- Germany

- /

- Metals and Mining

- /

- XTRA:SZG

A Fresh Look at Salzgitter (XTRA:SZG) Valuation Following Strong Three-Month Share Price Surge

Reviewed by Simply Wall St

Salzgitter (XTRA:SZG) has turned heads with an impressive share price climb in the past 3 months, delivering a 24% return. Investors are beginning to re-examine the company’s recent momentum and underlying fundamentals.

See our latest analysis for Salzgitter.

After a turbo-charged 24% jump in the last three months, Salzgitter’s share price is now up nearly 72% year-to-date. Such a strong move suggests renewed optimism about growth prospects, even as the one-year total shareholder return stands at a solid 63% and momentum appears to be building from recent lows.

If you're interested in more potential breakout stories, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

After such a rapid run-up, is Salzgitter’s current price the start of a lasting re-rating? Or are markets already factoring in any future gains, leaving little room for new investors to profit?

Most Popular Narrative: Fairly Valued

With Salzgitter closing at €27.68 and the most watched narrative putting its fair value at €27.55, the latest assessment sits almost perfectly at the current price. This creates a razor-thin balance of expectations. What is positioning the company for stability amid recent market volatility? A key passage below reveals an influential driver shaping the fair value outlook.

*Ongoing SALCOS and green steel initiatives position Salzgitter to capture emerging 'green premium' pricing and build resilient, higher-margin revenue streams as regulations and customer preference shift toward low-CO₂ steel, directly benefiting future net margins and margin stability.*

There is a strategic twist powering this valuation. Forward-looking growth assumptions hinge on sustainability, new pricing models, and bold margin targets. Wondering which financial levers analysts expect Salzgitter to pull to earn that valuation premium? Dig in to see the numbers and the pivotal storyline underpinning expectations for this steelmaker.

Result: Fair Value of €27.55 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing high steel imports and persistent weakness in key end-markets could quickly undermine Salzgitter’s positive outlook. This may challenge revenue and margin recovery.

Find out about the key risks to this Salzgitter narrative.

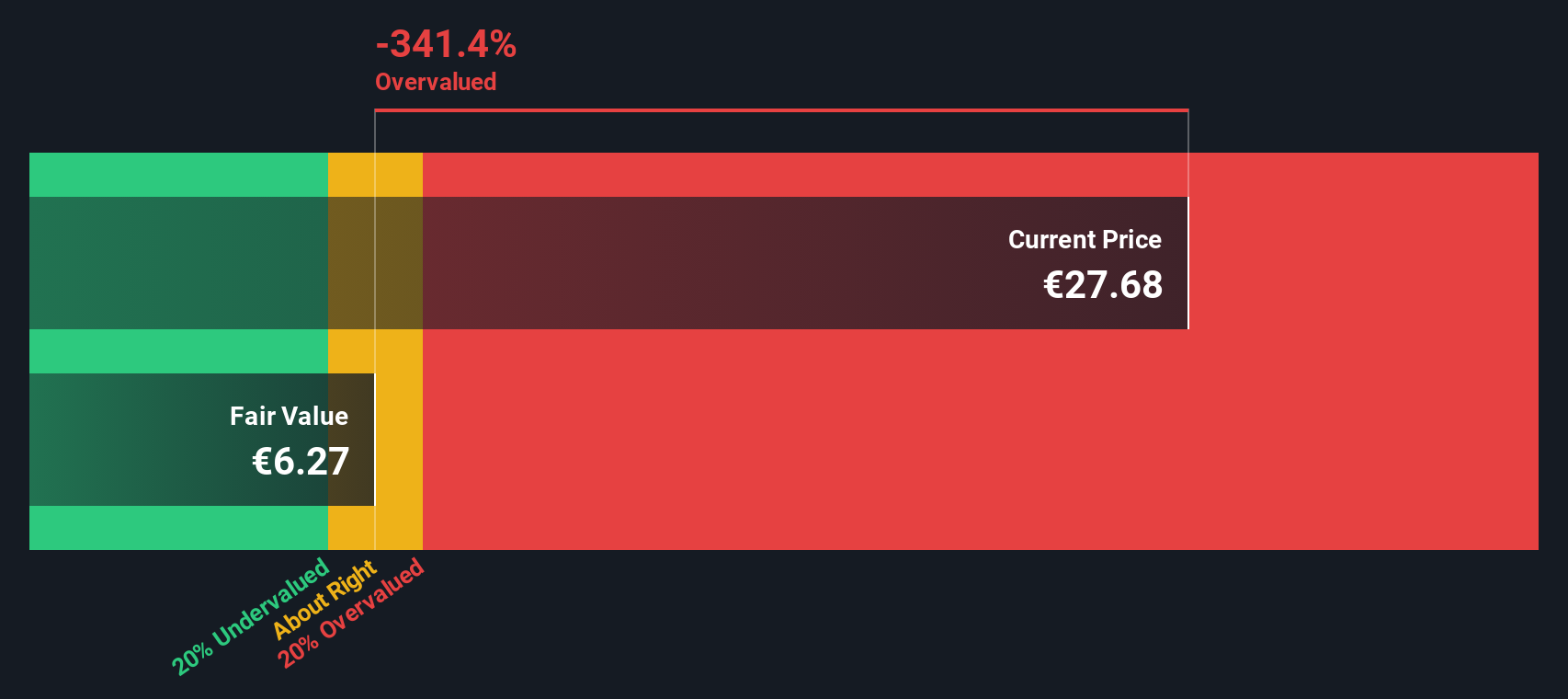

Another View: DCF Valuation Tells a Different Story

While the price-to-sales ratio portrays Salzgitter as a good value compared to peers, our DCF model raises a caution flag instead. According to the SWS DCF model, the shares appear overvalued at current prices, which suggests the market may be factoring in more optimism than underlying cash flows support.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Salzgitter Narrative

If you see things differently or enjoy taking a hands-on approach, you can analyze the numbers and shape your own story in just a few minutes, then Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Salzgitter.

Looking for More Smart Investment Opportunities?

Don't limit yourself to just one stock when so many potential winners are within reach. Get ahead of the crowd and spot tomorrow’s leaders right now.

- Capture steady income and growth by reviewing these 16 dividend stocks with yields > 3% with strong prospects and robust yields above 3%.

- Take a front-row seat to healthcare innovation by checking out these 30 healthcare AI stocks transforming patient outcomes with breakthrough technologies.

- Find value that the market hasn’t priced in yet with these 923 undervalued stocks based on cash flows based on reliable cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SZG

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives