3 Undiscovered German Gems with Strong Financial Foundations

Reviewed by Simply Wall St

As European inflation nears the central bank's target and Germany's DAX reaches new heights, the market sentiment is cautiously optimistic. This backdrop provides a fertile ground for identifying small-cap stocks with strong financial foundations that can thrive in such an environment. In this article, we will explore three undiscovered German gems that exhibit robust financial health and potential for growth amidst these favorable economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SIMONA (DB:SIM0)

Simply Wall St Value Rating: ★★★★★☆

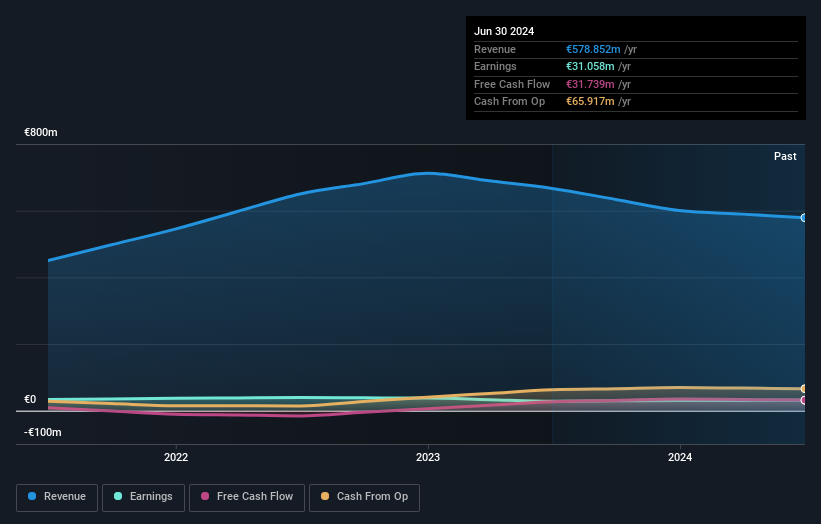

Overview: SIMONA Aktiengesellschaft develops, manufactures, and markets a range of semi-finished thermoplastics, pipes, fittings, and profiles worldwide with a market cap of €414.00 million.

Operations: Revenue for SIMONA Aktiengesellschaft is derived from semi-finished plastics, pipes, fittings, and finished parts totaling €578.85 million. The company has a market cap of €414.00 million.

With a debt to equity ratio that has increased from 9.6% to 17.9% over the last five years, SIMONA shows a satisfactory net debt to equity ratio of 0.8%. The company reported earnings growth of 9.6%, outpacing the Chemicals industry’s 5%. For the half year ending June 30, sales were EUR298.25 million compared to EUR319.8 million last year, while net income rose slightly to EUR13.24 million from EUR12.69 million previously. Trading at nearly 69% below its fair value estimate suggests potential upside for investors.

- Click to explore a detailed breakdown of our findings in SIMONA's health report.

Explore historical data to track SIMONA's performance over time in our Past section.

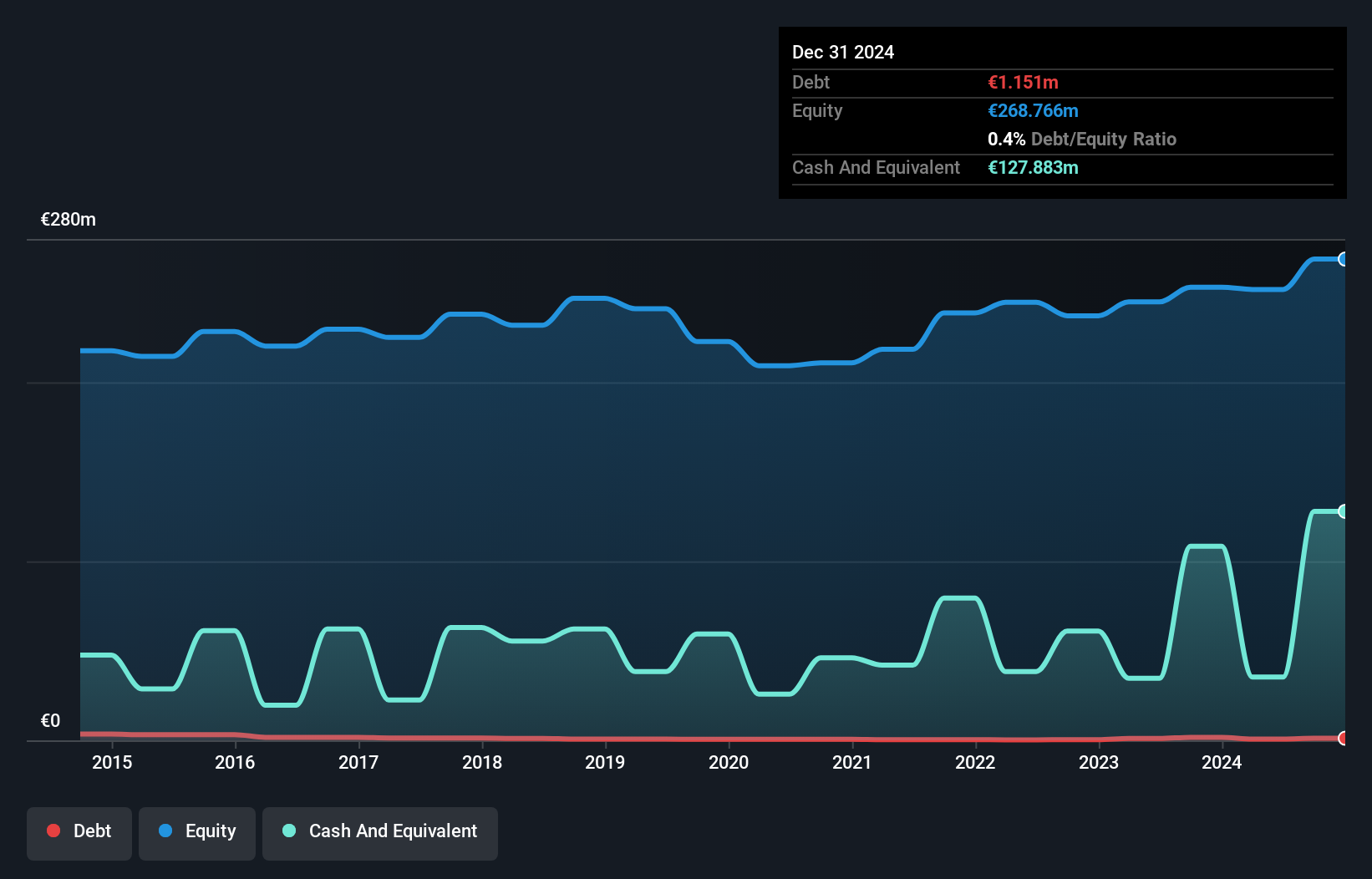

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €672.48 million, mines, produces, and sells salt in Germany, the European Union, and internationally through its subsidiaries.

Operations: Südwestdeutsche Salzwerke AG generates revenue primarily from its salt segment (€283.67 million) and waste management segment (€62.46 million). The company also has minor contributions from other segments totaling €17.80 million, with reconciliations amounting to -€17.18 million.

Südwestdeutsche Salzwerke (SWS) has shown impressive performance, with earnings growth of 4290.9% over the past year, far surpassing the Food industry’s 21.1%. For the half-year ended June 30, 2024, SWS reported sales of €163.06 million and net income of €15.4 million, up from €154.03 million and €7.96 million respectively a year ago. The company’s P/E ratio stands at a favorable 16.9x compared to the German market's average of 17x, indicating good value for investors.

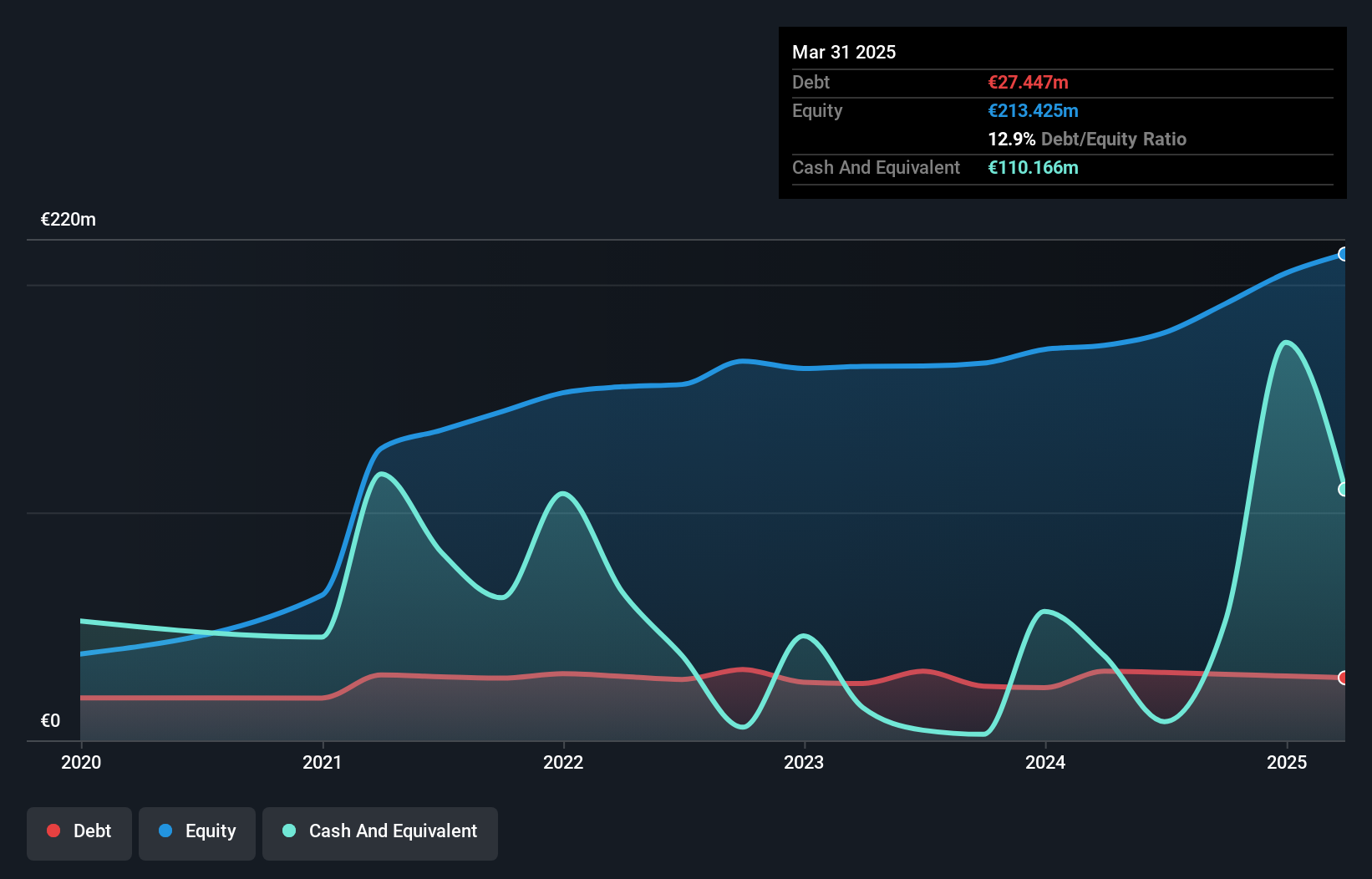

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Friedrich Vorwerk Group SE offers a range of solutions for energy transformation and transportation across Germany and Europe, with a market cap of €456.00 million.

Operations: The company's revenue streams are diversified across Electricity (€95.30 million), Natural Gas (€160.89 million), Clean Hydrogen (€28.38 million), and Adjacent Opportunities (€117.28 million).

Friedrich Vorwerk Group's recent performance highlights its potential as an investment. The company reported second-quarter sales of €117.41 million, up from €92.55 million last year, with net income rising to €7.96 million compared to €2.38 million previously. For the first half of 2024, revenue reached €202.24 million against last year's €174.91 million, while net income increased to €9.52 million from €3.13 million a year ago—showcasing robust growth and profitability trends in this small-cap stock.

Make It Happen

- Unlock more gems! Our German Undiscovered Gems With Strong Fundamentals screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 German Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:SIM0

SIMONA

Develops, manufactures, and markets a range of semi-finished thermoplastics, pipes, fittings, and profiles worldwide.

Excellent balance sheet, good value and pays a dividend.