German Exchange Stocks That May Be Trading Below Intrinsic Value In August 2024

Reviewed by Simply Wall St

As the European economy shows signs of resilience, with Germany's DAX index gaining 1.70% in August 2024, investors are increasingly looking for opportunities that may be trading below their intrinsic value. In this context, identifying undervalued stocks becomes crucial for maximizing returns and mitigating risks amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.60 | €30.09 | 44.8% |

| Bertrandt (XTRA:BDT) | €24.20 | €42.34 | 42.8% |

| MBB (XTRA:MBB) | €98.50 | €194.43 | 49.3% |

| M1 Kliniken (XTRA:M12) | €14.70 | €23.69 | 38% |

| Verbio (XTRA:VBK) | €17.15 | €29.81 | 42.5% |

| RENK Group (DB:R3NK) | €25.88 | €42.94 | 39.7% |

| Schweizer Electronic (XTRA:SCE) | €4.38 | €7.55 | 42% |

| MTU Aero Engines (XTRA:MTX) | €267.20 | €491.68 | 45.7% |

| Dr. Hönle (XTRA:HNL) | €15.90 | €28.42 | 44% |

| elumeo (XTRA:ELB) | €2.24 | €3.91 | 42.8% |

Let's take a closer look at a couple of our picks from the screened companies.

RENK Group (DB:R3NK)

Overview: RENK Group AG, with a market cap of €2.54 billion, specializes in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally.

Operations: The company's revenue segments include €344.33 million from the M&I Segment, €579.24 million from the VMS Segment, and €117.14 million from the Slide Bearings Segment.

Estimated Discount To Fair Value: 39.7%

RENK Group is trading at €25.88, significantly below its estimated fair value of €42.94, indicating it may be undervalued based on cash flows. The company’s earnings are forecast to grow 35.2% annually over the next three years, outpacing the German market's 19.9%. Despite recent executive changes, including a new CFO starting October 2024, RENK maintains strong revenue growth projections and high return on equity forecasts at 26.5%.

- In light of our recent growth report, it seems possible that RENK Group's financial performance will exceed current levels.

- Take a closer look at RENK Group's balance sheet health here in our report.

adidas (XTRA:ADS)

Overview: adidas AG, with a market cap of €39.94 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: The company's revenue segments are as follows: Greater China: €3.26 billion, Latin America: €2.39 billion, and North America: €5.07 billion.

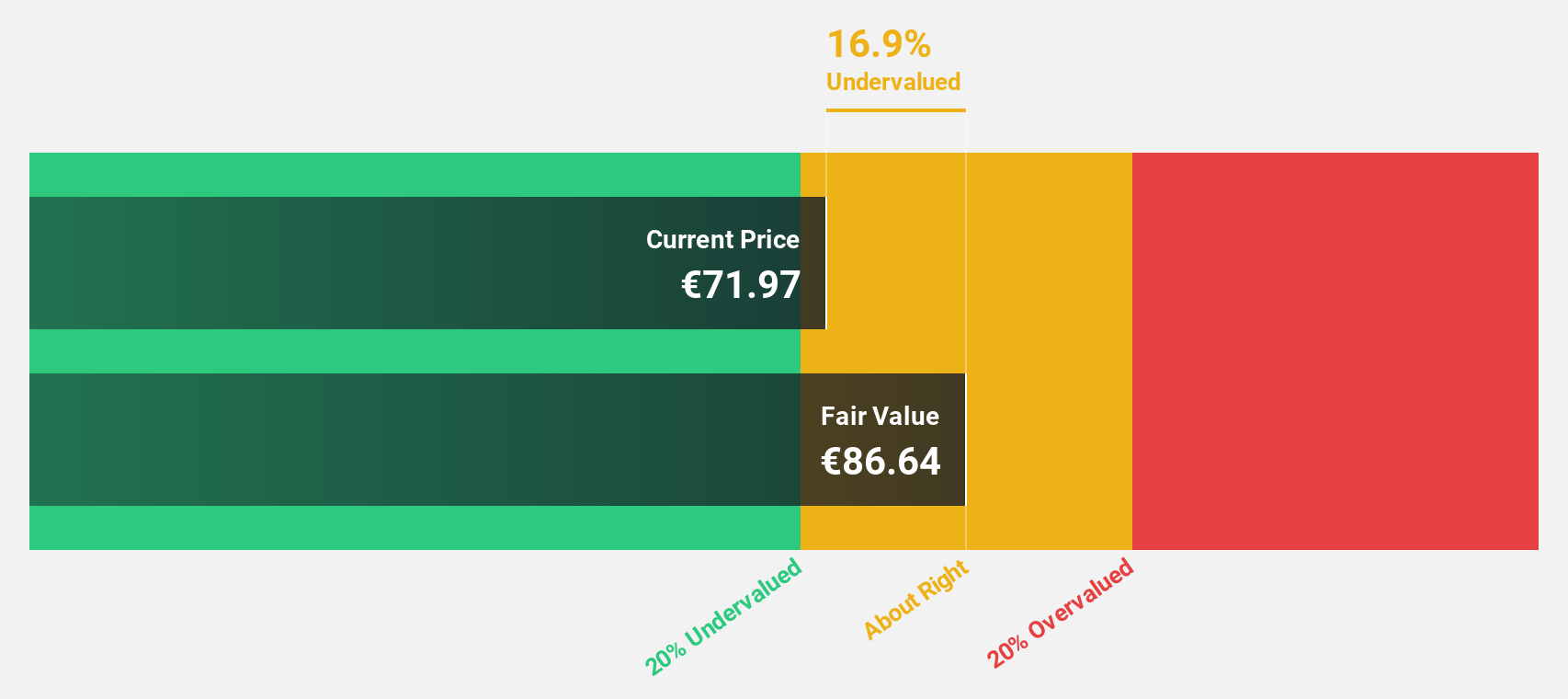

Estimated Discount To Fair Value: 19.3%

adidas AG, trading at €223.7, is undervalued compared to its estimated fair value of €277.18. Recent earnings reports show strong performance with Q2 2024 sales at €5.82 billion and net income of €190 million, up from €84 million a year ago. Earnings are expected to grow significantly at 40.68% annually over the next three years, outpacing the German market's growth rate and supported by raised full-year guidance despite unfavorable currency effects impacting profitability in 2024.

- Our comprehensive growth report raises the possibility that adidas is poised for substantial financial growth.

- Dive into the specifics of adidas here with our thorough financial health report.

Formycon (XTRA:FYB)

Overview: Formycon AG, a biotechnology company with a market cap of €923.46 million, develops biosimilar drugs in Germany and Switzerland.

Operations: Formycon generates revenue primarily from its Drug Delivery Systems segment, amounting to €60.80 million.

Estimated Discount To Fair Value: 12.8%

Formycon AG, trading at €52.3, is undervalued compared to its estimated fair value of €59.98 and trades 12.8% below this estimate. Despite a challenging H1 2024 with sales dropping to €26.89 million from €43.79 million and a net loss of €10.09 million, earnings are forecasted to grow significantly at 30.87% annually over the next three years, outpacing the German market's growth rate and indicating strong future cash flows despite recent shareholder dilution.

- Our expertly prepared growth report on Formycon implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Formycon with our comprehensive financial health report here.

Key Takeaways

- Click this link to deep-dive into the 26 companies within our Undervalued German Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential and fair value.