Stock Analysis

- Germany

- /

- Oil and Gas

- /

- XTRA:VH2

3 High Insider Ownership German Stocks With Earnings Growth Up To 30%

Reviewed by Simply Wall St

Amid a backdrop of mixed performance across major European stock indices, with Germany's DAX experiencing modest gains, investors continue to navigate through a landscape marked by economic uncertainties and fluctuating market sentiments. In such an environment, stocks with high insider ownership in Germany could offer potential resilience and growth, as insiders' substantial equity stakes often align their interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| Deutsche Beteiligungs (XTRA:DBAN) | 35.4% | 31.6% |

| YOC (XTRA:YOC) | 24.8% | 22.2% |

| NAGA Group (XTRA:N4G) | 14.1% | 79.2% |

| Exasol (XTRA:EXL) | 25.3% | 105.4% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Stratec (XTRA:SBS) | 30.9% | 21.9% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 48.7% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

We're going to check out a few of the best picks from our screener tool.

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE operates globally, designing and manufacturing automation and instrumentation solutions for in-vitro diagnostics and life sciences, with a market capitalization of approximately €557.35 million.

Operations: The company generates its revenue from designing and manufacturing automation and instrumentation solutions for in-vitro diagnostics and life sciences sectors across Germany, the European Union, and other international markets.

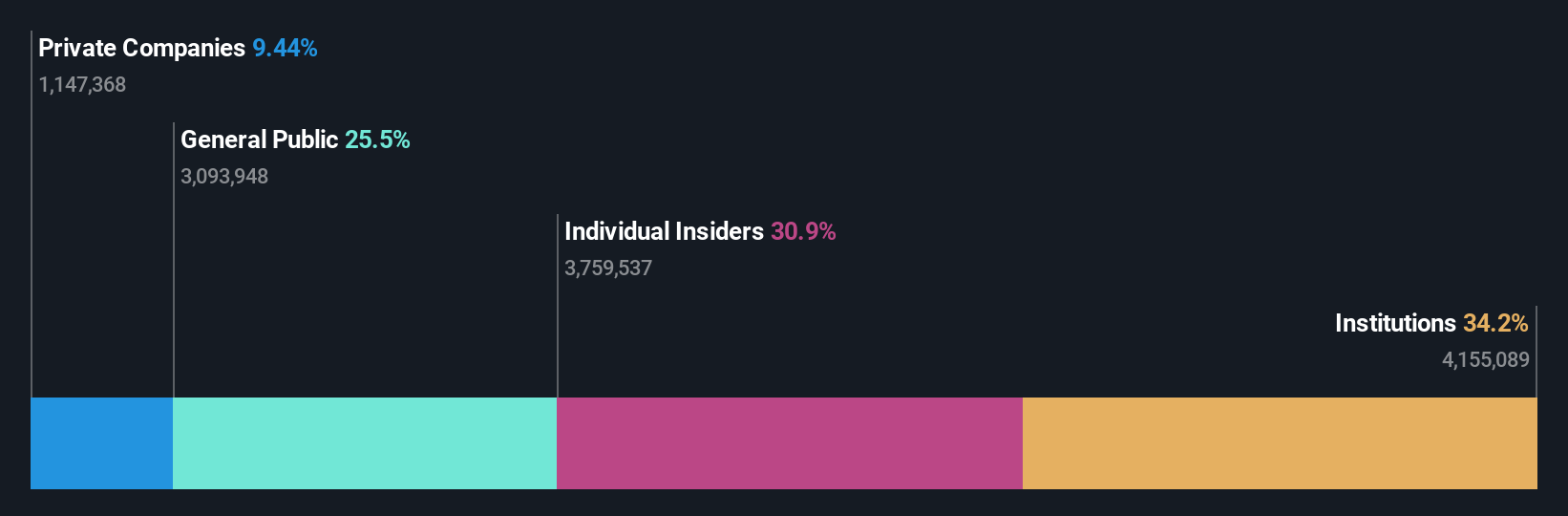

Insider Ownership: 30.9%

Earnings Growth Forecast: 21.9% p.a.

Stratec SE, a German growth company with high insider ownership, faces challenges with a recent decline in sales and net income as reported for Q1 2024. Despite this downturn, Stratec is projected to outpace the German market with its earnings growth forecast at 21.9% annually and revenue growth at 7.8% per year. However, its debt is poorly covered by operating cash flow and profit margins have diminished from the previous year. The stock trades significantly below estimated fair value, suggesting potential undervaluation.

- Delve into the full analysis future growth report here for a deeper understanding of Stratec.

- In light of our recent valuation report, it seems possible that Stratec is trading beyond its estimated value.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

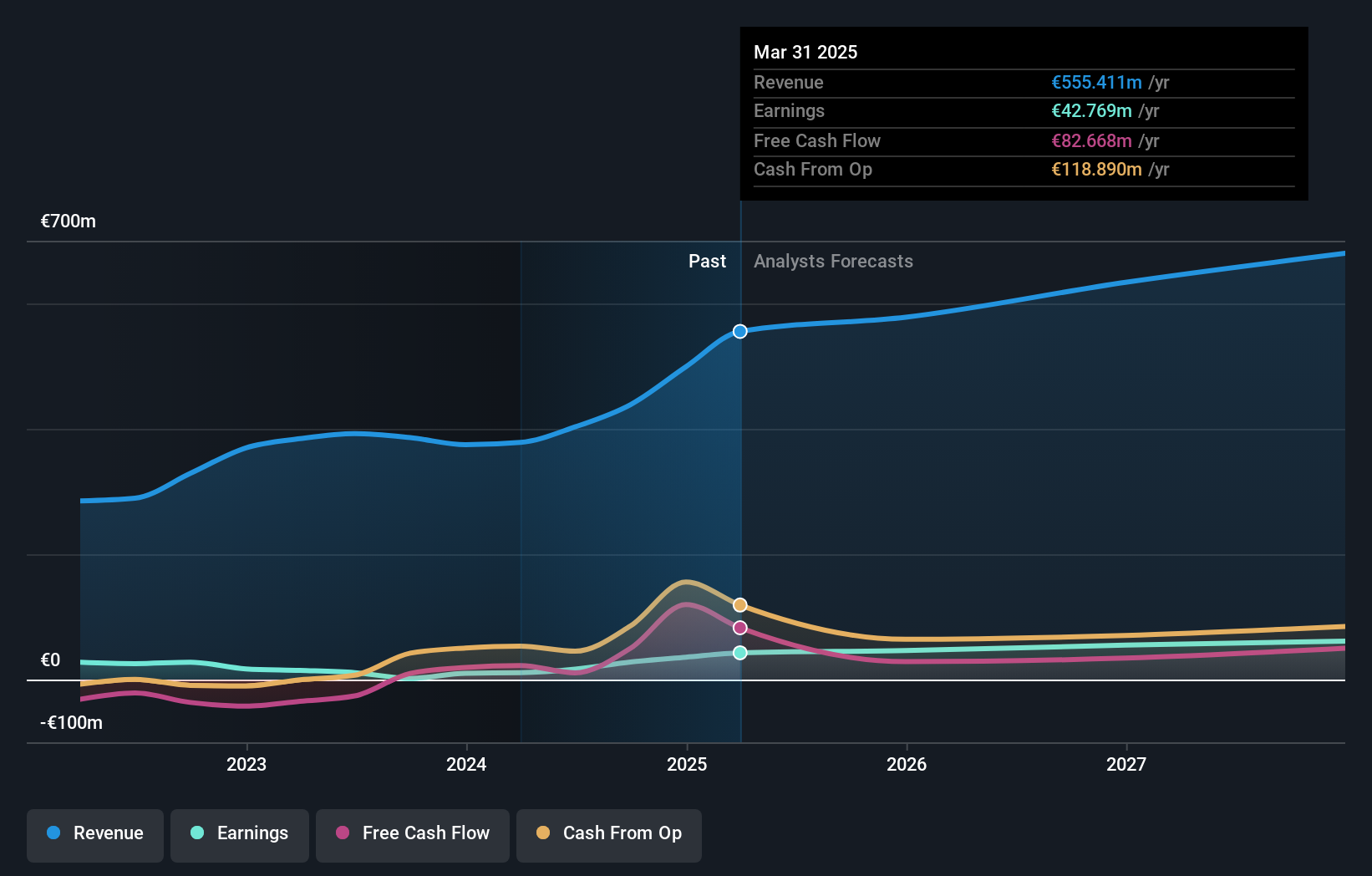

Overview: Friedrich Vorwerk Group SE specializes in solutions for the transformation and transportation of energy within Germany and Europe, with a market capitalization of approximately €0.36 billion.

Operations: The company generates revenue through segments focused on electricity (€72.07 million), natural gas (€157.60 million), clean hydrogen (€28.59 million), and adjacent opportunities (€118.73 million).

Insider Ownership: 18%

Earnings Growth Forecast: 30.4% p.a.

Friedrich Vorwerk Group SE, a German company with significant insider ownership, shows promising growth prospects. Its recent earnings report for Q1 2024 revealed an increase in sales to €81.2 million and net income to €1.56 million, marking substantial improvements from the previous year. The company's earnings are expected to grow by 30.45% annually over the next three years, outpacing the German market average of 18.6%. However, its forecasted Return on Equity is relatively low at 11%, indicating potential concerns about future profitability efficiency.

- Unlock comprehensive insights into our analysis of Friedrich Vorwerk Group stock in this growth report.

- The analysis detailed in our Friedrich Vorwerk Group valuation report hints at an inflated share price compared to its estimated value.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE is an e-commerce company based in Germany, specializing in fashion and lifestyle products, with a market capitalization of approximately €5.87 billion.

Operations: The company generates €10.40 billion in revenue from its online fashion and lifestyle platform.

Insider Ownership: 10.4%

Earnings Growth Forecast: 26.6% p.a.

Zalando SE, despite trading at 55% below its estimated fair value, shows a mixed growth trajectory in the German market. While its revenue growth is modest at 5.4% per year, slightly above the market average of 5.2%, its earnings have surged by 184.3% over the past year and are expected to continue growing significantly at an annual rate of 26.6%. However, it's projected to have a low Return on Equity of 12.7% in three years, which could raise concerns about long-term profitability efficiency. Recent guidance anticipates up to a 5% increase in sales for 2024 with an operating profit expected.

- Click to explore a detailed breakdown of our findings in Zalando's earnings growth report.

- Our valuation report here indicates Zalando may be overvalued.

Turning Ideas Into Actions

- Reveal the 18 hidden gems among our Fast Growing German Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Friedrich Vorwerk Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VH2

Friedrich Vorwerk Group

Provides various solutions for transformation and transportation of energy in Germany and Europe.

Reasonable growth potential with adequate balance sheet.