It's Down 27% But Wacker Chemie AG (ETR:WCH) Could Be Riskier Than It Looks

Wacker Chemie AG (ETR:WCH) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 40% in that time.

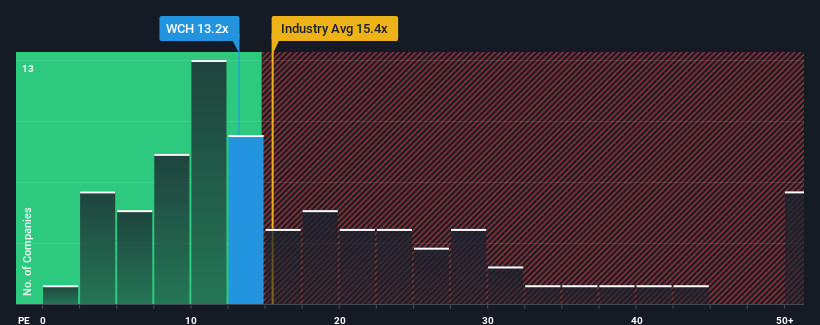

Even after such a large drop in price, given about half the companies in Germany have price-to-earnings ratios (or "P/E's") above 18x, you may still consider Wacker Chemie as an attractive investment with its 13.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We've discovered 1 warning sign about Wacker Chemie. View them for free.Wacker Chemie could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Wacker Chemie

Is There Any Growth For Wacker Chemie?

In order to justify its P/E ratio, Wacker Chemie would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. This means it has also seen a slide in earnings over the longer-term as EPS is down 70% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 15% each year over the next three years. With the market predicted to deliver 15% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it odd that Wacker Chemie is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Wacker Chemie's P/E?

Wacker Chemie's recently weak share price has pulled its P/E below most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Wacker Chemie currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Wacker Chemie you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Wacker Chemie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:WCH

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives