- Germany

- /

- Medical Equipment

- /

- XTRA:SHL

Does Siemens Healthineers’ Medical Imaging Breakthrough Signal a Missed Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if Siemens Healthineers is trading at a great price or if you are chasing the story too late? You are not alone. Let's dig into what the current market is saying.

- The stock has nudged up 0.8% over the past week and managed a steady 3.5% gain for the year, signaling renewed interest and possibly shifting risk perceptions.

- Recent news around advancements in medical imaging technology and key partnerships have been grabbing headlines, giving investors more to weigh as the company sharpens its competitive edge. These developments put a spotlight on the company’s role in shaping the future of healthcare tech and have played a part in its latest stock moves.

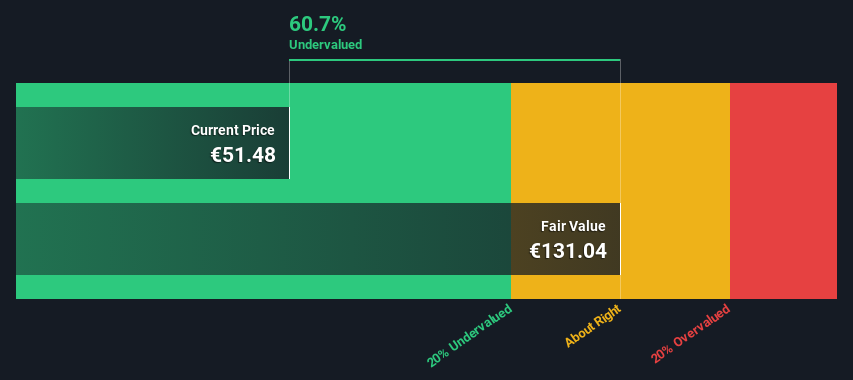

- On our valuation scorecard, Siemens Healthineers checks in at 5 out of 6 for undervaluation, suggesting the stock might be attractively priced using standard measures. As we will explore, there may be an even smarter way to assess its value by the end of this article.

Approach 1: Siemens Healthineers Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. This reflects the time value of money and helps investors gauge whether a stock’s current price is justified by its long-term earning potential.

For Siemens Healthineers, the current Free Cash Flow (FCF) stands at approximately €3.02 Billion. While analysts provide detailed estimates for the next five years, projections beyond that are extrapolated. By 2029, FCF is projected to rise to €4.6 Billion. Looking out a decade, estimates surpass €6.9 Billion annually based on continued growth trends.

Applying the 2 Stage Free Cash Flow to Equity DCF methodology, the model arrives at an intrinsic value of €110.04 per share. Compared to the current share price, this suggests the stock is trading at a 55.2% discount to its calculated value, which points to significant undervaluation by the market at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Siemens Healthineers is undervalued by 55.2%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Siemens Healthineers Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies because it directly reflects how much investors are willing to pay today for a euro of earnings. It is especially useful for established, consistently profitable businesses like Siemens Healthineers, as it allows for apples-to-apples comparisons across companies and industries.

Growth expectations and perceived risk play a big role in setting what is considered a “fair” PE ratio. Companies expected to grow earnings faster, or seen as less risky, tend to command higher PE multiples, while those with slower growth or more risk have lower multiples.

Currently, Siemens Healthineers trades at a PE ratio of 25x. For context, the average PE for the Medical Equipment industry stands at 28.1x, and the peer group average is even higher at 34.3x. This places Siemens Healthineers below both benchmarks, suggesting a potentially more attractive entry point, assuming its growth and profitability are in line with peers.

Simply Wall St’s proprietary “Fair Ratio” offers a more nuanced perspective. Unlike simple industry or peer comparisons, the Fair Ratio incorporates Siemens Healthineers’ projected earnings growth, profit margins, risk factors, market cap, and specific industry dynamics to estimate a tailored multiple. This way, it avoids the pitfalls of one-size-fits-all metrics and provides a fairer reflection of the company’s true value.

With a Fair Ratio of 34.2x, which is significantly above the current 25x PE, the analysis suggests Siemens Healthineers is undervalued on this measure and is trading well below what would be considered reasonable given its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Siemens Healthineers Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers; it combines your perspective on Siemens Healthineers' strategy, expected revenue, earnings, and profit margins into a single forecast that produces your personalized fair value for the stock.

Narratives work by directly linking a company’s story and operating assumptions to a dynamic financial forecast, resulting in a fair value estimate you can use to make buy or sell decisions with confidence. On Simply Wall St, Narratives are an easy-to-use tool found on the Community page, trusted by millions of investors to help turn investment research into actionable decisions.

When news breaks or new results are announced, Narratives instantly update, so your analysis stays relevant and up to date. This makes it far easier to connect the latest developments, such as Siemens Healthineers launching innovative AI diagnostic tools or announcing partnerships, to shifts in fair value and possible changes in investment strategy.

For example, some investors may have a more optimistic Narrative for Siemens Healthineers, forecasting faster revenue growth and higher future earnings, resulting in a fair value near €65. More cautious perspectives, weighing risks like tariff pressures or China market challenges, result in fair values around €50.

Do you think there's more to the story for Siemens Healthineers? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SHL

Siemens Healthineers

Through its subsidiaries, develops, manufactures, and sells a range of diagnostic and therapeutic products and services to healthcare providers worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives