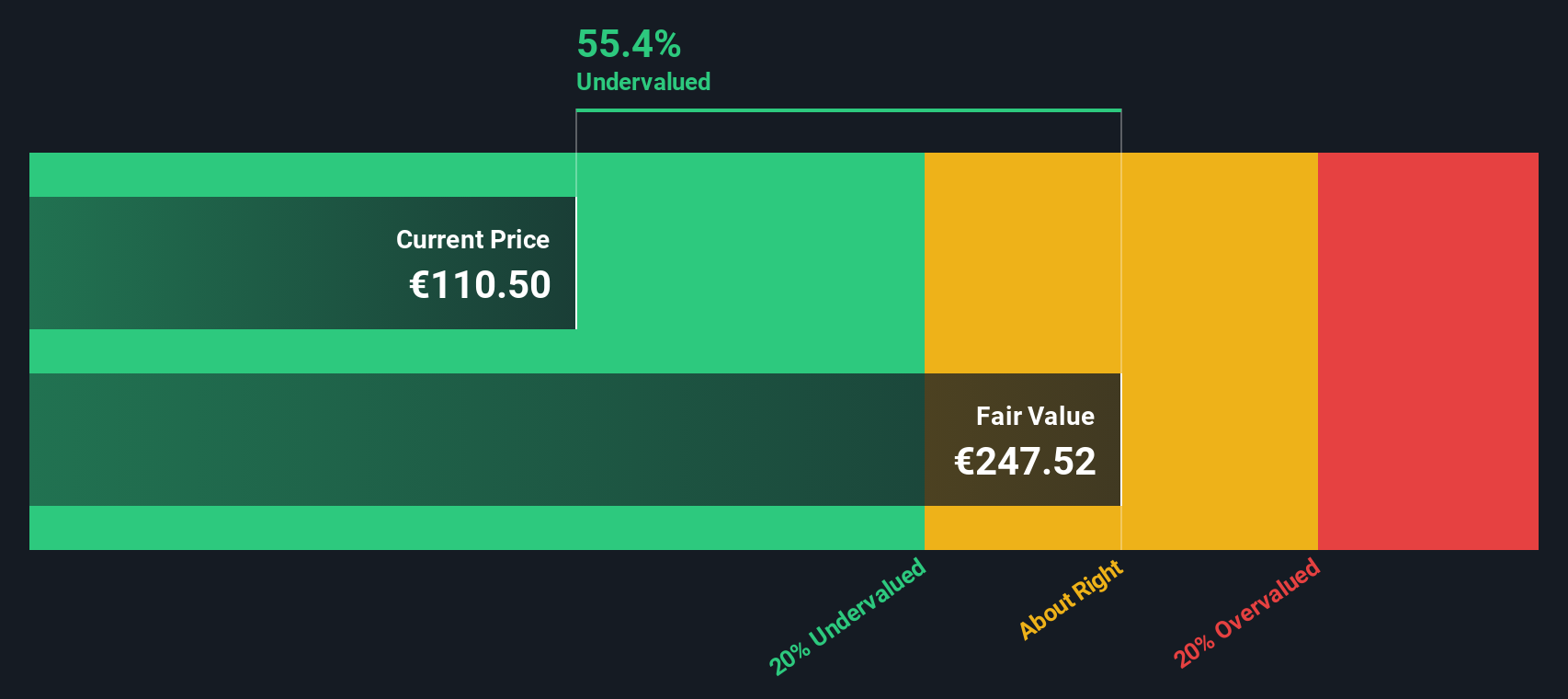

Based on these cash flow projections, the DCF model calculates an intrinsic value of €247.52 per share for Merck KGaA. With the stock currently trading at a 54.2% discount to this fair value, the DCF approach signals that the shares are deeply undervalued compared to anticipated future performance in euros.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Merck KGaA is undervalued by 54.2%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Merck KGaA Price vs Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio is one of the most widely used valuation tools for profitable companies. It helps investors understand how much the market is willing to pay for each euro of current earnings, making it particularly useful when evaluating mature, consistently profitable businesses like Merck KGaA.

When assessing if a P/E is “normal” or “fair,” it is important to consider both the company’s future growth prospects and the risks it faces. Fast-growing companies or those with lower risks often attract higher P/E multiples, while slower growers or riskier businesses typically trade at lower valuations.

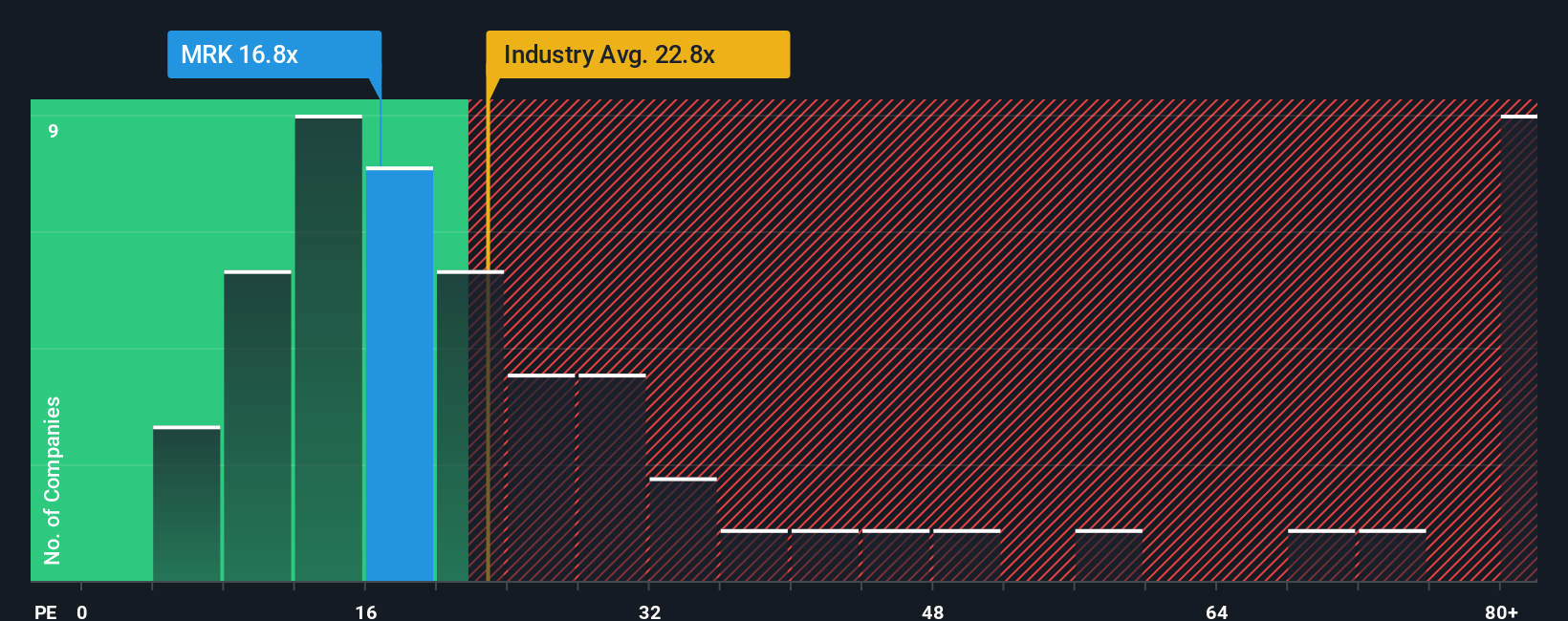

Currently, Merck KGaA trades at a P/E ratio of 17.2x. This is well below the Pharmaceuticals industry average of 24.4x and the peer group average of 47.2x. However, a simple comparison to these benchmarks can miss the unique characteristics of the business.

Simply Wall St’s proprietary “Fair Ratio” addresses this. The Fair Ratio establishes the P/E you might expect given Merck’s specific growth, profit margins, industry, market cap, and risk factors. This provides a more tailored benchmark than any single industry or peer average. Merck KGaA’s Fair Ratio is 21.3x. Since the current P/E of 17.2x is meaningfully lower than this Fair Ratio, this suggests the stock is undervalued on an earnings basis, even after accounting for its specific company profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Merck KGaA Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a powerful approach that goes beyond numbers to capture your view on a company's future.

A Narrative is your own story about a company, including what you believe about its long-term prospects, what you expect for growth or margins, and which catalysts or risks matter most to you. Narratives link the company’s real-world context to financial forecasts and then to a fair value, creating a clear bridge from ideas to investment decisions.

Narratives are available and easy to use on Simply Wall St’s Community page, where millions of investors share, update, and compare perspectives. You can create your own Narrative for Merck KGaA using your preferred assumptions, or see how others are framing the company’s potential.

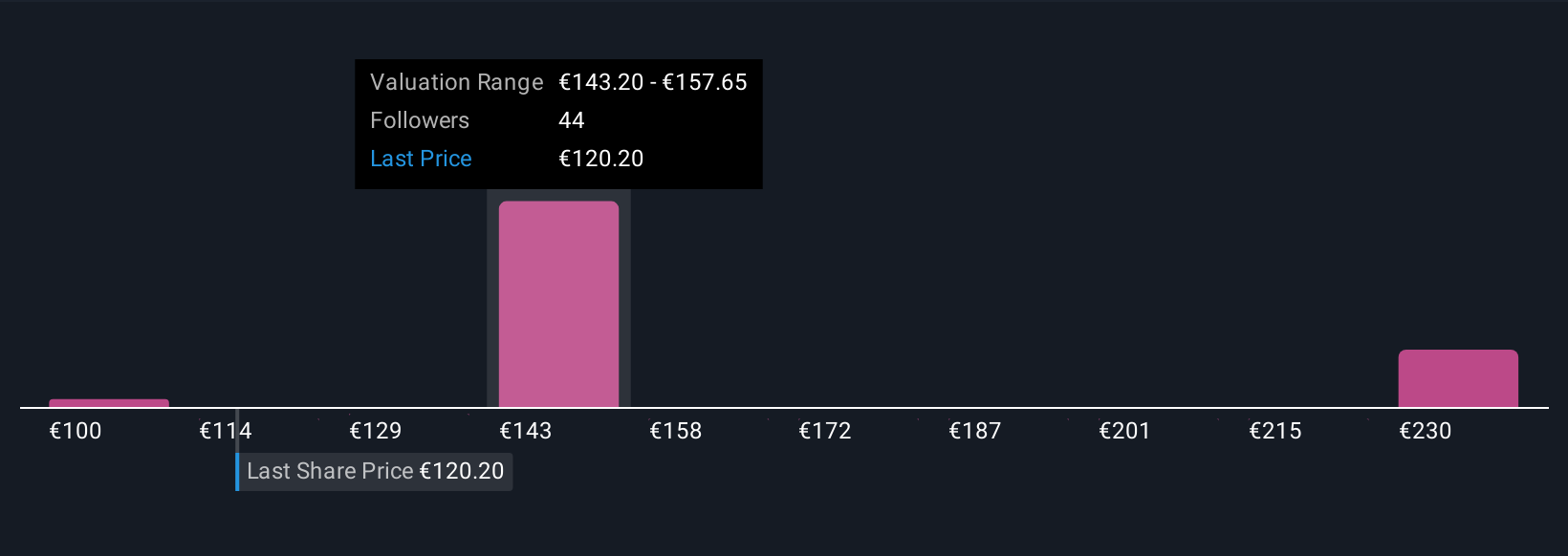

This tool helps you decide when to buy or sell by letting you compare your Narrative’s Fair Value to the current share price, taking into account new news or earnings numbers as they happen. For example, some investors see Merck KGaA achieving a fair value as high as €191.0 based on bold forecasts for global biotech and automation, while others are more cautious with a fair value as low as €100.0, mainly due to regulatory and competitive headwinds.

With Narratives, you can adjust your outlook as events unfold, making your investment process proactive, flexible, and truly informed.

Do you think there's more to the story for Merck KGaA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MRK

Merck KGaA

Operates as a science and technology company in Germany and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives