- Germany

- /

- Healthcare Services

- /

- XTRA:RHK

Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien And 2 Other Undiscovered Gems with Solid Fundamentals

Reviewed by Simply Wall St

Germany's stock market has been buoyed by a recent interest rate cut from the European Central Bank, with the DAX showing a notable rise of 2.17%. This positive sentiment presents an opportune moment to explore some lesser-known stocks with solid fundamentals that could benefit from these favorable conditions. In this environment, identifying stocks with strong financial health and growth potential becomes crucial. Among these hidden gems is Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien, along with two other promising companies that merit attention for their robust fundamentals and strategic positioning in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien (XTRA:BVB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien, based in Dortmund, operates a football club in Germany with a market cap of €420.54 million.

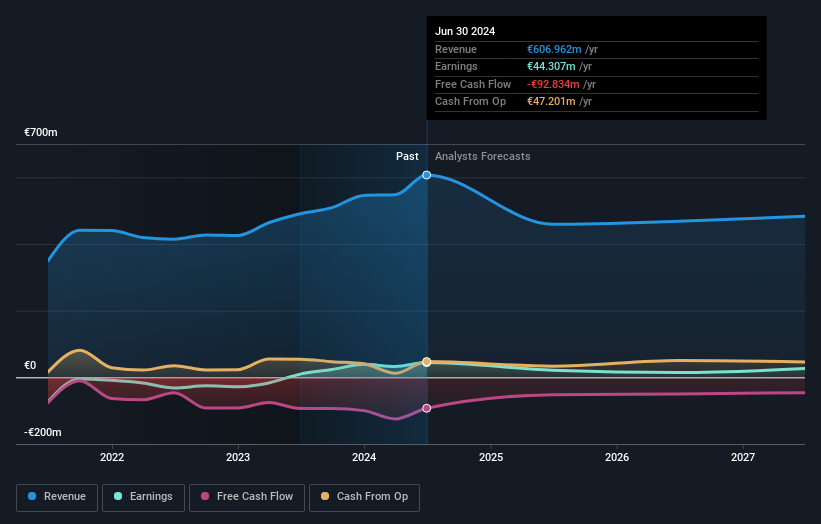

Operations: Borussia Dortmund generates revenue primarily from match operations, advertising, TV marketing, and transfers. The company reported a net profit margin of 4.5% in the most recent period. Key cost components include player salaries and matchday expenses.

Borussia Dortmund GmbH & Co. KGaA has shown impressive earnings growth of 363.9% over the past year, outpacing the Entertainment industry’s 8.8%. The net debt to equity ratio stands at a satisfactory 7.4%, indicating sound financial health. With a price-to-earnings ratio of 9.5x, it is attractively valued compared to the German market's 16.2x average. Recent earnings report highlighted sales of €606.96 million and net income of €44.31 million for FY2024, showcasing robust performance despite forecasted declines in future earnings by an average of 23% per year over the next three years.

PharmaSGP Holding (XTRA:PSG)

Simply Wall St Value Rating: ★★★★★☆

Overview: PharmaSGP Holding SE manufactures and sells over-the-counter drugs and other healthcare products in Germany with a market cap of €254.19 million.

Operations: PharmaSGP Holding SE generates revenue primarily from its pharmaceutical segment, amounting to €107.29 million.

PharmaSGP Holding, a small pharmaceutical company, has shown impressive growth with earnings up 38.1% in the past year, outpacing the industry average of 1.5%. The company repurchased shares in June 2024 under a shareholder-mandated program. Trading at 80.5% below its estimated fair value, PSG appears undervalued. Despite having high-quality earnings and EBIT covering interest payments by 7.4 times, its net debt to equity ratio stands at a high 60.3%.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★☆

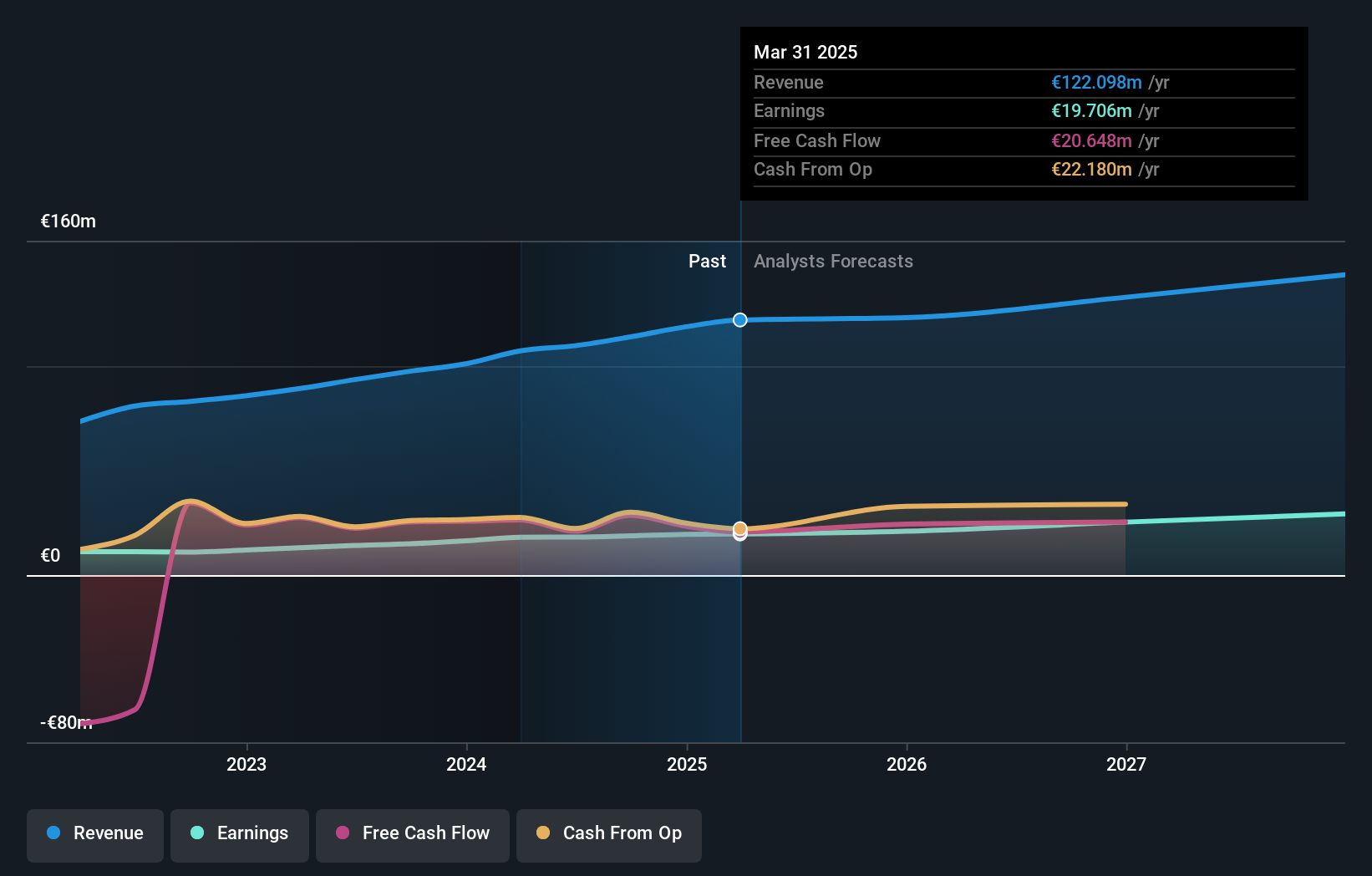

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides in-patient, semi-patient, and outpatient healthcare services in Germany and has a market cap of €809.96 million.

Operations: RHÖN-KLINIKUM generates revenue primarily from its acute hospitals (€1.45 billion), medical care centres (€23.90 million), and rehabilitation hospitals (€34.70 million). The acute hospitals segment is the largest contributor to the company's revenue streams.

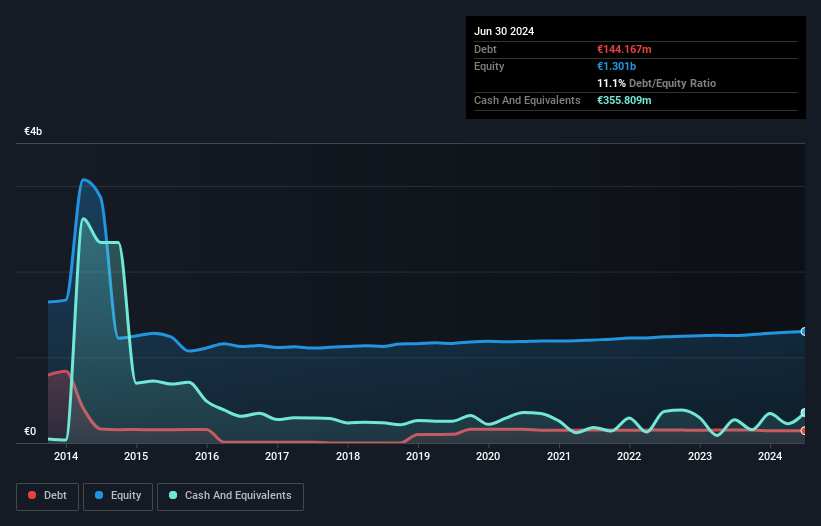

RHÖN-KLINIKUM has seen its debt to equity ratio rise from 8.7% to 11.1% over the last five years, yet it remains profitable with a price-to-earnings ratio of 17.4x, below the healthcare industry average of 20.4x. Earnings grew by an impressive 81.6% in the past year, outpacing the industry’s growth rate of 30.9%. Recent financials show second-quarter sales at €392 million and net income at €9 million, both higher than last year’s figures.

- Navigate through the intricacies of RHÖN-KLINIKUM with our comprehensive health report here.

Understand RHÖN-KLINIKUM's track record by examining our Past report.

Key Takeaways

- Gain an insight into the universe of 53 German Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHK

RHÖN-KLINIKUM

Offers in-patient, semi-patient, and outpatient healthcare services in Germany.

Solid track record with excellent balance sheet.