Shareholders May Be Wary Of Increasing K+S Aktiengesellschaft's (ETR:SDF) CEO Compensation Package

Shareholders will probably not be too impressed with the underwhelming results at K+S Aktiengesellschaft (ETR:SDF) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 12 May 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for K+S

Comparing K+S Aktiengesellschaft's CEO Compensation With the industry

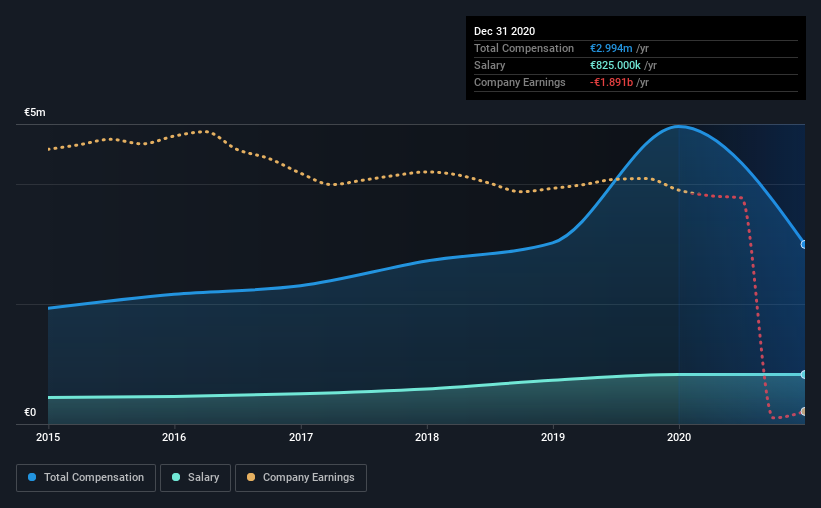

At the time of writing, our data shows that K+S Aktiengesellschaft has a market capitalization of €1.8b, and reported total annual CEO compensation of €3.0m for the year to December 2020. We note that's a decrease of 40% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €825k.

On comparing similar companies from the same industry with market caps ranging from €832m to €2.7b, we found that the median CEO total compensation was €1.3m. Hence, we can conclude that Burkhard Lohr is remunerated higher than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €825k | €825k | 28% |

| Other | €2.2m | €4.1m | 72% |

| Total Compensation | €3.0m | €5.0m | 100% |

On an industry level, roughly 28% of total compensation represents salary and 72% is other remuneration. Although there is a difference in how total compensation is set, K+S more or less reflects the market in terms of setting the salary. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at K+S Aktiengesellschaft's Growth Numbers

Over the last three years, K+S Aktiengesellschaft has shrunk its earnings per share by 142% per year. In the last year, its revenue is down 5.2%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has K+S Aktiengesellschaft Been A Good Investment?

Few K+S Aktiengesellschaft shareholders would feel satisfied with the return of -61% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for K+S that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading K+S or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if K+S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:SDF

K+S

Operates as a supplier of mineral products for the agricultural, industrial, consumer, and community sectors worldwide.

Flawless balance sheet, good value and pays a dividend.