K+S (XTRA:SDF): Is the Turnaround Boosting Valuation After Return to Profitability?

Reviewed by Simply Wall St

K+S (XTRA:SDF) just released its third quarter earnings, turning last year's net loss into a small profit. This turnaround was accompanied by modest sales growth and comes after a period of persistent losses.

See our latest analysis for K+S.

K+S’s rebound to profitability has caught some attention, but the momentum has not quite translated to the stock price yet. The share price recently closed at €11.09, and while the year-to-date share price return sits at a modest 3.4%, the total shareholder return over one year is barely positive at 0.2%. In the longer term, investors who held on for five years have more than doubled their money, with an 83% five-year total shareholder return. However, the past three years have seen a steep drop. With the latest turnaround, it will be interesting to see if improving fundamentals can help reverse the fading momentum.

If this kind of turnaround story has you scanning for new opportunities, now is a perfect chance to broaden your search and discover fast growing stocks with high insider ownership

Given the stock’s modest gains this year and a current price around 19% below analyst targets, the key question is whether K+S shares offer an undervalued entry point or if expectations are already fully reflected in the valuation.

Most Popular Narrative: 18.8% Undervalued

At a last close price of €11.09, K+S trades below the narrative's fair value of €13.66. This sets the scene for what could be a pivotal period as analysts weigh improving operations against industry headwinds.

Strategic investments in expanding specialty and higher-margin fertilizer production (for example, ramp-up at Bethune and expansion into specialty products) enable K+S to pursue revenue diversification and margin enhancement, positioning the company for improved net margins and earnings stability.

Want the real story behind this valuation? There is a tug-of-war between growth projections and ambitious profit targets, all built on critical industry catalysts. Find out which bold assumptions drive this price target and why the future PE ratio could surprise even the bulls.

Result: Fair Value of €13.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high European energy costs and K+S’s sensitivity to currency fluctuations could quickly reverse the company’s recent progress if conditions worsen.

Find out about the key risks to this K+S narrative.

Another View: Does Value Stack Up?

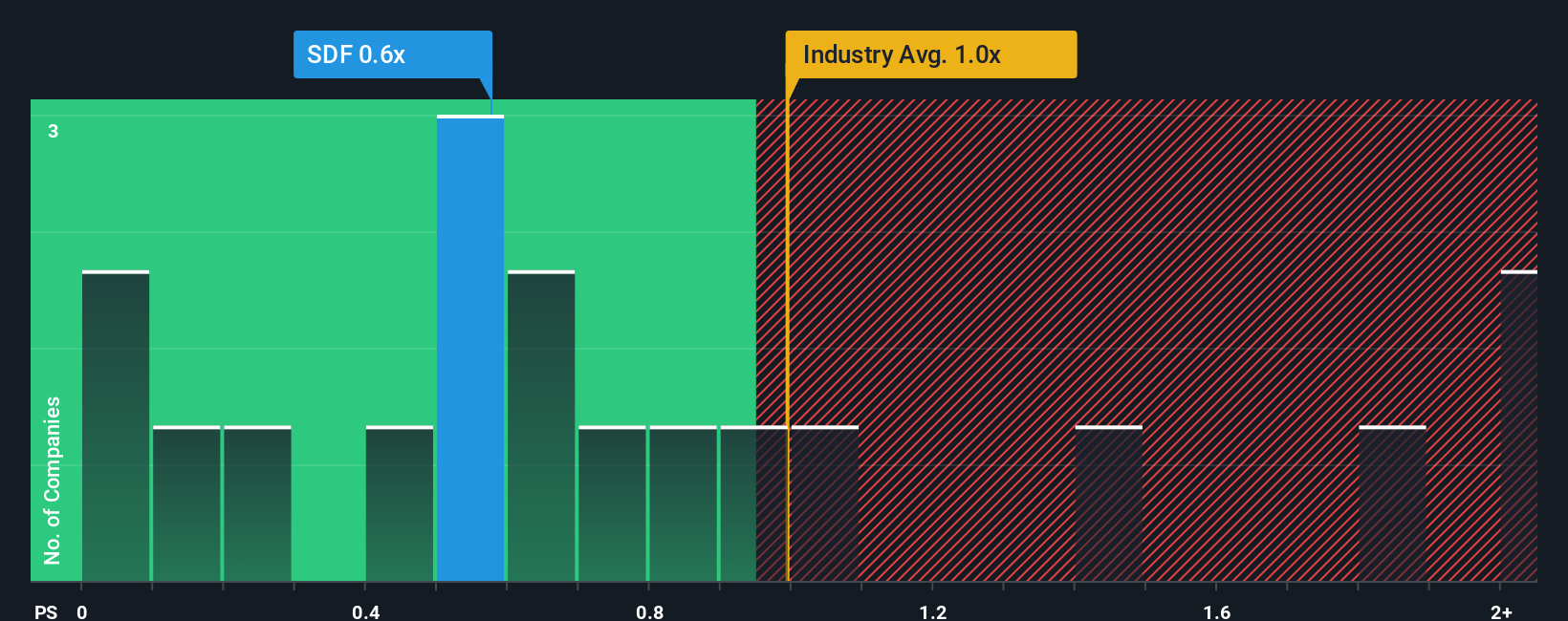

Looking at K+S through the lens of sales multiples offers a slightly different take. The company trades at a price-to-sales ratio of 0.5x, cheaper than its European Chemicals industry peers (1x) and below the peer group average (0.8x). However, it is still above the fair ratio of 0.1x, which suggests some valuation risk if the market reverts. Is this gap a value opportunity or a warning sign if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own K+S Narrative

If you see the numbers differently or want to piece together your own investment story, you can build a personalised view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding K+S.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Use the Simply Wall Street Screener to quickly find handpicked stocks that match your interests and financial goals.

- Unlock incredible yield potential by targeting steady performers among these 15 dividend stocks with yields > 3% with impressive payouts and robust financials.

- Tap into the innovation boom by tracking the hottest breakthroughs driving market buzz with these 26 AI penny stocks.

- Capture hidden value early by acting on smart ideas with these 872 undervalued stocks based on cash flows built on strong fundamentals and big upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K+S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SDF

K+S

Operates as a supplier of mineral products for the agricultural, industrial, consumer, and community sectors in Europe, the United States, Asia, Africa, and Oceania.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives