Why Investors Shouldn't Be Surprised By Biofrontera AG's (ETR:B8F) 30% Share Price Plunge

Biofrontera AG (ETR:B8F) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

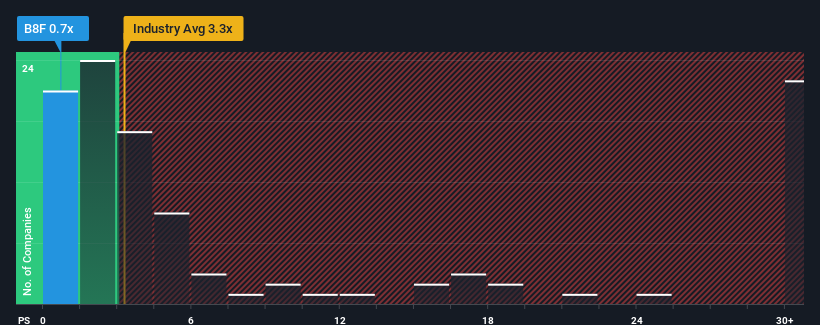

Since its price has dipped substantially, given about half the companies operating in Germany's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 2.3x, you may consider Biofrontera as an attractive investment with its 0.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Biofrontera

How Biofrontera Has Been Performing

For instance, Biofrontera's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Biofrontera will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Biofrontera's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. As a result, revenue from three years ago have also fallen 13% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 0.1% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's not too hard to see why Biofrontera is trading at a lower P/S in comparison. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From Biofrontera's P/S?

Biofrontera's recently weak share price has pulled its P/S back below other Pharmaceuticals companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear that Biofrontera trades at a low P/S relative to the wider industry on the weakness of its recent three-year revenue being even worse than the forecasts for a struggling industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. However, we're still cautious about the company's ability to prevent an acceleration of its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Biofrontera (2 can't be ignored!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Biofrontera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:B8FK

Biofrontera

A biopharmaceutical company, engages in the research, development, and distribution of dermatological products in Germany, Spain, the United Kingdom, rest of Europe, the United States, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives