What Tele Columbus AG's (HMSE:TC1) 39% Share Price Gain Is Not Telling You

Tele Columbus AG (HMSE:TC1) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 76% share price drop in the last twelve months.

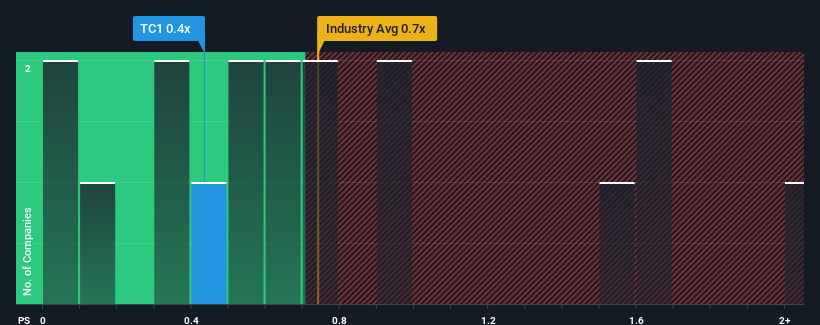

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Tele Columbus' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Media industry in Germany is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Tele Columbus

What Does Tele Columbus' P/S Mean For Shareholders?

Tele Columbus could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Tele Columbus will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Tele Columbus?

In order to justify its P/S ratio, Tele Columbus would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 9.4% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.1% per year as estimated by the sole analyst watching the company. That's not great when the rest of the industry is expected to grow by 5.8% each year.

In light of this, it's somewhat alarming that Tele Columbus' P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Tele Columbus' P/S?

Tele Columbus' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that Tele Columbus currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Having said that, be aware Tele Columbus is showing 4 warning signs in our investment analysis, and 3 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Tele Columbus, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tele Columbus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HMSE:TC1

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives