- Germany

- /

- Auto Components

- /

- XTRA:SFQ

Top German Dividend Stocks To Consider In July 2024

Reviewed by Simply Wall St

As of July 2024, the German market has shown positive momentum, with the DAX index climbing 1.48% in a week, buoyed by favorable economic data from both Europe and the U.S. This uplift reflects a broader European trend where major indices have advanced following encouraging inflation reports and monetary policy adjustments. In this context, dividend stocks remain an attractive consideration for investors looking for potential income generation amidst fluctuating markets. These stocks can offer a steady stream of returns which might be particularly appealing in an environment marked by moderated inflation and shifting central bank policies.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.25% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.66% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.16% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.37% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.09% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 6.87% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.33% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.20% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.21% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.12% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top German Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in designing vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle sectors globally, with a market capitalization of €250 million.

Operations: EDAG Engineering Group AG generates its revenue primarily from three segments: Vehicle Engineering (€488.93 million), Production Solutions (€268.86 million), and Electrics/Electronics (€111.45 million).

Dividend Yield: 5.5%

EDAG Engineering Group AG, despite a recent special dividend of €0.55 and a stable dividend yield of 5.5%, struggles with an unstable dividend track record over the past 8 years, marked by volatility and declining payments. The company's dividends are reasonably covered by earnings and cash flows, with payout ratios at 49.7% and 46.4% respectively. However, recent executive changes and a slight dip in net income from €8.34 million to €7.04 million could influence future stability and growth prospects.

- Click here to discover the nuances of EDAG Engineering Group with our detailed analytical dividend report.

- The analysis detailed in our EDAG Engineering Group valuation report hints at an inflated share price compared to its estimated value.

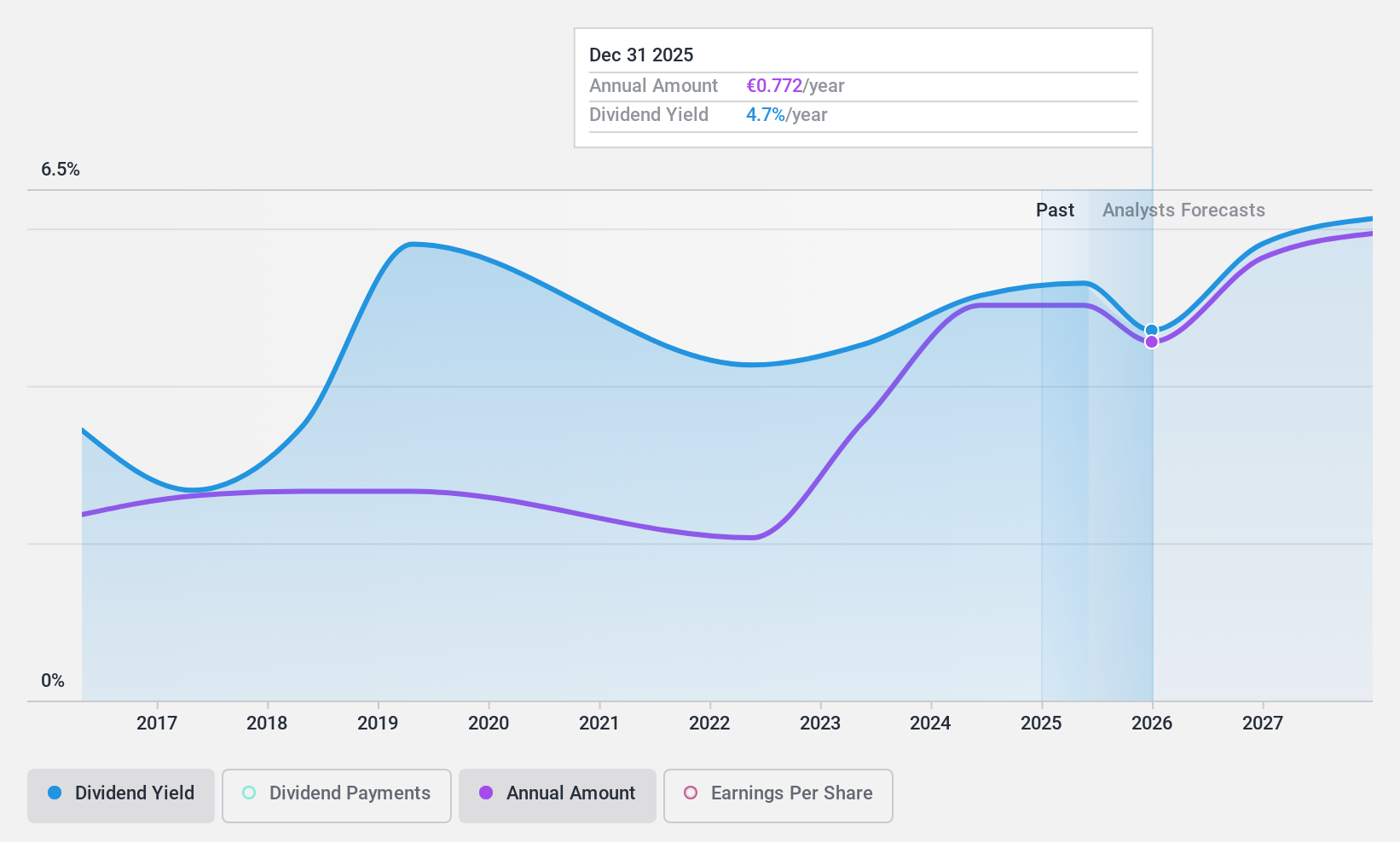

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SAF-Holland SE is a manufacturer and supplier of chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market capitalization of approximately €0.86 billion.

Operations: SAF-Holland SE generates its revenues primarily from three geographic segments: €951.75 million from Europe, the Middle East, and Africa (EMEA), €898.79 million from the Americas, and €280.64 million from Asia/Pacific including China and India.

Dividend Yield: 4.5%

SAF-Holland SE, with a dividend yield of 4.47%, trades below its fair value by 44.9%. Although the dividends have increased over the past decade, their reliability has been compromised by volatility and an unstable track record. Earnings coverage is solid at a 44.6% payout ratio, supported by a growth of 28% in earnings last year and forecasted annual growth of 9.46%. However, high debt levels and a dividend yield slightly lower than the top German payers pose challenges.

- Click to explore a detailed breakdown of our findings in SAF-Holland's dividend report.

- In light of our recent valuation report, it seems possible that SAF-Holland is trading behind its estimated value.

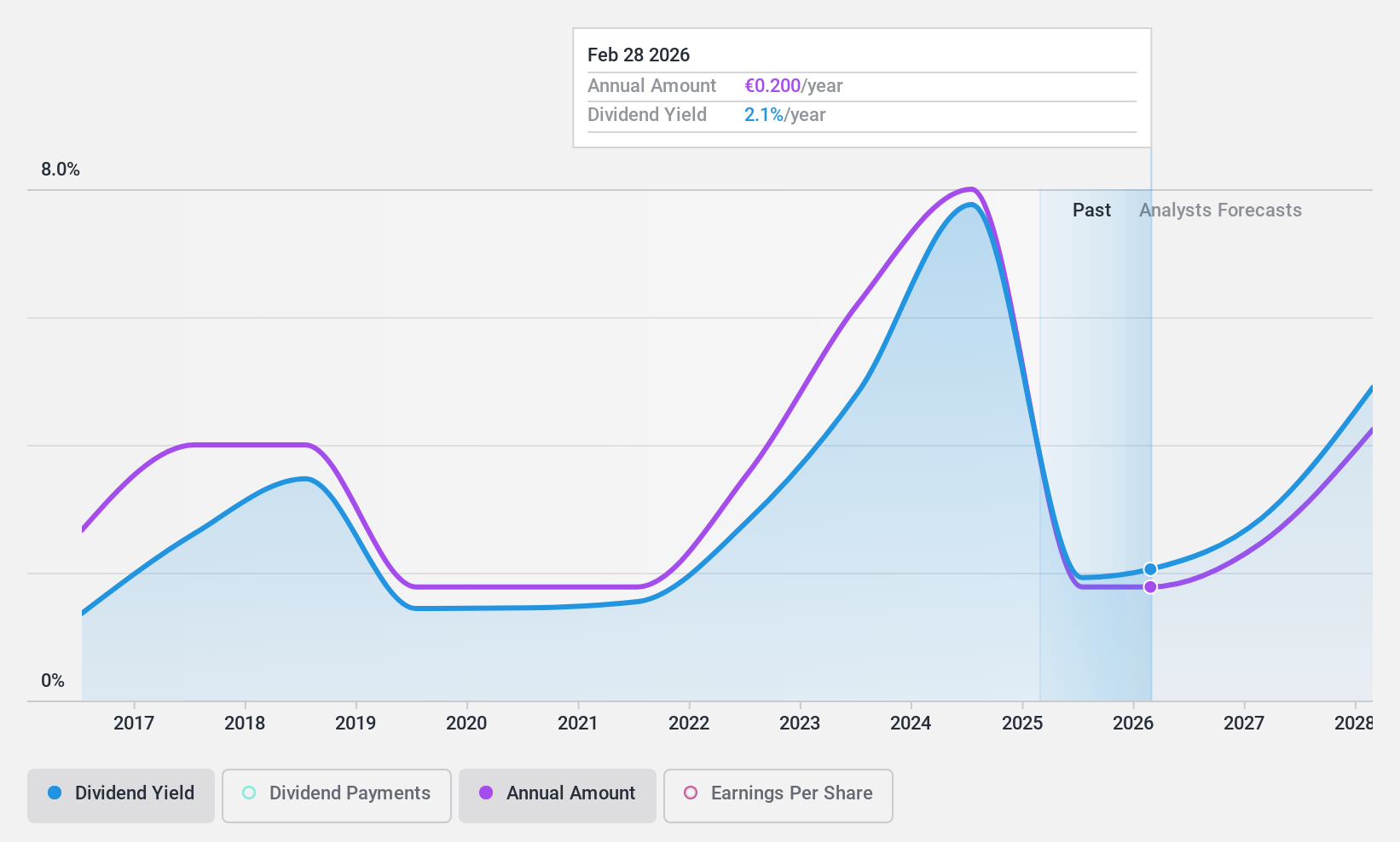

Südzucker (XTRA:SZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG is a global producer and seller of sugar products, operating in Germany, the rest of the European Union, the United Kingdom, the United States, and other international markets, with a market capitalization of approximately €2.67 billion.

Operations: Südzucker AG's revenue is generated from several segments, with Sugar contributing €4.59 billion, Special Products (excluding Starch) at €2.40 billion, Fruit at €1.58 billion, Starch at €1.12 billion, and CropEnergies at €1.16 billion.

Dividend Yield: 6.9%

Südzucker AG, despite its unstable dividend history over the past decade, maintains a solid foundation for its dividends with a payout ratio of 39.4% and a cash payout ratio of 23.4%, indicating good coverage by both earnings and cash flows. The company's recent dividend increase to €0.90 per share reflects confidence, although it faces challenges with forecasted earnings declines averaging 22.7% annually over the next three years. Trading at 37.7% below estimated fair value suggests potential undervaluation relative to peers.

- Unlock comprehensive insights into our analysis of Südzucker stock in this dividend report.

- The analysis detailed in our Südzucker valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 26 Top German Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SFQ

SAF-Holland

Manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses.

Undervalued with solid track record and pays a dividend.