Evonik Industries AG's (ETR:EVK) Share Price Could Signal Some Risk

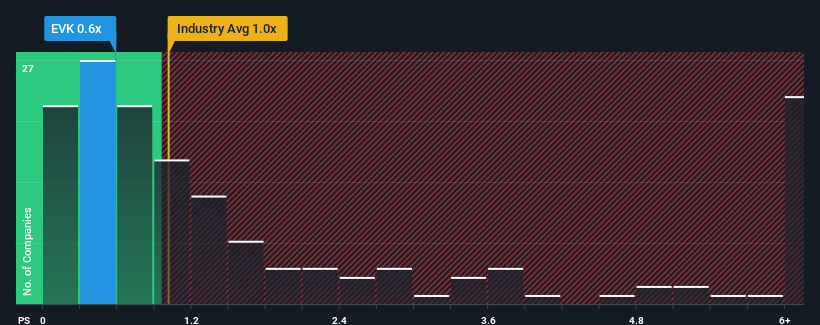

There wouldn't be many who think Evonik Industries AG's (ETR:EVK) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Chemicals industry in Germany is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Evonik Industries

What Does Evonik Industries' P/S Mean For Shareholders?

Evonik Industries' negative revenue growth of late has neither been better nor worse than most other companies. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Evonik Industries' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Evonik Industries?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Evonik Industries' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 2.3% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 4.4% per annum, which is noticeably more attractive.

With this information, we find it interesting that Evonik Industries is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Evonik Industries' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Evonik Industries that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Evonik Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EVK

Evonik Industries

Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives