AlzChem Group's (ETR:ACT) five-year earnings growth trails the 51% YoY shareholder returns

Buying shares in the best businesses can build meaningful wealth for you and your family. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held AlzChem Group AG (ETR:ACT) shares for the last five years, while they gained 568%. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 41% over the last quarter. Anyone who held for that rewarding ride would probably be keen to talk about it.

The past week has proven to be lucrative for AlzChem Group investors, so let's see if fundamentals drove the company's five-year performance.

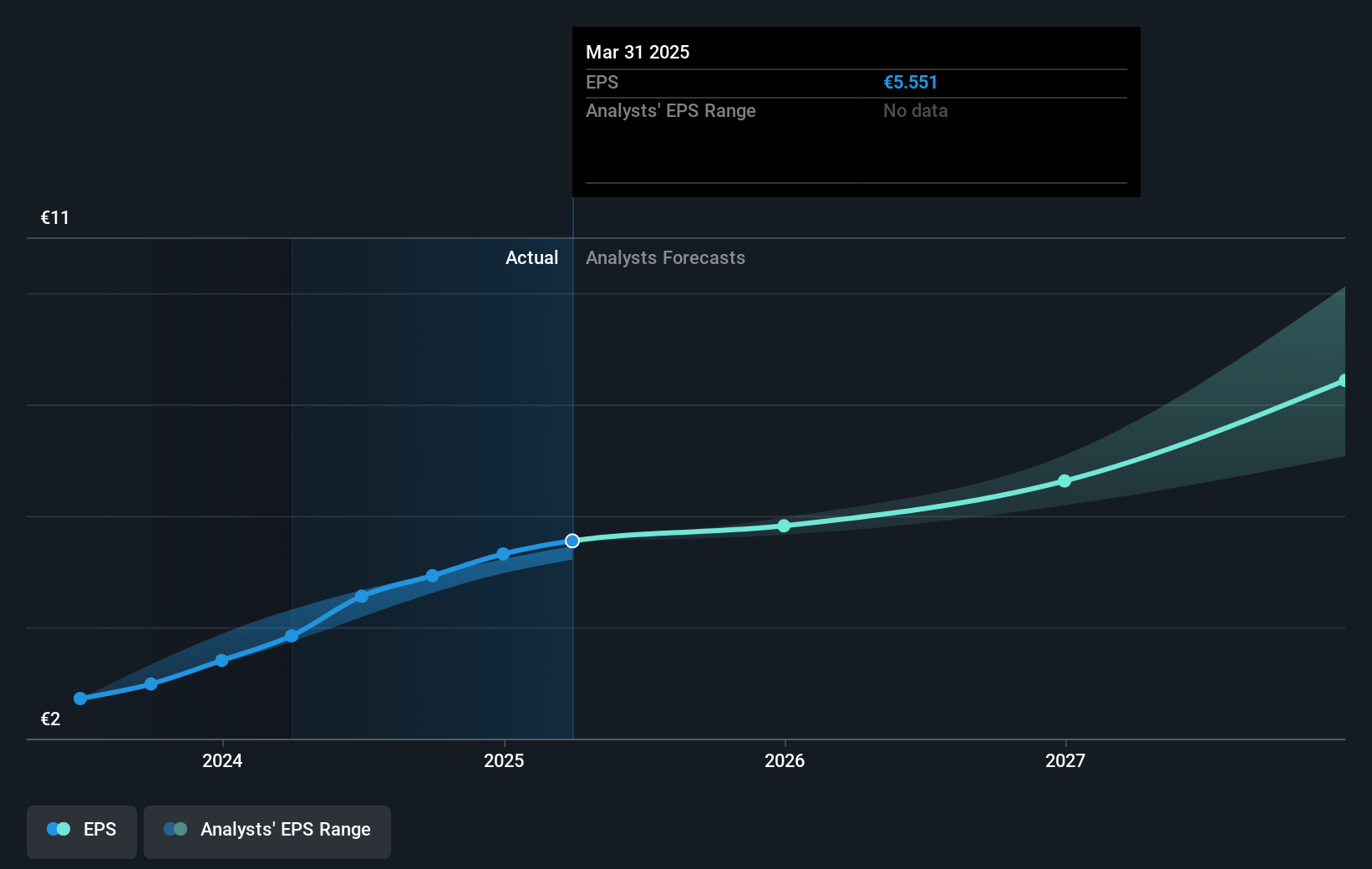

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, AlzChem Group managed to grow its earnings per share at 27% a year. This EPS growth is lower than the 46% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that AlzChem Group has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of AlzChem Group, it has a TSR of 692% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that AlzChem Group shareholders have received a total shareholder return of 211% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 51% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is AlzChem Group cheap compared to other companies? These 3 valuation measures might help you decide.

Of course AlzChem Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ACT

AlzChem Group

Develops, produces, and markets a range of chemical specialties in Germany, European Union, rest of Europe, Asia, NAFTA region, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives