thyssenkrupp AG (ETR:TKA) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The last month tops off a massive increase of 170% in the last year.

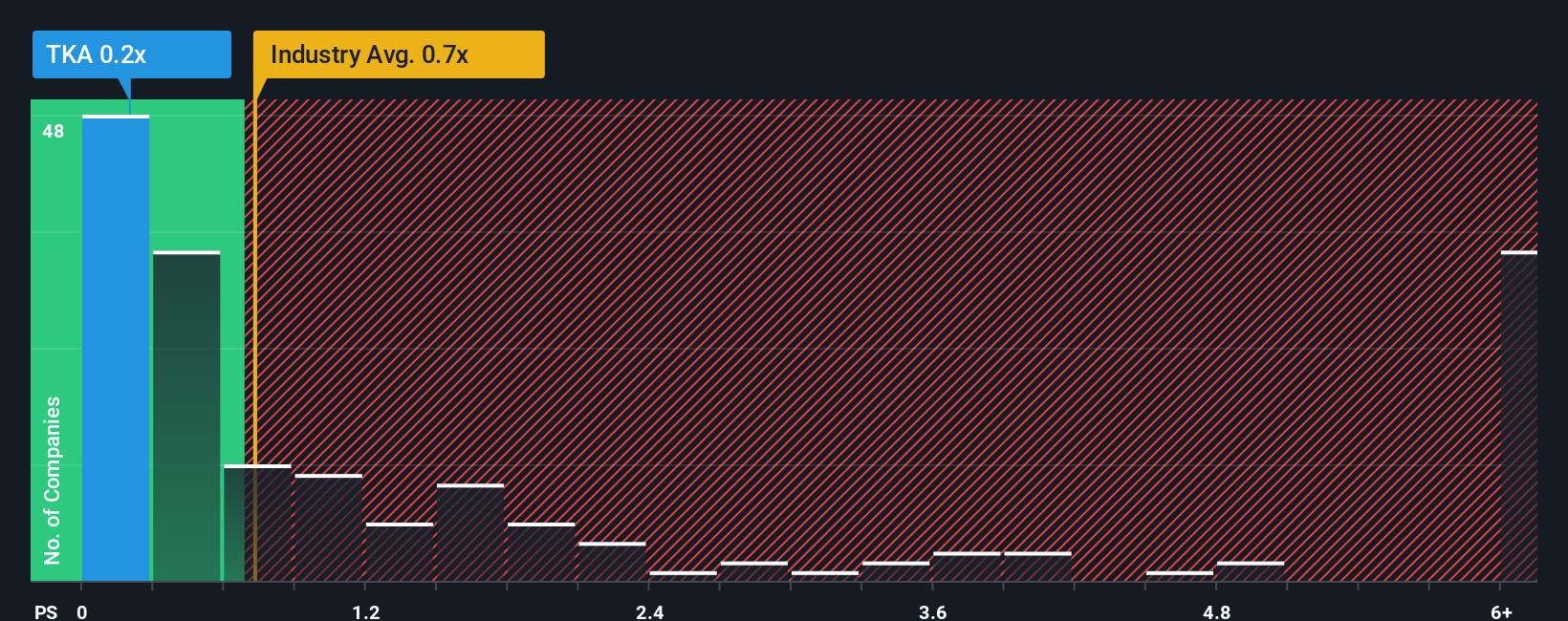

Even after such a large jump in price, you could still be forgiven for feeling indifferent about thyssenkrupp's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Germany is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for thyssenkrupp

How thyssenkrupp Has Been Performing

With revenue that's retreating more than the industry's average of late, thyssenkrupp has been very sluggish. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think thyssenkrupp's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For thyssenkrupp?

There's an inherent assumption that a company should be matching the industry for P/S ratios like thyssenkrupp's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 9.4% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 2.4% per year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 2.1% per annum, which is not materially different.

With this in mind, it makes sense that thyssenkrupp's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does thyssenkrupp's P/S Mean For Investors?

thyssenkrupp appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at thyssenkrupp's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for thyssenkrupp with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives