Fuchs (XTRA:FPE3) Profit Margin Drops, Reinforcing Concerns Over Growth Versus Market Peers

Reviewed by Simply Wall St

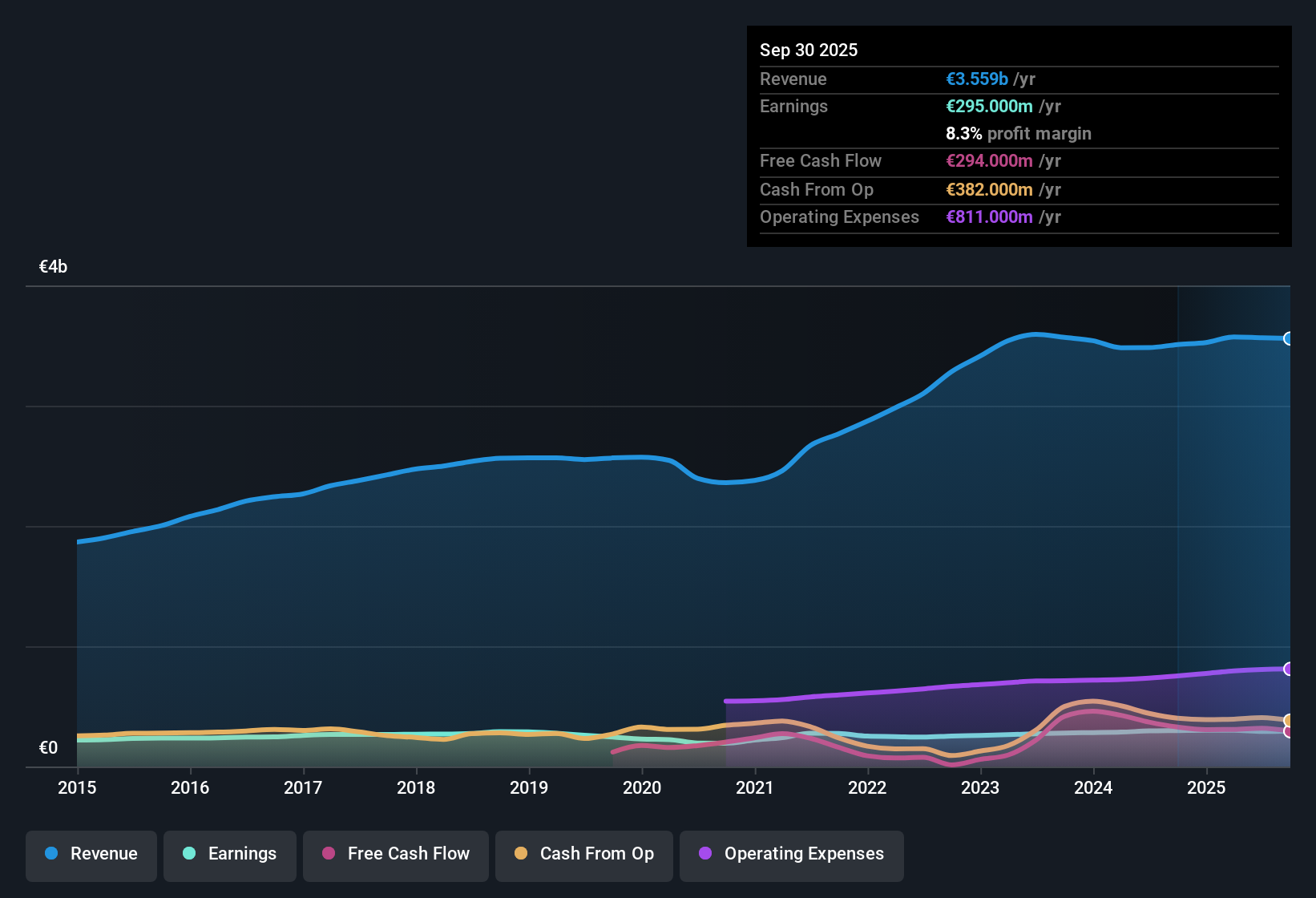

Fuchs (XTRA:FPE3) posted a net profit margin of 8.2%, down from last year’s 8.5%, while earnings are forecast to grow at 8% per year, lagging the German market’s 16.7% annual pace. Over the last five years, the company delivered 6.8% annual earnings growth, with revenue expected to climb 3.1% per year, slower than the broader market’s projected 6.1%. Despite a drop in earnings growth this past year, Fuchs maintains high quality earnings and continues to offer an attractive dividend, trading below both fair value estimates and analyst targets. However, its price-to-earnings ratio sits above peer and industry averages, pointing to a mixed valuation picture for investors.

See our full analysis for Fuchs.Next up, we’ll see how these latest numbers measure up against the most widely followed narratives around Fuchs, spotlighting which stories get reinforced and which ones face new challenges.

See what the community is saying about Fuchs

Margin Expansion Expected Despite Recent Pressures

- Analysts project that Fuchs' profit margins will improve from 8.2% now to 9.5% in three years, even as the company faces ongoing margin pressure today.

- According to analysts' consensus view, investments in specialty lubricants for electric vehicles and a stronger presence in Asia-Pacific are expected to drive higher-value sales that support future margin gains. However, persistent cost challenges and macroeconomic softness keep short-term margin improvements uncertain.

- On one hand, the sustainability focus and "local-to-local" production strategy are designed to protect and grow profits in volatile environments.

- On the other hand, margin compression risk lingers as inflation and adverse product mix shifts, especially in the Americas, dampen expected gains.

Growth Forecast Trails Market, but Electric Vehicle Push Stands Out

- Analysts expect Fuchs' annual earnings growth rate to average 8% and revenue growth at 3.1% per year. Both rates lag the German market’s expected rates of 16.7% and 6.1% respectively, but electric vehicle lubricants and emerging markets are cited as key future drivers.

- The consensus narrative highlights that while Fuchs’ slower projected growth reflects tough headwinds in Europe and the Americas, strategic investments in specialty products for EVs and rapid expansion in Asia-Pacific create opportunities to exceed these moderate forecasts.

- Expansion in China and India is positioned to capture rising demand in fast-industrializing regions, adding balance to European stagnation.

- However, continued macro weakness and market stagnation may constrain acquisitions and slow momentum outside these core growth pockets.

Discounted Price Versus Analyst Target and DCF Fair Value

- Fuchs trades at €38.78, which is far below both its €50.70 analyst price target and its DCF fair value of €61.36. Its P/E of 17.5x is above peer and industry benchmarks (17x and 17.2x), creating a complex valuation profile for investors.

- Under the consensus narrative, bulls may see the almost 31% gap to DCF fair value and 31% discount to the latest analyst price target as a value opportunity if future growth and margin assumptions are realized. Skeptics highlight the valuation premium and risk that anticipated improvements may not materialize as planned.

- With no material new risks flagged and ongoing robust dividend, the main question is whether Fuchs can deliver on those margin and growth forecasts given current headwinds.

- The premium P/E raises the bar for executing on new product strategies and sustaining relative outperformance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fuchs on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a different angle? Share your insights and shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fuchs.

See What Else Is Out There

Fuchs’ slowing revenue and earnings forecasts, ongoing margin pressure, and weaker growth potential compared to its peers raise concerns for investors seeking more consistent upside.

If steadier results matter to you, use our stable growth stocks screener (2101 results) to focus on companies consistently delivering reliable earnings and revenue growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FPE3

Fuchs

Develops, produces, and distributes lubricants and functional fluids in Europe, the Middle East, Africa, the Asia Pacific, and North and South America.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives