Stock Analysis

High Growth Tech Stocks In Germany To Watch This October 2024

Reviewed by Simply Wall St

Germany's DAX Index surged 4.03% recently, buoyed by hopes for interest rate cuts and China's robust stimulus measures, which have lifted market sentiment across Europe. Against this backdrop of optimism, investors are keenly watching high-growth tech stocks in Germany that are well-positioned to capitalize on these favorable economic conditions and technological advancements.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.37% | 29.88% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.26% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| GK Software | 8.70% | 33.04% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Northern Data AG develops and operates high-performance computing (HPC) infrastructure solutions for businesses and research institutions worldwide, with a market cap of approximately €1.55 billion.

Operations: Northern Data AG generates revenue primarily through Peak Mining (€156.13 million), Taiga Cloud (€22.13 million), and Ardent Data Centers (€31.46 million). The company also incurs a significant consolidation cost of -€178.50 million, impacting overall profitability.

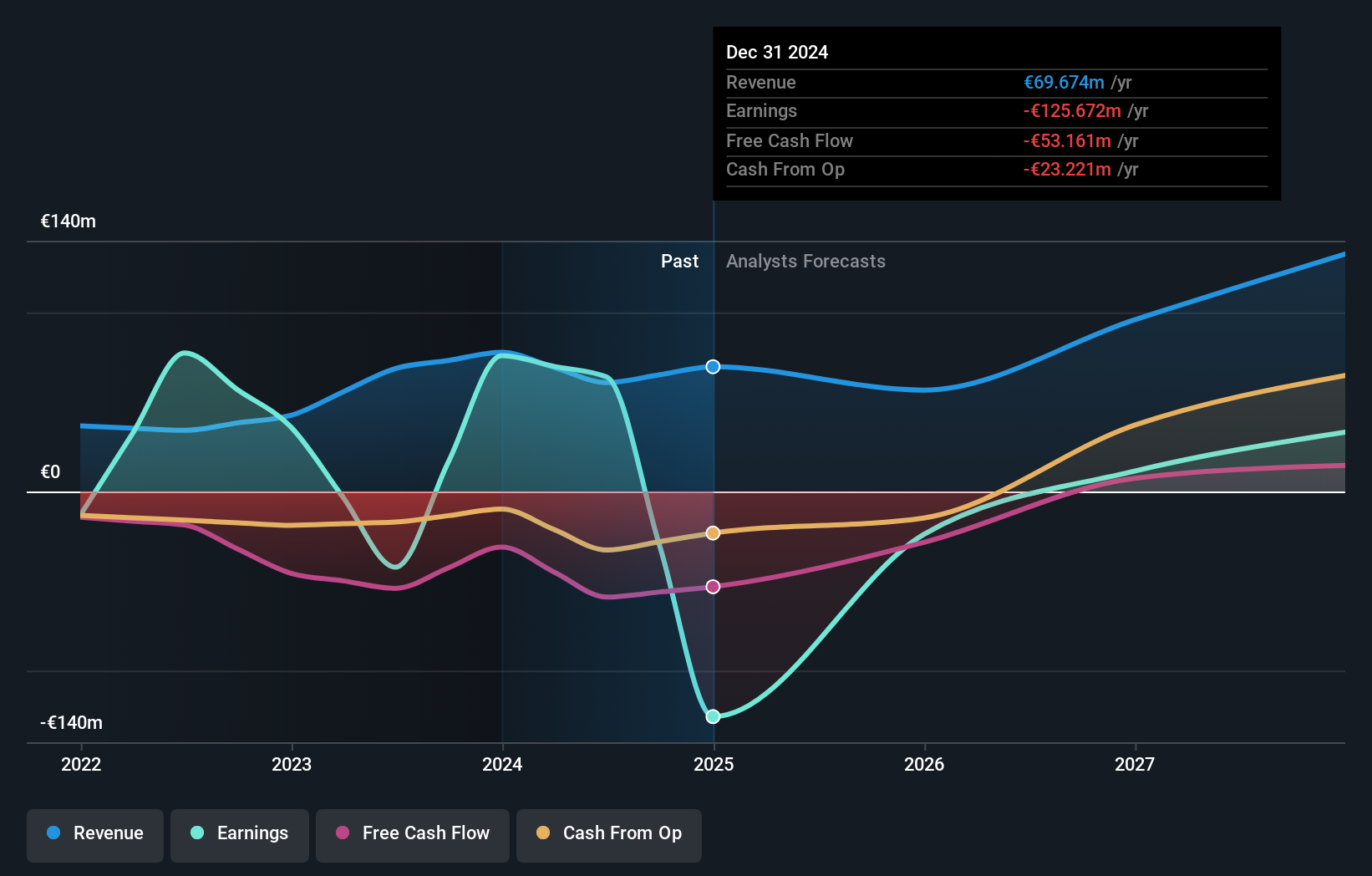

Northern Data AG, despite its current unprofitable status, is positioned for significant growth with revenue expected to surge at 32.5% annually, outpacing the German market's 5.4%. This growth trajectory is underscored by recent inclusion in the S&P Global BMI Index and robust conference activity signaling strong market engagement. Furthermore, R&D investments are robust, aligning with anticipated earnings growth of 68.2% per year. These strategic moves could pivot Northern Data towards profitability within three years amidst a volatile share price landscape and substantial shareholder dilution over the past year.

- Unlock comprehensive insights into our analysis of Northern Data stock in this health report.

Examine Northern Data's past performance report to understand how it has performed in the past.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally with a market cap of €472.07 million.

Operations: The company generates revenue primarily from IT services (€1.39 billion) and IT solutions (€128.12 million). The combined revenue is partially offset by consolidation and reconciliation adjustments totaling -€288.80 million.

Adesso SE, navigating through a challenging landscape with a net loss of €9.86 million for the first half of 2024, still shows potential in the high-tech sector in Germany. Its sales growth to €633.47 million from €548.19 million indicates resilience and an ability to expand revenue by 11.7% year-on-year despite broader market uncertainties. Significantly, the firm's commitment to innovation is evident from its R&D spending which has surged by 46.4%, positioning it well for future technology developments and market demands. This strategic focus on research could drive long-term competitiveness and recovery in its financial performance.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG, a biotechnology company, focuses on developing biosimilar drugs in Germany and Switzerland with a market cap of €914.63 million.

Operations: Formycon AG specializes in the development of biosimilar drugs, generating €60.80 million from its Drug Delivery Systems segment. The company operates primarily in Germany and Switzerland.

Formycon AG, despite a challenging half-year with revenues dropping to €26.89 million from €43.79 million and a shift to a net loss of €10.09 million, remains pivotal in the biotech landscape due to its strategic R&D investments and recent FDA approval of Otulfi (ustekinumab-aauz). This approval marks significant progress in its partnership with Fresenius Kabi, enhancing its presence in the U.S. market. With an expected revenue growth rate of 32.5% per year and earnings forecasted to surge by 30.7% annually, Formycon's focus on expanding its biosimilar portfolio could reshape its financial trajectory despite current setbacks.

- Click to explore a detailed breakdown of our findings in Formycon's health report.

Understand Formycon's track record by examining our Past report.

Seize The Opportunity

- Gain an insight into the universe of 43 German High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADN1

adesso

Provides IT services in Germany, Austria, Switzerland, and internationally.