AlzChem Group (XTRA:ACT) Earnings Beat Reinforces Bullish Narrative With Margins Rising to 10.2%

Reviewed by Simply Wall St

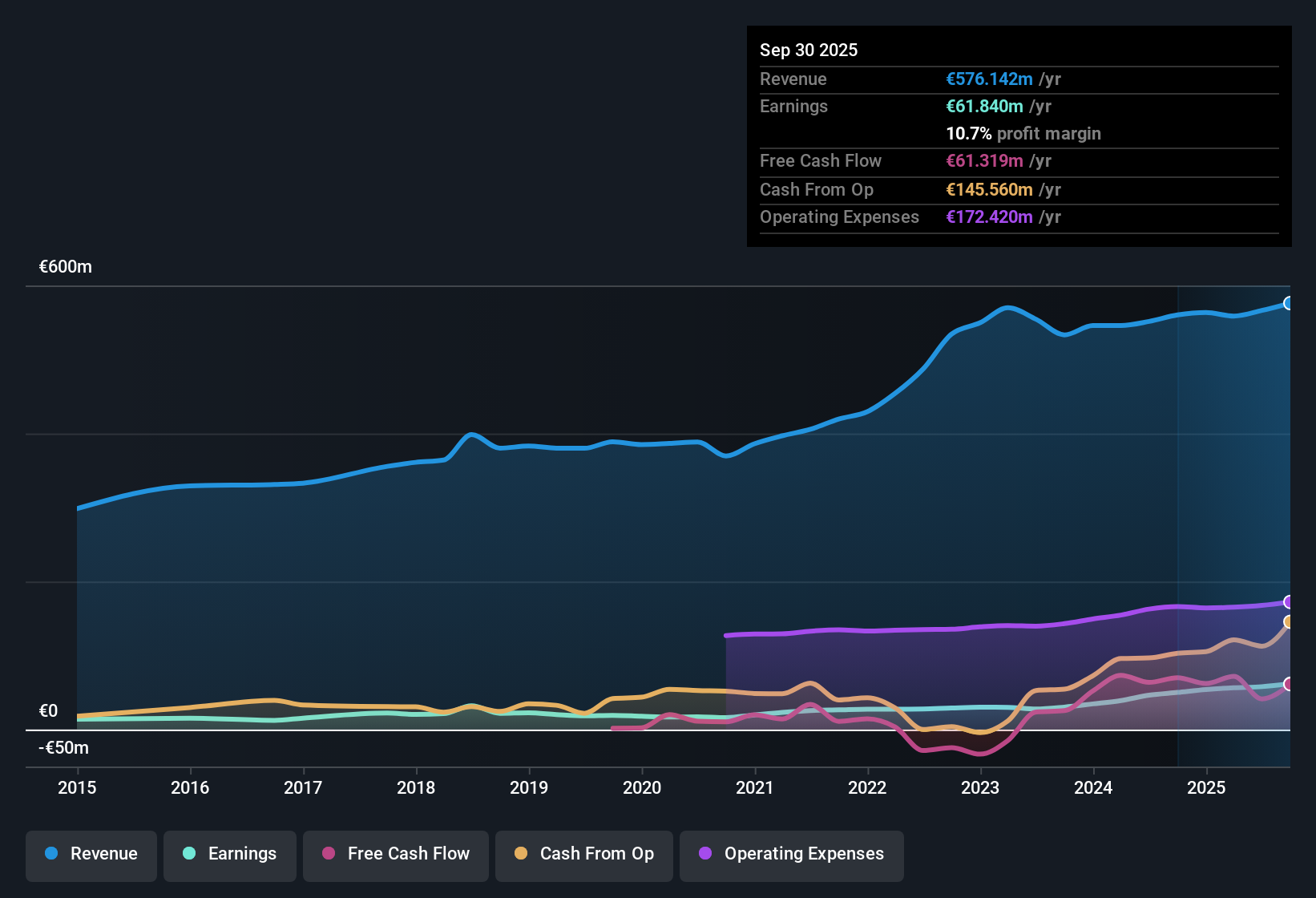

AlzChem Group (XTRA:ACT) posted annual earnings growth of 25%, well above its five-year average of 22.9% per year and comfortably outpacing the German market's current 16.7% rate. Net profit margins reached 10.2%, up from 8.4% last year. The company's strong forecasts call for 18.5% annual earnings growth ahead. With all reward indicators showing positive trends and no identified risks, investors are likely to view these results as robust. However, the elevated price-to-earnings ratio relative to peers could temper enthusiasm for value-focused buyers.

See our full analysis for AlzChem Group.The next section puts AlzChem’s headline numbers side by side with prevailing narratives to see which stories are confirmed and where opinions might shift.

See what the community is saying about AlzChem Group

Margins Strengthen on Premium Products and Innovation

- Net profit margins have climbed to 10.2%, notably higher than last year's 8.4%, with analysts forecasting further improvement to 13.0% over three years.

- Analysts' consensus view points to growth being fueled by strong global demand for specialty products, along with successful capacity expansions in advanced materials and nutrition. These factors drive margin expansion and premium pricing.

- Capacity growth in high-margin specialty chemicals like creatine and nitroguanidine helps AlzChem capitalize on global wellness trends, supporting top-line gains.

- Strategic funding and operational improvements reduce investment risks and reinforce earnings stability despite sector headwinds.

- Consensus narrative sees process optimization and automation offsetting persistent challenges such as high energy costs and regulatory risk, preserving robust profitability and underpinning resilient future margins.

- Revenue growth of 9.5% per year is expected, underpinned by stable demand and premium products, despite European market softness.

- Secured customer grants for U.S.-based operations are anticipated to diversify revenue streams and add margin resilience.

See how analysts and the AlzChem community balance strong margin signals with underlying growth and risk factors. 📊 Read the full AlzChem Group Consensus Narrative.

Valuation Stands at a Premium Despite Potential Upside

- At a price-to-earnings ratio of 29.2x, AlzChem shares are priced well above the German chemicals peer average of 18.2x and the wider European industry’s 17.2x. The current share price of €166.6 exceeds the analyst target of €154.24 and trades at a discount to the €199.31 DCF fair value.

- Analysts' consensus view recognizes the risk that robust profit growth still hasn't been fully priced in, as DCF modeling suggests undervaluation. However, narrative tension persists since consensus price targets see the current price only moderately above fair value, while peer benchmarks indicate a sizable premium.

- The relatively small gap between the market price and analyst price target (7.99% above) underscores the idea that AlzChem is viewed as nearly fairly priced barring upside surprise.

- Persistent premium valuation suggests momentum but presents a hurdle for value-oriented buyers, especially given sector comparisons.

Profit Growth Faces Industry-Specific Risks Ahead

- Earnings are forecast to rise by 18.5% annually, but sector-specific headwinds include volatile energy costs, potential EU regulatory action on key fertilizer products, and double-digit revenue declines in the Basics & Intermediates segment.

- Consensus narrative flags that AlzChem’s earnings durability is tethered to outperforming in high-margin specialties while managing threats from global competition and short-duration supply contracts.

- Chinese competitors’ aggressive pricing and supply overcapacity create ongoing pressure and risk to both margins and market share, challenging revenue stability.

- Exposure to changing customer demand in specialty products like creatine may leave earnings susceptible to market shifts or substitution trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AlzChem Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Is your take on the data unique? Add your point of view and shape the story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AlzChem Group.

Explore Alternatives

Despite robust profit growth and innovation efforts, AlzChem trades at a significant valuation premium to peers. This presents a challenge for value-seeking investors and raises concerns about potential upside.

If you prefer to focus on stocks with stronger value credentials and greater room for upside, see what you can find among these 832 undervalued stocks based on cash flows that align better with your investment goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ACT

AlzChem Group

Develops, produces, and markets a range of chemical specialties in Germany, European Union, rest of Europe, Asia, NAFTA region, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives