LANXESS (ETR:LXS investor three-year losses grow to 61% as the stock sheds €152m this past week

Investing in stocks inevitably means buying into some companies that perform poorly. Long term LANXESS Aktiengesellschaft (ETR:LXS) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 63% drop in the share price over that period. And over the last year the share price fell 33%, so we doubt many shareholders are delighted. More recently, the share price has dropped a further 20% in a month.

If the past week is anything to go by, investor sentiment for LANXESS isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for LANXESS

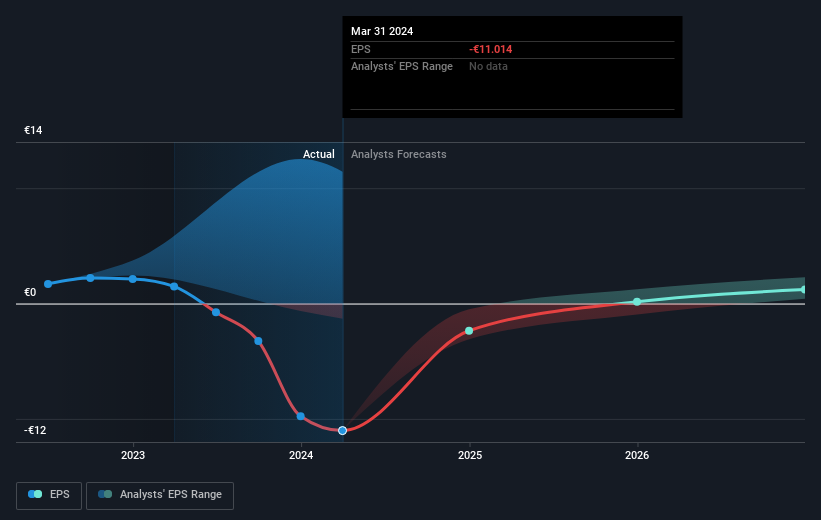

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

LANXESS saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into LANXESS' key metrics by checking this interactive graph of LANXESS's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of LANXESS, it has a TSR of -61% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in LANXESS had a tough year, with a total loss of 33% (including dividends), against a market gain of about 4.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with LANXESS .

But note: LANXESS may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LXS

LANXESS

Operates as a specialty chemicals company that engages in the development, manufacture, and marketing of chemical intermediates, additives, specialty chemicals, and consumer protection products worldwide.

Good value with moderate growth potential.