In the wake of NÜRNBERGER Beteiligungs-AG's (ETR:NBG6) latest €46m market cap drop, institutional owners may be forced to take severe actions

Key Insights

- Institutions' substantial holdings in NÜRNBERGER Beteiligungs-AG implies that they have significant influence over the company's share price

- A total of 3 investors have a majority stake in the company with 53% ownership

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

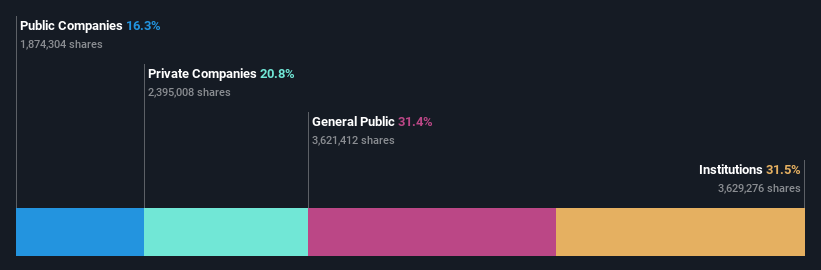

If you want to know who really controls NÜRNBERGER Beteiligungs-AG (ETR:NBG6), then you'll have to look at the makeup of its share registry. With 32% stake, institutions possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As a result, institutional investors endured the highest losses last week after market cap fell by €46m. The recent loss, which adds to a one-year loss of 7.5% for stockholders, may not sit well with this group of investors. Institutions or "liquidity providers" control large sums of money and therefore, these types of investors usually have a lot of influence over stock price movements. As a result, if the decline continues, institutional investors may be pressured to sell NÜRNBERGER Beteiligungs-AG which might hurt individual investors.

Let's delve deeper into each type of owner of NÜRNBERGER Beteiligungs-AG, beginning with the chart below.

See our latest analysis for NÜRNBERGER Beteiligungs-AG

What Does The Institutional Ownership Tell Us About NÜRNBERGER Beteiligungs-AG?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

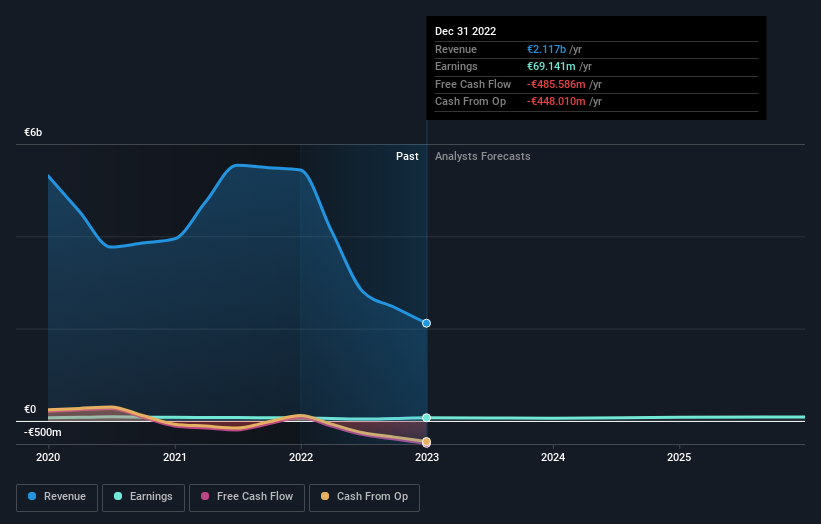

We can see that NÜRNBERGER Beteiligungs-AG does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of NÜRNBERGER Beteiligungs-AG, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don't have a meaningful investment in NÜRNBERGER Beteiligungs-AG. The company's largest shareholder is Neue SEBA Beteiligungsgesellschaft mbH, with ownership of 21%. The second and third largest shareholders are Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München and Versicherungskammer Bayern Versicherungsanstalt Des öffentlichen Rechts, Asset Management Arm, with an equal amount of shares to their name at 16%.

After doing some more digging, we found that the top 3 shareholders collectively control more than half of the company's shares, implying that they have considerable power to influence the company's decisions.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of NÜRNBERGER Beteiligungs-AG

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our data cannot confirm that board members are holding shares personally. It is unusual not to have at least some personal holdings by board members, so our data might be flawed. A good next step would be to check how much the CEO is paid.

General Public Ownership

With a 31% ownership, the general public, mostly comprising of individual investors, have some degree of sway over NÜRNBERGER Beteiligungs-AG. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

Our data indicates that Private Companies hold 21%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Public Company Ownership

We can see that public companies hold 16% of the NÜRNBERGER Beteiligungs-AG shares on issue. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for NÜRNBERGER Beteiligungs-AG you should be aware of, and 1 of them is concerning.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if NÜRNBERGER Beteiligungs-AG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NBG6

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives