As the German economy faces a contraction in 2024 with factory orders plunging, the country's tech sector remains a focal point for investors looking to navigate these challenging times. In this environment, identifying high-growth tech stocks involves assessing companies that demonstrate resilience and innovation amidst economic headwinds, offering potential opportunities for those willing to explore this dynamic market segment.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.50% | 29.71% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.37% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| Pantaflix | 20.93% | 113.65% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

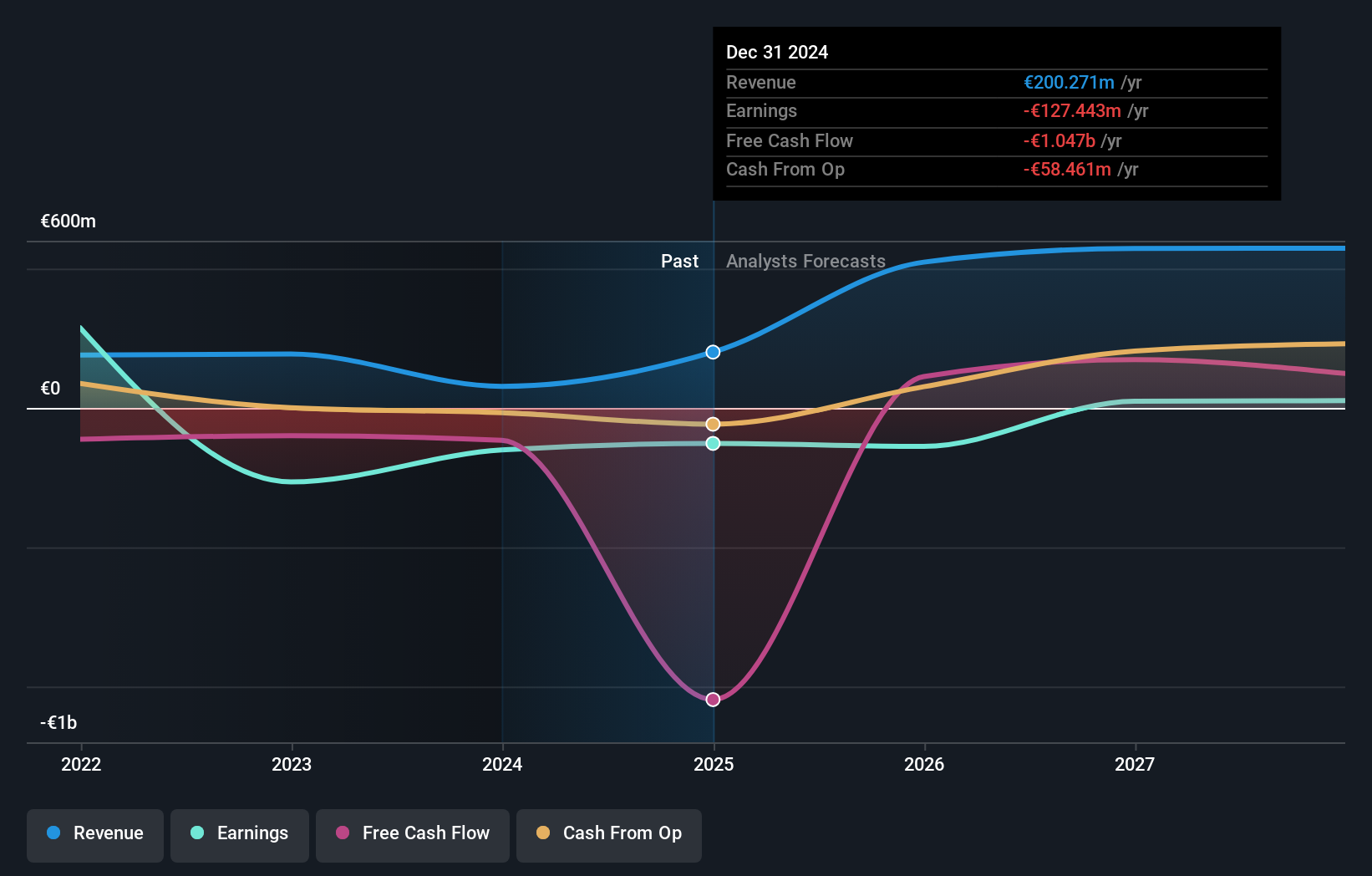

Overview: Northern Data AG provides high-performance computing infrastructure solutions to businesses and research institutions globally, with a market capitalization of approximately €1.63 billion.

Operations: The company's primary revenue streams include Peak Mining (€156.13 million) and Ardent Data Centers (€31.46 million), with Taiga Cloud contributing €22.13 million. A notable cost is reflected in the Consolidation segment, which shows a negative impact of €178.50 million on revenues.

Northern Data AG, recently added to the S&P Global BMI Index, is navigating a transformative phase with a forecasted revenue growth of 32.5% annually, outpacing the German market's average of 5.4%. Despite current unprofitability and a volatile share price, the company is poised for significant advancements with expected earnings growth at an impressive rate of 68.2% per year. This growth trajectory is supported by robust investment in R&D which stands as a testament to its commitment to innovation and market expansion. The firm's strategic presentations at major industry conferences underscore its proactive approach in fortifying industry relationships and showcasing technological prowess, setting the stage for potential profitability within three years amidst challenging market conditions.

- Click to explore a detailed breakdown of our findings in Northern Data's health report.

Assess Northern Data's past performance with our detailed historical performance reports.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space across North America and Europe, with a market cap of €616.84 million.

Operations: The company generates revenue primarily through its Supply Side Platforms (SSP) and Demand Side Platforms (DSP), with SSP contributing significantly more at €341.35 million compared to DSP's €57.59 million.

Verve Group, a participant in the high-growth tech sector in Germany, has shown a promising trajectory with its revenue forecast to increase by 12.5% annually, outstripping the national average of 5.4%. This growth is underpinned by significant R&D investments which have consistently accounted for a substantial portion of its revenue, reflecting an aggressive strategy to foster innovation and secure competitive advantages. Recently, the company raised its annual earnings guidance following robust second-quarter results where net income surged to €6.26 million from €1.74 million year-over-year, highlighting operational efficiency and market adaptability. Moreover, Verve's active participation in prominent industry conferences demonstrates their commitment to maintaining visibility and relevance in the dynamic tech landscape.

- Click here to discover the nuances of Verve Group with our detailed analytical health report.

Evaluate Verve Group's historical performance by accessing our past performance report.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

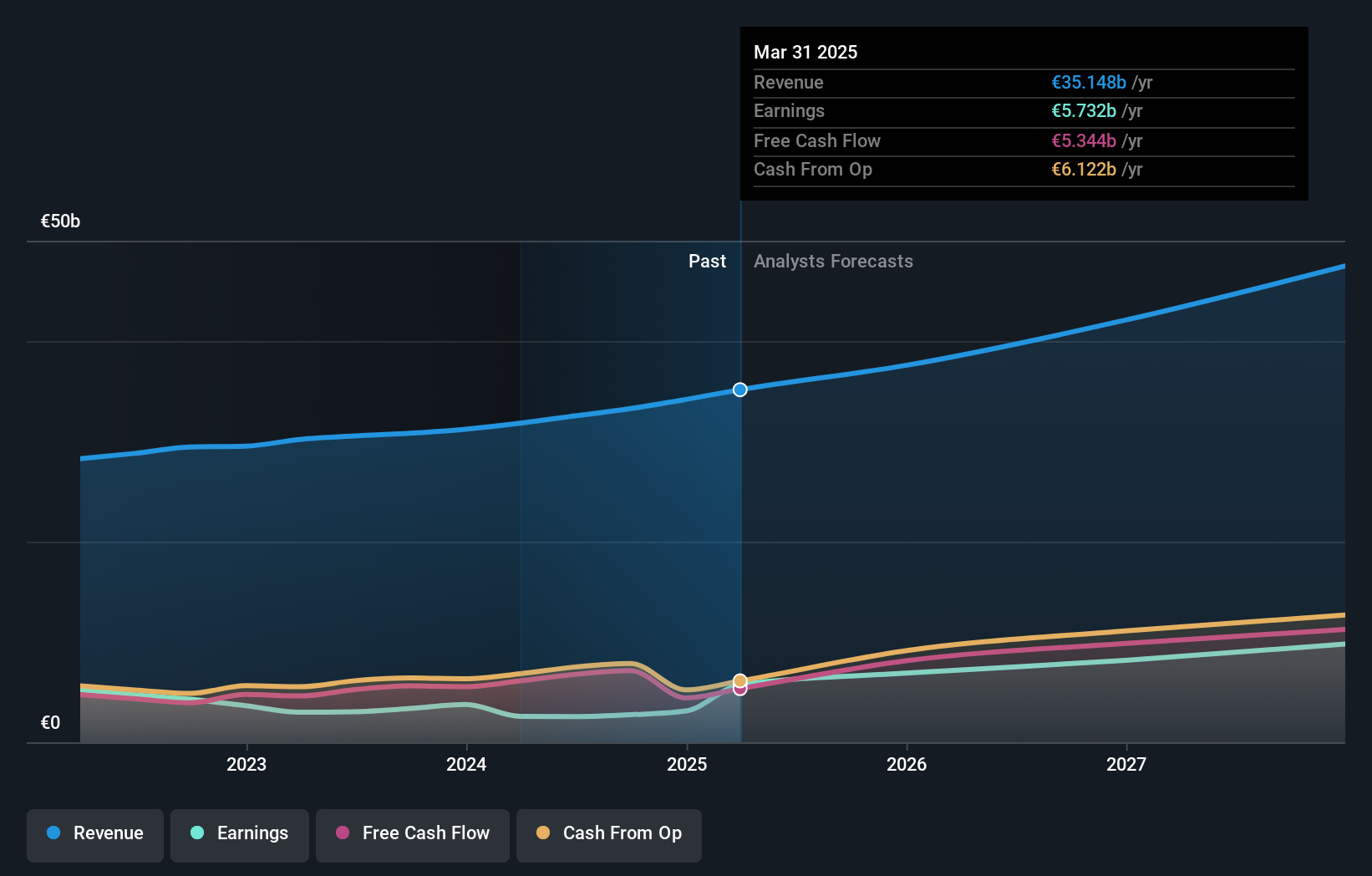

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology solutions, and services globally and has a market capitalization of approximately €246.17 billion.

Operations: SAP generates revenue primarily from its Applications, Technology & Services segment, which accounts for €32.54 billion.

SAP, a stalwart in the tech landscape, is harnessing AI to redefine business processes and enhance operational efficiencies. With a robust R&D expenditure that underscores its commitment to innovation—evidenced by the recent integration of its AI-powered platform DeepHow into SAP® Store—SAP is poised for transformative growth. This strategic move not only streamlines training across global teams but also embeds AI deeper into daily workflows, potentially increasing SAP's market adaptability and customer value proposition. Moreover, the expected revenue growth of 9.6% per year aligns with its aggressive expansion plans in cloud-based solutions, while an anticipated earnings surge of 37.9% reflects a strategic pivot that could set new industry standards in efficiency and productivity.

- Delve into the full analysis health report here for a deeper understanding of SAP.

Examine SAP's past performance report to understand how it has performed in the past.

Next Steps

- Investigate our full lineup of 43 German High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential.