- Germany

- /

- Life Sciences

- /

- XTRA:EVT

Evotec (XTRA:EVT): Losses Deepen, Profitability Forecast to Return by 2027 Challenges Bearish View

Reviewed by Simply Wall St

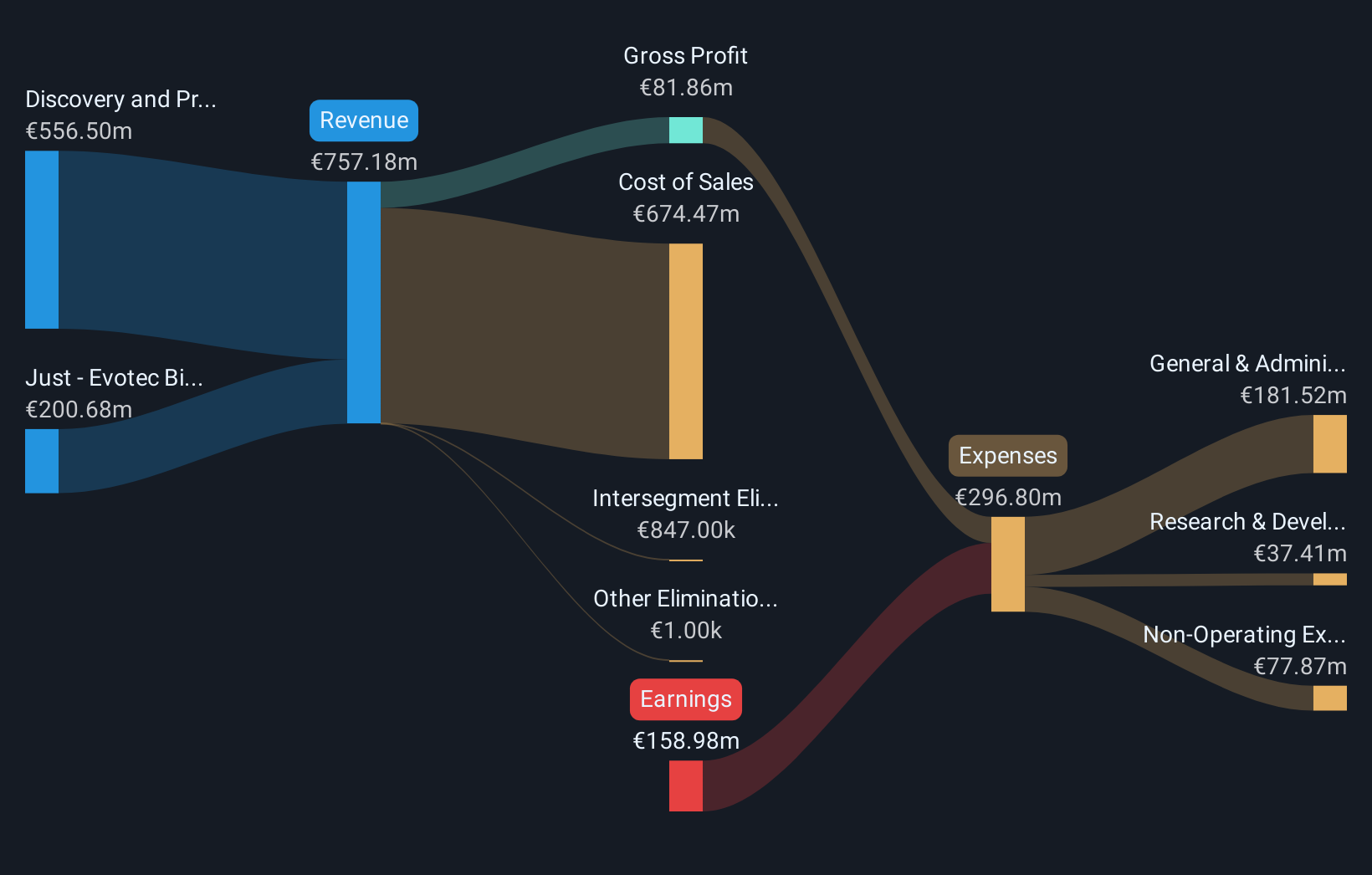

Evotec (XTRA:EVT) is still in the red, with losses having accelerated by 51.9% per year over the past five years and profit margins showing no sign of improvement. Despite this recent track record, the outlook is much brighter. Analysts see earnings growing at an impressive 74.86% per year, with profitability expected within the next three years and revenue set to climb 9% annually, outpacing the broader German market. These strong growth forecasts and a Price-To-Sales Ratio of just 1.4x compared to industry averages are spotlighting Evotec’s potential for a turnaround in the eyes of investors.

See our full analysis for Evotec.Now, let’s set those headline numbers against the prevailing narratives. It is time to see which stories get reinforced and where the market view might start to shift.

See what the community is saying about Evotec

Margins Still Deep in Negative Territory

- Profit margins remain under pressure, sitting at -20.0% today, and the company has yet to produce quality earnings in recent periods.

- Consensus narrative highlights that despite these weak margins, analysts expect profit margins to rebound to 5.5% over the next three years. This turnaround is built on higher-margin revenue from new pharma partnerships and technology licensing.

- This projected shift is largely driven by the company's strategic pivot to a CapEx-lighter business model. The approach aims to boost net margins and capital efficiency even as historical profitability metrics remain challenged.

- However, the transition brings tension, as reduced internal capacity after asset sales may limit high-value production services and add volatility to near-term earnings stability.

- For a full breakdown of how analysts see these margin dynamics playing into the company’s outlook, dive into the balanced take in the full consensus narrative. 📊 Read the full Evotec Consensus Narrative.

DCF Fair Value Sits Far Above Market Price

- Evotec is trading at €5.82 per share, markedly below its DCF fair value of €51.09. Its Price-To-Sales Ratio of 1.4x compares favorably to both its peer group at 2.4x and the industry average of 3.7x.

- Analysts’ consensus view underscores that this discount could be a rare opportunity: their price target of €9.45 (up 62% from the current share price) is based on projected earnings growth to €53.9 million by 2028, with the company needing to achieve a P/E ratio of 37.0x to justify such targets.

- This outlook is only achievable if Evotec sustains annual revenue growth above 8% and delivers on partnership and licensing strategies fueling recurring, higher-margin sales.

- What stands out is that, while valuation metrics paint a strongly discounted picture, execution risks such as dependency on a few large contracts and the shift away from asset-intensive models could limit upside if not managed carefully.

Capital-Light Model Redefines Growth Path

- The completion of the Toulouse site sale and move toward an asset-lighter (CapEx-lighter) model is expected to immediately improve capital efficiency, with anticipated proceeds around USD 300 million, milestone payments, and royalties that should strengthen liquidity and boost earnings quality over time.

- Analysts’ consensus view details how this strategic shift aligns Evotec with industry trends toward outsourcing and innovative R&D, aiming for robust growth in personalized medicine, but also notes revenue and earnings could remain volatile given reliance on a handful of key partners and ongoing pressure in early-stage biotech funding.

- Deepening pharma partnerships (such as the rapid expansion of the Just – Evotec Biologics business) and investment in proprietary AI-enabled platforms are cited as critical drivers supporting higher-margin, recurring revenue streams and future royalty upside.

- Nevertheless, reduced internal manufacturing capacity and concentration of major contracts introduce new risks, highlighting that the company’s growth profile is now more tightly coupled to executing these capital-light strategies effectively.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Evotec on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on the figures? Share your perspective and shape your personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Evotec.

See What Else Is Out There

Evotec’s negative profit margins, lack of recent quality earnings, and reliance on a small set of partners point to inconsistent performance and potential volatility in the future.

If you want stocks with a steadier record, use stable growth stocks screener (2079 results) to zero in on companies delivering consistent growth in revenues and profits, regardless of ups and downs elsewhere.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evotec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVT

Evotec

Operates as a drug discovery and development company in the United States, Germany, France, the United Kingdom, Switzerland, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives