- Germany

- /

- Medical Equipment

- /

- XTRA:SHL

Would Shareholders Who Purchased Siemens Healthineers' (ETR:SHL) Stock Year Be Happy With The Share price Today?

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Siemens Healthineers AG (ETR:SHL) have tasted that bitter downside in the last year, as the share price dropped 13%. That's disappointing when you consider the market returned 4.7%. Siemens Healthineers may have better days ahead, of course; we've only looked at a one year period. It's up 1.2% in the last seven days.

View our latest analysis for Siemens Healthineers

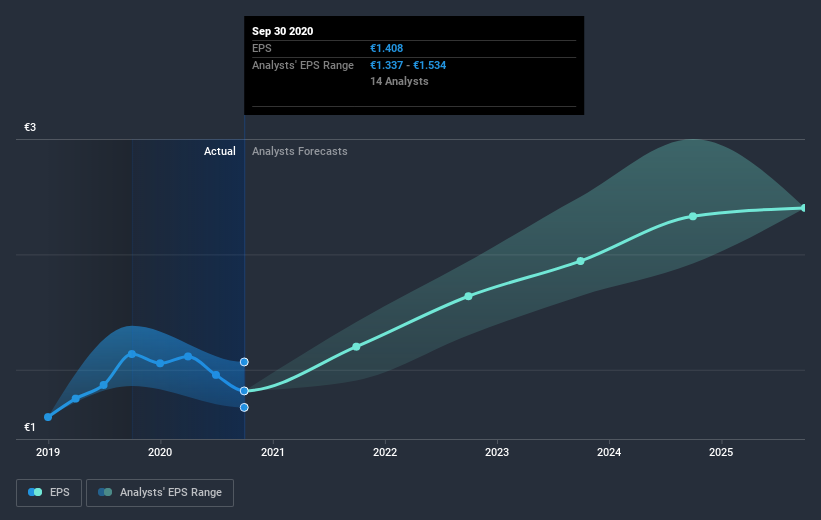

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Siemens Healthineers had to report a 10% decline in EPS over the last year. This reduction in EPS is not as bad as the 13% share price fall. So it seems the market was too confident about the business, a year ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While Siemens Healthineers shareholders are down 11% for the year (even including dividends), the market itself is up 4.7%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 0.6% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Siemens Healthineers better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Siemens Healthineers .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you’re looking to trade Siemens Healthineers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:SHL

Siemens Healthineers

Through its subsidiaries, develops, manufactures, and sells a range of diagnostic and therapeutic products and services to healthcare providers worldwide.

Undervalued with solid track record.