Germany's DAX index has recently experienced a 2.17% rise, buoyed by an interest rate cut from the European Central Bank amid signs of weakening economic growth and slowing inflation in the eurozone. As investors navigate these shifting economic landscapes, dividend stocks can offer a stable income stream and potential for capital appreciation. In this context, identifying strong dividend stocks involves looking for companies with consistent earnings, robust cash flows, and a commitment to returning value to shareholders through regular dividends. Here are three top German dividend stocks to watch in September 2024.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| All for One Group (XTRA:A1OS) | 3.19% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.29% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.29% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.74% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.78% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.20% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.58% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.21% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.31% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.73% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Allianz (XTRA:ALV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Allianz SE, with a market cap of €111.56 billion, operates globally through its subsidiaries offering property-casualty insurance, life/health insurance, and asset management products and services.

Operations: Allianz SE generates revenue from property-casualty insurance (€74.95 billion), life/health insurance (€45.52 billion), and asset management (€3.34 billion) segments worldwide.

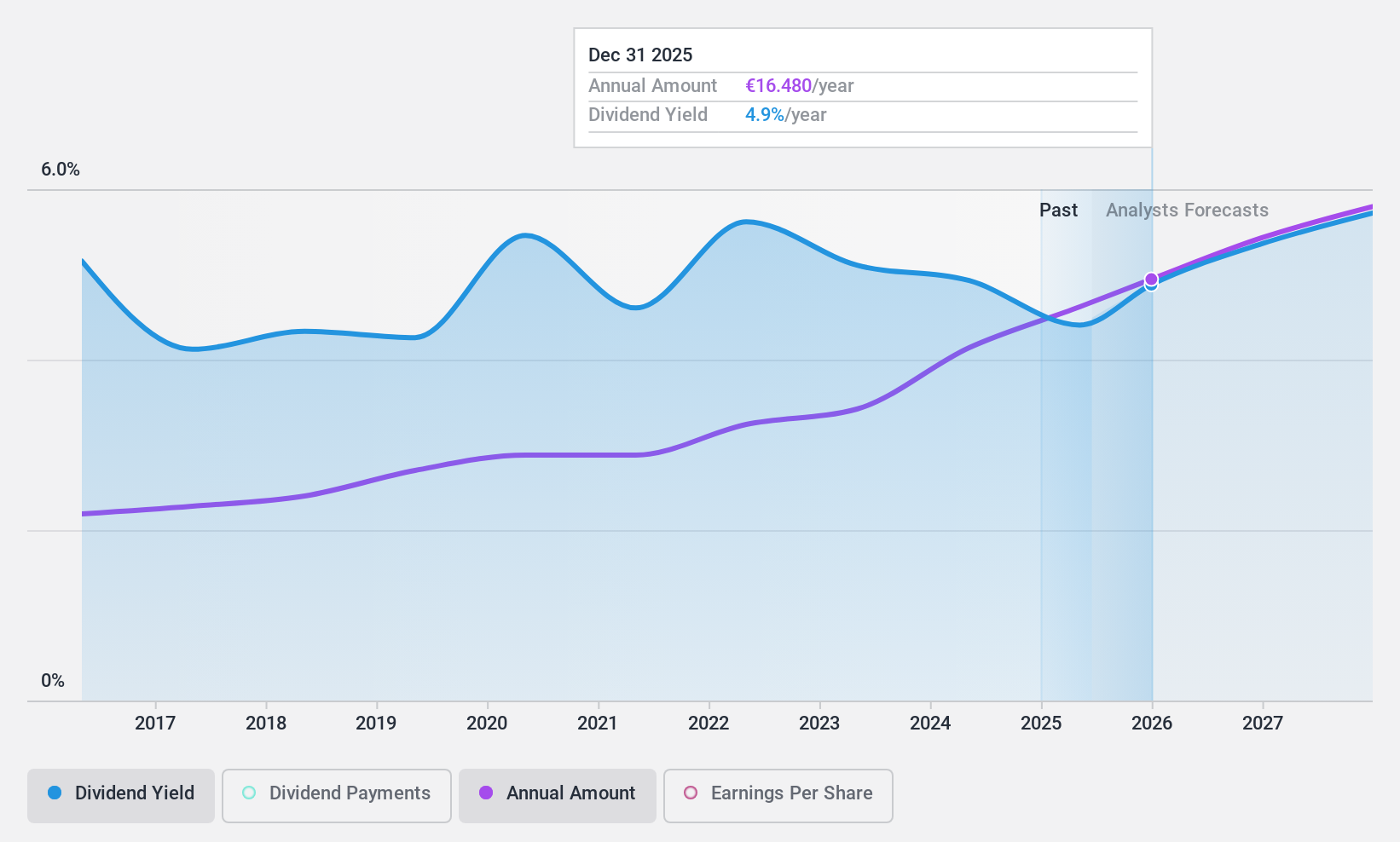

Dividend Yield: 4.8%

Allianz's dividend payments have been stable and growing over the past 10 years, with a current yield of 4.79%. The company's dividends are well-covered by earnings (60% payout ratio) and cash flows (23.1% cash payout ratio). Recent activities include completing a $1.25 billion fixed-income offering, repurchasing shares worth €1 billion, and affirming its 2024 operating profit target at €14.8 billion.

- Click here to discover the nuances of Allianz with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Allianz's current price could be quite moderate.

DATAGROUP (XTRA:D6H)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATAGROUP SE provides IT solutions in Germany and internationally, with a market cap of €335.76 million.

Operations: DATAGROUP SE generates revenue through its Services segment (€456.25 million) and Solutions & Consulting segment (€77.59 million).

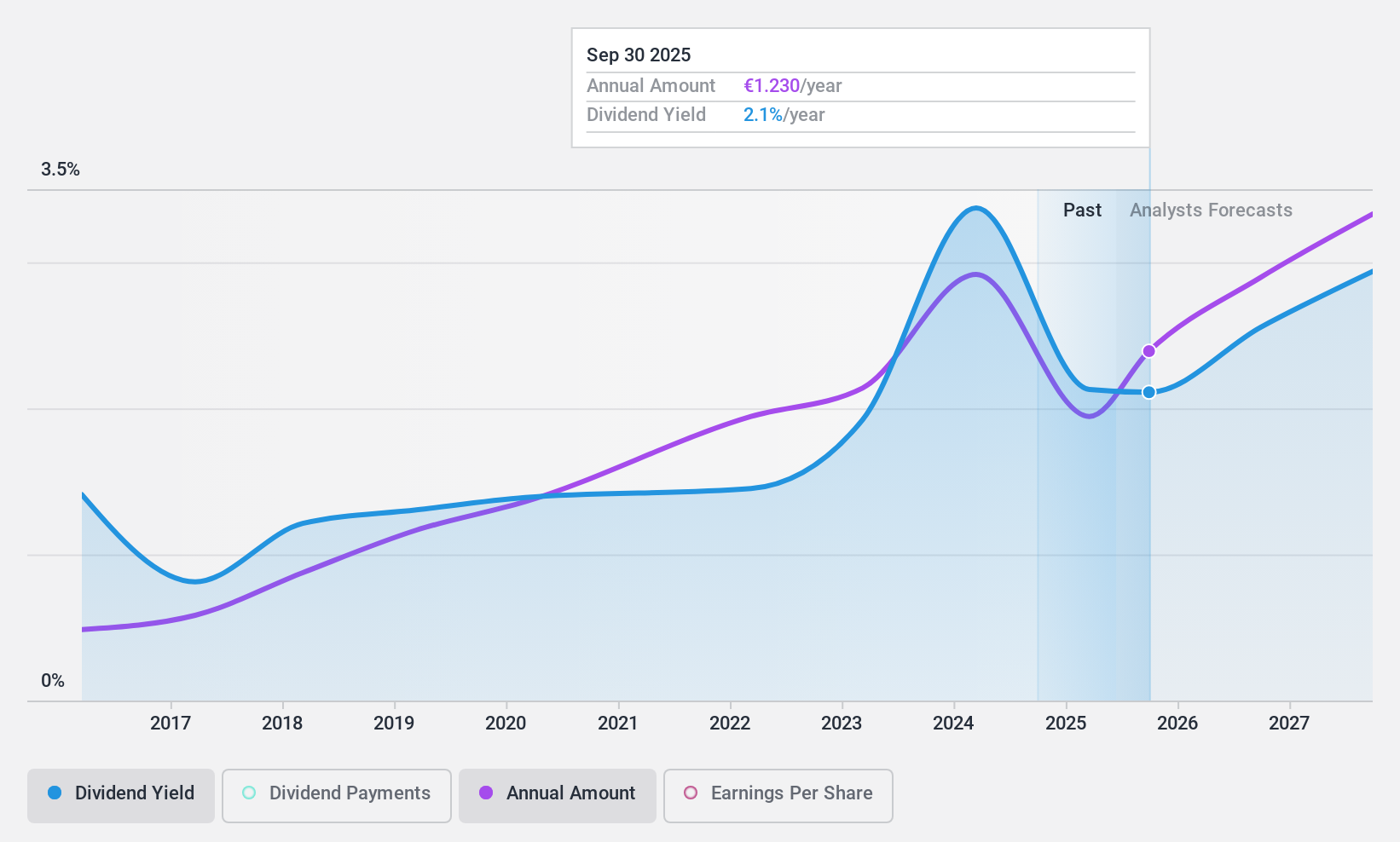

Dividend Yield: 3.7%

DATAGROUP's dividend payments have been volatile over the past 10 years, but they are well covered by earnings (48.1% payout ratio) and cash flows (28.2% cash payout ratio). The stock is trading at good value compared to peers and industry, with analysts expecting an 88.2% price increase. Recent earnings for the nine months ended June 30, 2024, showed sales of €383.75 million and net income of €18.34 million, indicating steady revenue growth but a slight dip in profits year-over-year.

- Click to explore a detailed breakdown of our findings in DATAGROUP's dividend report.

- According our valuation report, there's an indication that DATAGROUP's share price might be on the cheaper side.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA, with a market cap of approximately €1.04 billion, manufactures and supplies pumps, valves, and related services globally through its subsidiaries.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

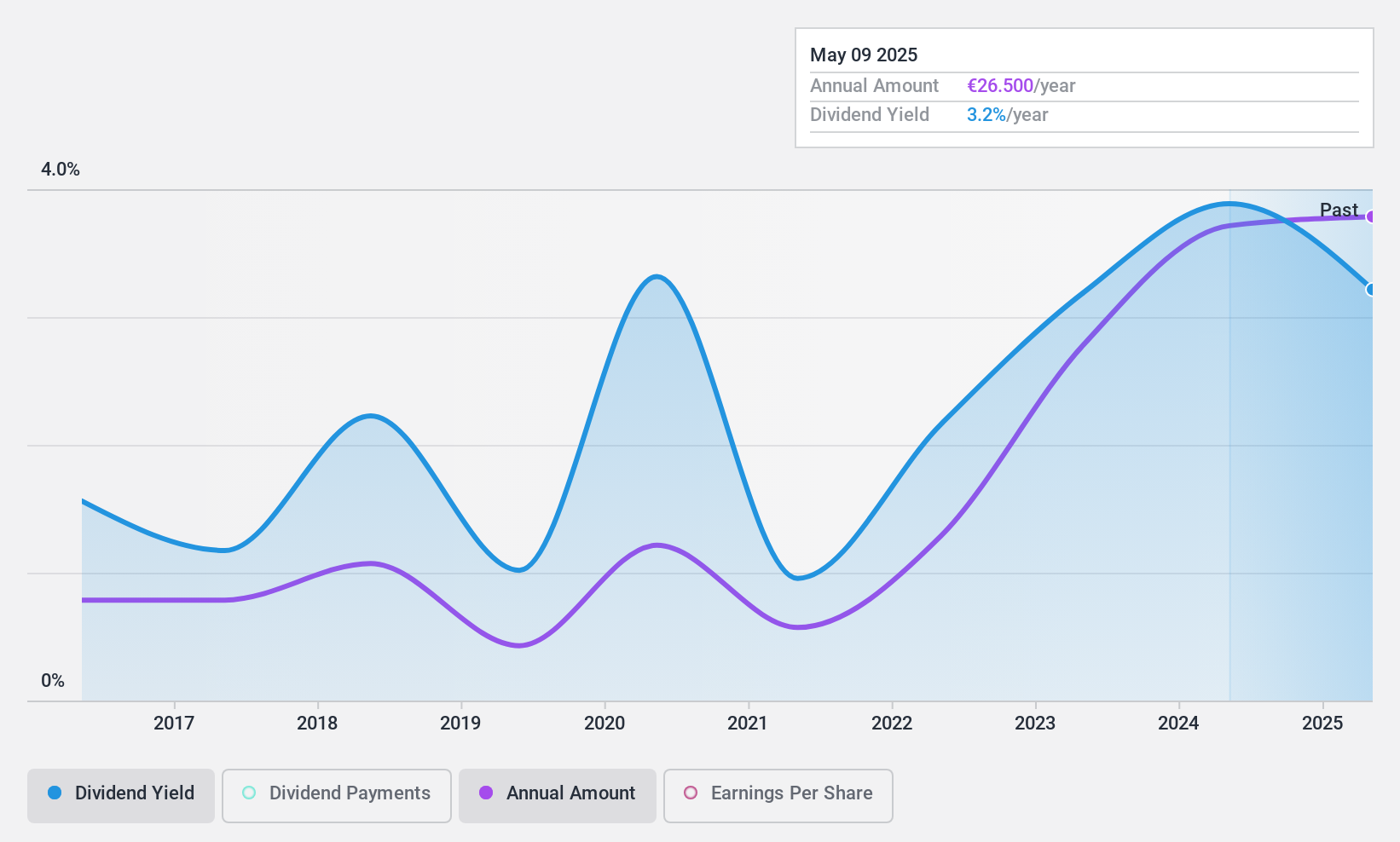

Dividend Yield: 4.1%

KSB SE & Co. KGaA's dividend yield (4.13%) is below the top 25% of German dividend payers, and its payments have been volatile over the past decade. Despite this, dividends are well covered by earnings (29.9% payout ratio) and cash flows (24.2% cash payout ratio). Recent earnings for H1 2024 showed sales of €1.44 billion with a net income of €58.2 million, reflecting steady revenue growth but a slight dip in profits year-over-year.

- Dive into the specifics of KSB SE KGaA here with our thorough dividend report.

- Our valuation report unveils the possibility KSB SE KGaA's shares may be trading at a discount.

Taking Advantage

- Embark on your investment journey to our 31 Top German Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:D6H

DATAGROUP

Provides information technology (IT) solutions in Germany and internationally.

Very undervalued with adequate balance sheet and pays a dividend.