- Germany

- /

- Interactive Media and Services

- /

- XTRA:G24

Getting In Cheap On Scout24 AG (ETR:G24) Might Be Difficult

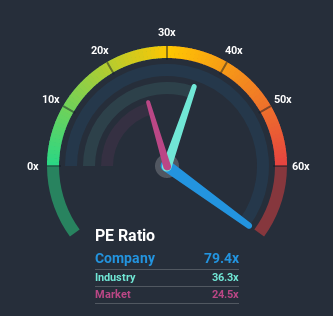

When close to half the companies in Germany have price-to-earnings ratios (or "P/E's") below 24x, you may consider Scout24 AG (ETR:G24) as a stock to avoid entirely with its 79.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Scout24 certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Scout24

What Are Growth Metrics Telling Us About The High P/E?

Scout24's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 384%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 14% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 29% each year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 18% per year, which is noticeably less attractive.

In light of this, it's understandable that Scout24's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Scout24's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Scout24 (1 doesn't sit too well with us!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

When trading Scout24 or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:G24

Scout24

Operates ImmoScout24, a digital platform for the residential and commercial real estate sectors in Germany and internationally.

Adequate balance sheet and slightly overvalued.