Has Evonik’s Recent Price Drop Created a New Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if Evonik Industries might be a bargain or a value trap? You're not alone. Plenty of investors are watching for signs the stock is undervalued.

- Despite some ups and downs, the share price has dipped 3.3% this week and is down 14.4% so far this year, signaling shifting market sentiment and possibly fresh opportunities.

- Market chatter has picked up around Evonik’s portfolio restructuring and sustainability initiatives, both of which have caught the attention of analysts and industry insiders. As headlines discuss the company’s pivot towards specialty chemicals and its latest green innovation targets, investors are recalibrating their expectations about future growth and risk.

- According to our valuation checks, Evonik Industries scores a 5 out of 6, a strong showing for value. Next, we'll break down what this means across several valuation models, but stick around because there is an even smarter way to make sense of the numbers that we’ll reveal by the end of this article.

Find out why Evonik Industries's -24.4% return over the last year is lagging behind its peers.

Approach 1: Evonik Industries Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its expected future cash flows and then discounting them back to today’s value. In Evonik Industries’ case, analysts provide estimates for free cash flow over the next five years, with further projections provided by Simply Wall St for a long-term outlook.

Currently, Evonik Industries generates a Free Cash Flow (FCF) of €534 million. Analyst forecasts expect FCF to climb steadily, with projections reaching €961 million by 2029. In addition, longer-term estimates suggest further growth out to 2035, as the company continues to optimize its business and focus on specialty chemicals. All cash flows are denominated in Euros, matching the company’s reporting currency.

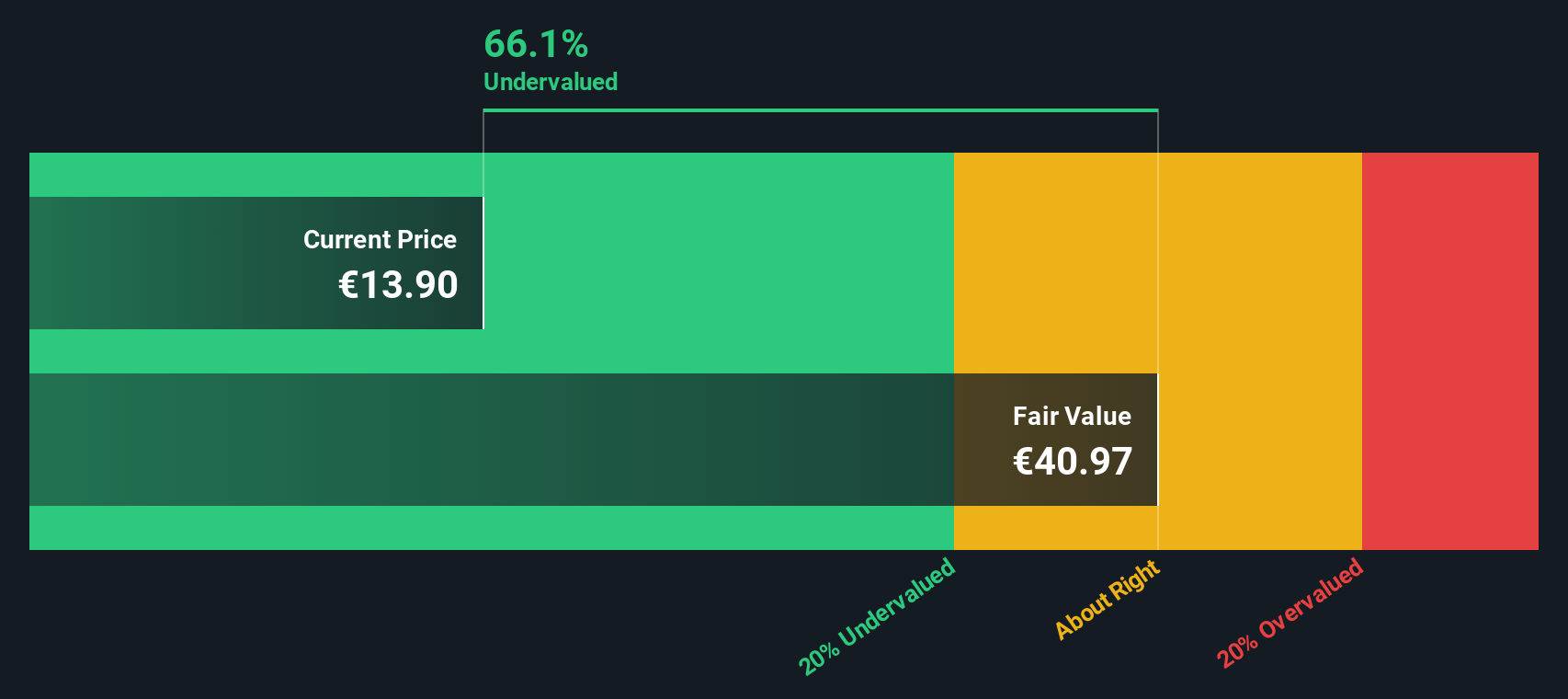

Based on these projections, the DCF approach estimates Evonik Industries’ fair value per share at €47.78. This implies the stock is trading at a 70.1% discount to its intrinsic value, making it appear significantly undervalued at current market prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Evonik Industries is undervalued by 70.1%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: Evonik Industries Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation multiple, especially for profitable companies like Evonik Industries, because it connects the company’s current share price with its actual earnings performance. For businesses consistently generating profits, the PE ratio is a gauge of how much investors are willing to pay for each unit of earnings.

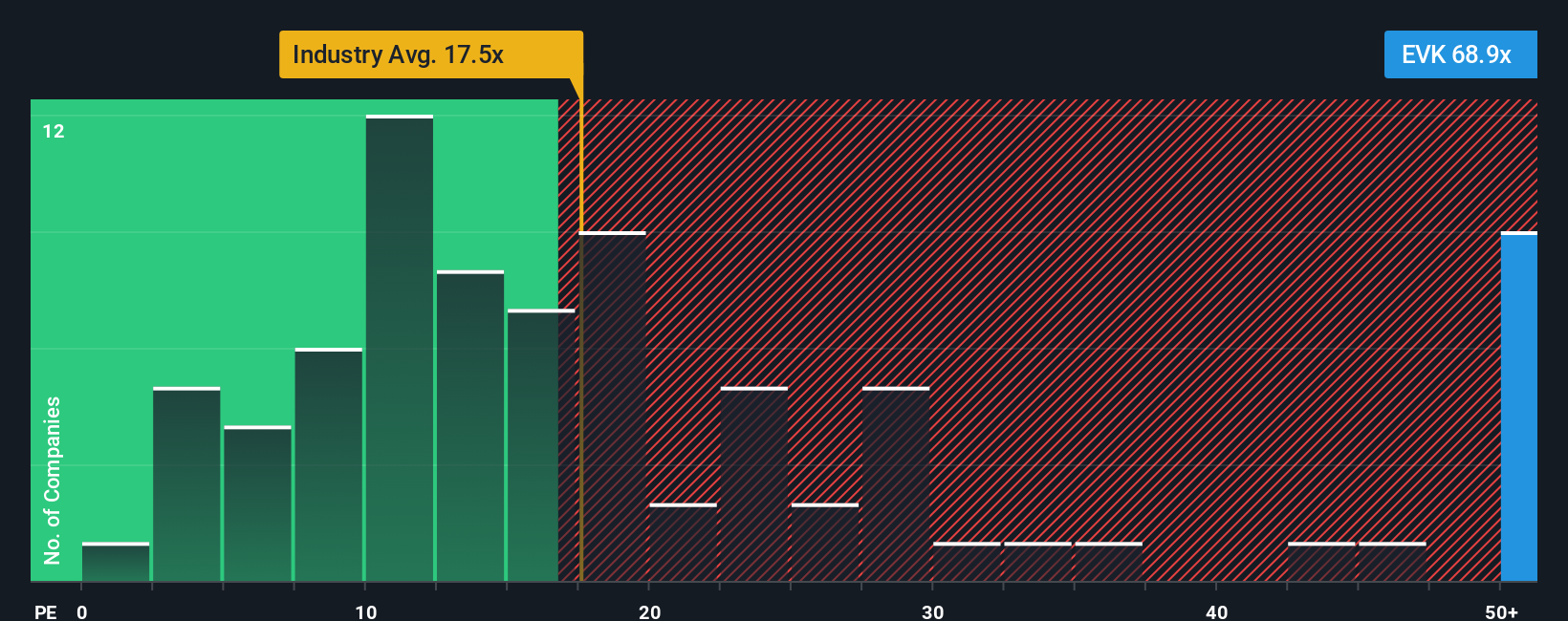

It is important to note that what counts as a “normal” or “fair” PE ratio varies across industries and market cycles. High growth expectations, low perceived risk, or wider profit margins may warrant a higher ratio. Conversely, slower growth or greater risk can drag the PE down. Comparing against benchmarks provides added context.

Currently, Evonik Industries trades on a PE ratio of 15.8x. This is noticeably below the industry average PE of 22.0x and the average among peers at 20.4x. This suggests the stock is priced more conservatively versus its sector.

Simply Wall St’s proprietary “Fair Ratio” goes beyond these simple averages by using factors such as the company’s projected earnings growth, its profit margins, its industry profile, market capitalization, and potential risks. For Evonik, the Fair Ratio comes to 20.9x, representing where the PE should reasonably sit given these attributes.

Because the Fair Ratio considers growth, risk, and profitability alongside sector trends, it gives a comprehensive sense of value that industry and peer averages miss. In Evonik’s case, the current PE ratio is well below the Fair Ratio, indicating the market may be undervaluing the company’s potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Evonik Industries Narrative

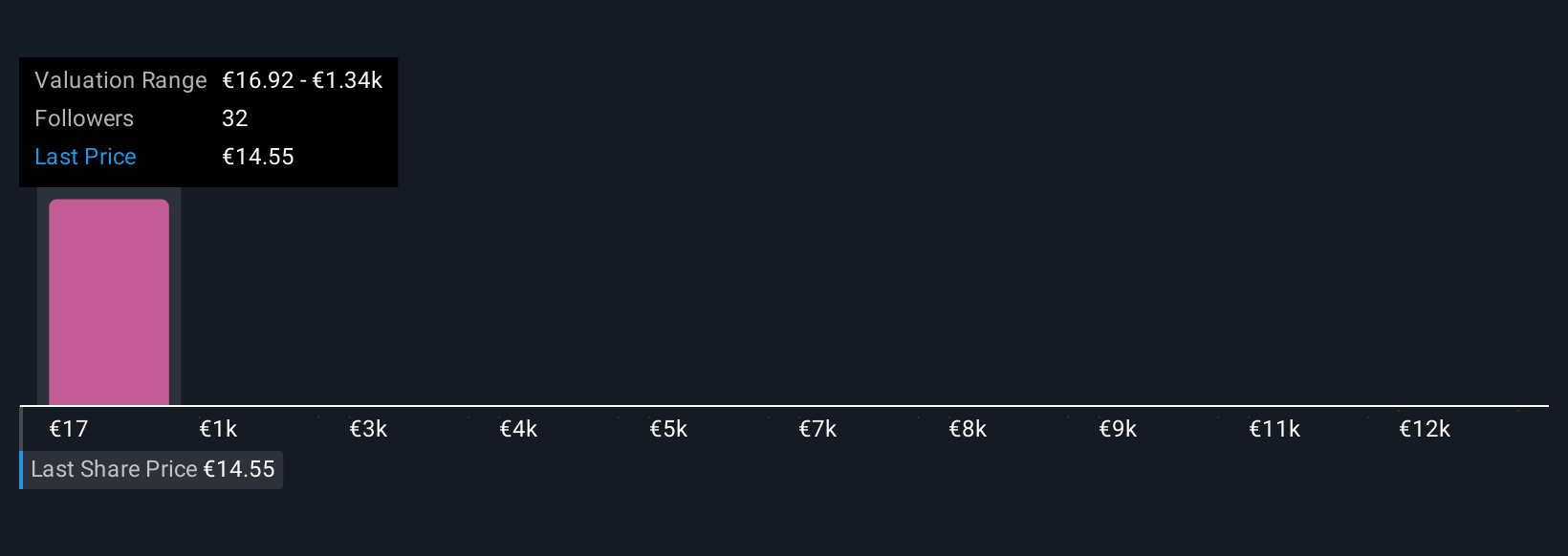

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal take on a company's story, where you connect what is happening on the ground (like Evonik Industries' pivot toward specialty chemicals and cost optimization) with a clear financial forecast and a fair value estimate. Narratives make it easy to share your view of the future by mapping your assumptions about growth, earnings, and margins onto what you believe the company's shares should be worth.

Accessible through the Simply Wall St Community, Narratives let millions of investors not only track but update their perspectives as new information comes in, whether it is news about Evonik's earnings, partnerships, or regulatory trends. By comparing your Narrative-based Fair Value to the current market price, you can decide whether it's time to buy, hold, or sell.

For example, some investors see Evonik’s aggressive cost management and expansion into high-value sectors as the path to stable growth and set higher price targets, while others worry about ongoing macroeconomic headwinds and forecast a lower fair value. Narratives help you interpret these differences and make more confident, personalized decisions.

Do you think there's more to the story for Evonik Industries? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evonik Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVK

Evonik Industries

Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives