- Germany

- /

- Oil and Gas

- /

- XTRA:VBK

3 German Exchange Stocks Estimated To Be Up To 49.6% Below Intrinsic Value

Reviewed by Simply Wall St

The German market has recently faced declines, with the DAX dropping 3.20% amid renewed fears about global economic growth. Despite this downturn, opportunities still exist for discerning investors who can identify undervalued stocks. In the current climate, a good stock is one that demonstrates strong fundamentals and resilience against broader market volatility. Here are three German exchange stocks estimated to be up to 49.6% below their intrinsic value, presenting potential opportunities for those looking to invest wisely in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.65 | €31.38 | 46.9% |

| MBB (XTRA:MBB) | €98.80 | €196.08 | 49.6% |

| Gerresheimer (XTRA:GXI) | €102.90 | €201.90 | 49% |

| ecotel communication ag (XTRA:E4C) | €12.35 | €21.95 | 43.7% |

| Verbio (XTRA:VBK) | €15.65 | €30.40 | 48.5% |

| Schweizer Electronic (XTRA:SCE) | €4.12 | €7.43 | 44.6% |

| MTU Aero Engines (XTRA:MTX) | €267.50 | €497.80 | 46.3% |

| elumeo (XTRA:ELB) | €2.20 | €3.92 | 43.9% |

| LPKF Laser & Electronics (XTRA:LPK) | €8.02 | €12.53 | 36% |

| Basler (XTRA:BSL) | €9.35 | €14.16 | 34% |

We'll examine a selection from our screener results.

MBB (XTRA:MBB)

Overview: MBB SE, with a market cap of €564.78 million, acquires and manages medium-sized companies in the technology and engineering sectors both in Germany and internationally.

Operations: MBB SE generates revenue from three primary segments: Consumer Goods (€92.53 million), Technical Applications (€386.64 million), and Service & Infrastructure (€515.75 million).

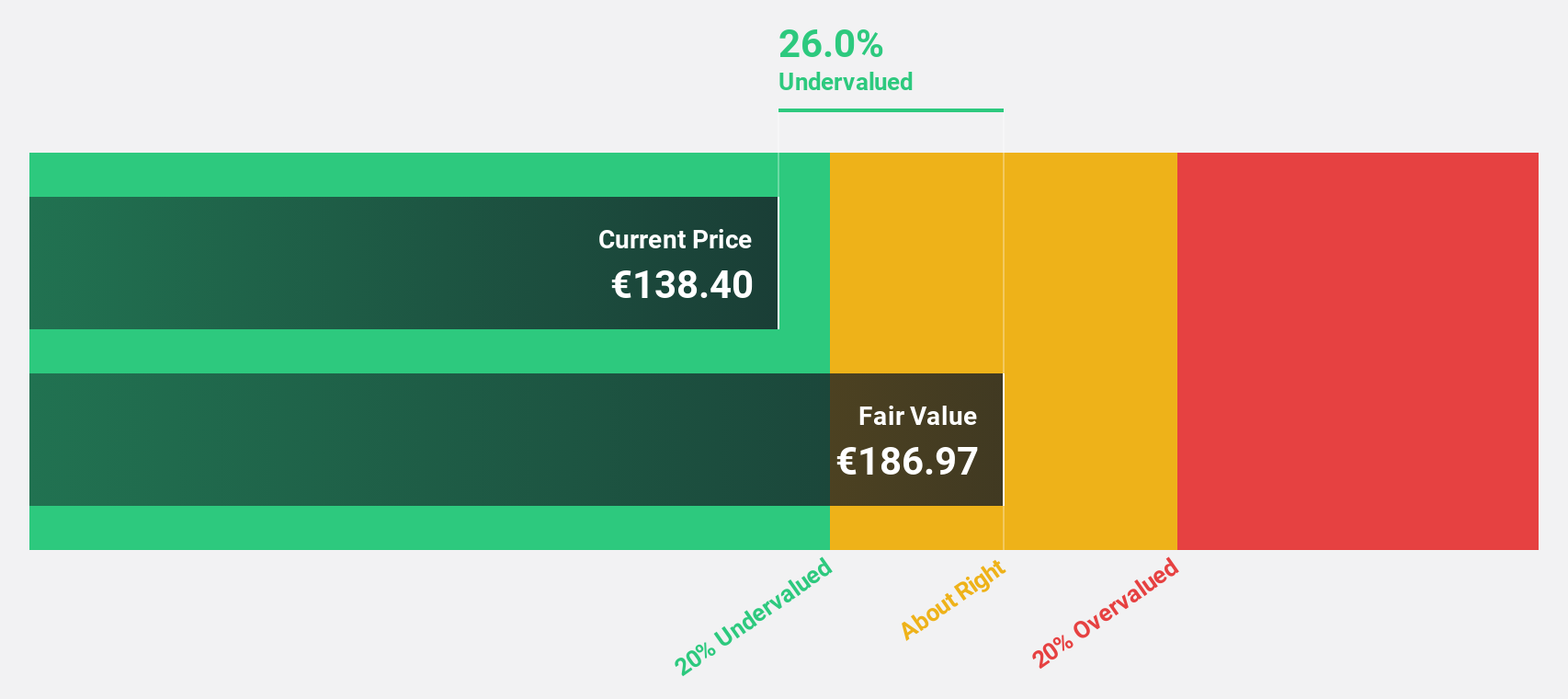

Estimated Discount To Fair Value: 49.6%

MBB SE (€98.8) appears significantly undervalued, trading at 49.6% below its estimated fair value (€196.08). Recent earnings reports show strong performance with net income rising to €7.47 million in Q2 2024 from €1.77 million a year ago and revenue increasing to €266.77 million from €233.61 million in the same period. The company has also completed a substantial share buyback and is actively seeking acquisitions, suggesting potential for future growth and improved cash flows.

- According our earnings growth report, there's an indication that MBB might be ready to expand.

- Click to explore a detailed breakdown of our findings in MBB's balance sheet health report.

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG provides commercial real estate and public investment finance in Europe and the United States, with a market cap of €774.58 million.

Operations: The company's revenue segments include €223 million from Real Estate Finance (REF) and €103 million from Non-Core (NC).

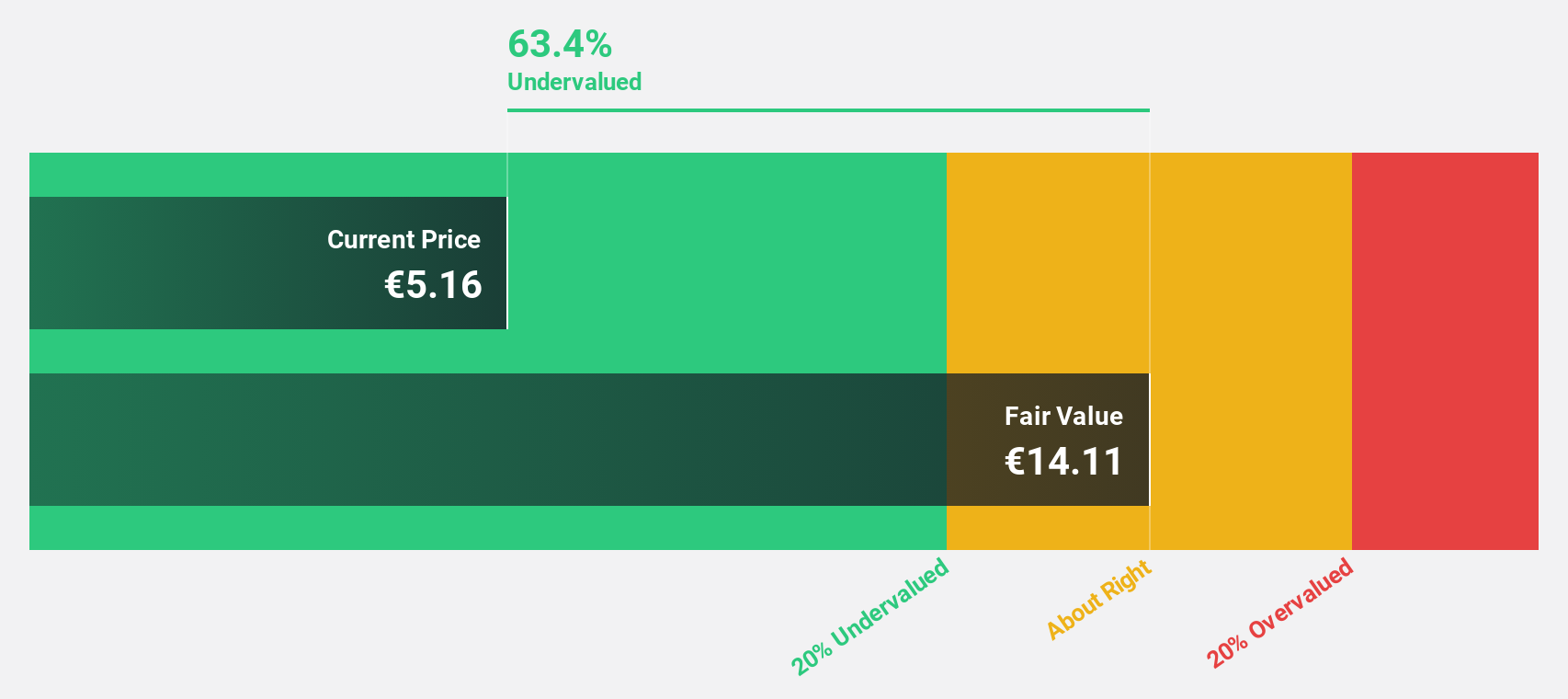

Estimated Discount To Fair Value: 17%

Deutsche Pfandbriefbank AG (€5.76) is trading at a 17% discount to its estimated fair value (€6.94). Despite reporting a drop in net income to €40 million for H1 2024 from €69 million a year ago, earnings are forecast to grow significantly at 40.2% per year, outpacing the German market's 19.9%. However, the company faces challenges with high bad loans (4.1%) and lower profit margins (11%) compared to last year's 31.1%.

- The analysis detailed in our Deutsche Pfandbriefbank growth report hints at robust future financial performance.

- Click here to discover the nuances of Deutsche Pfandbriefbank with our detailed financial health report.

Verbio (XTRA:VBK)

Overview: Verbio SE produces and supplies fuels and finished products in Germany and the rest of Europe, with a market cap of approximately €996 million.

Operations: The company's revenue segments include Biodiesel (€1.06 billion) and Bioethanol (including Biomethane) (€704.92 million).

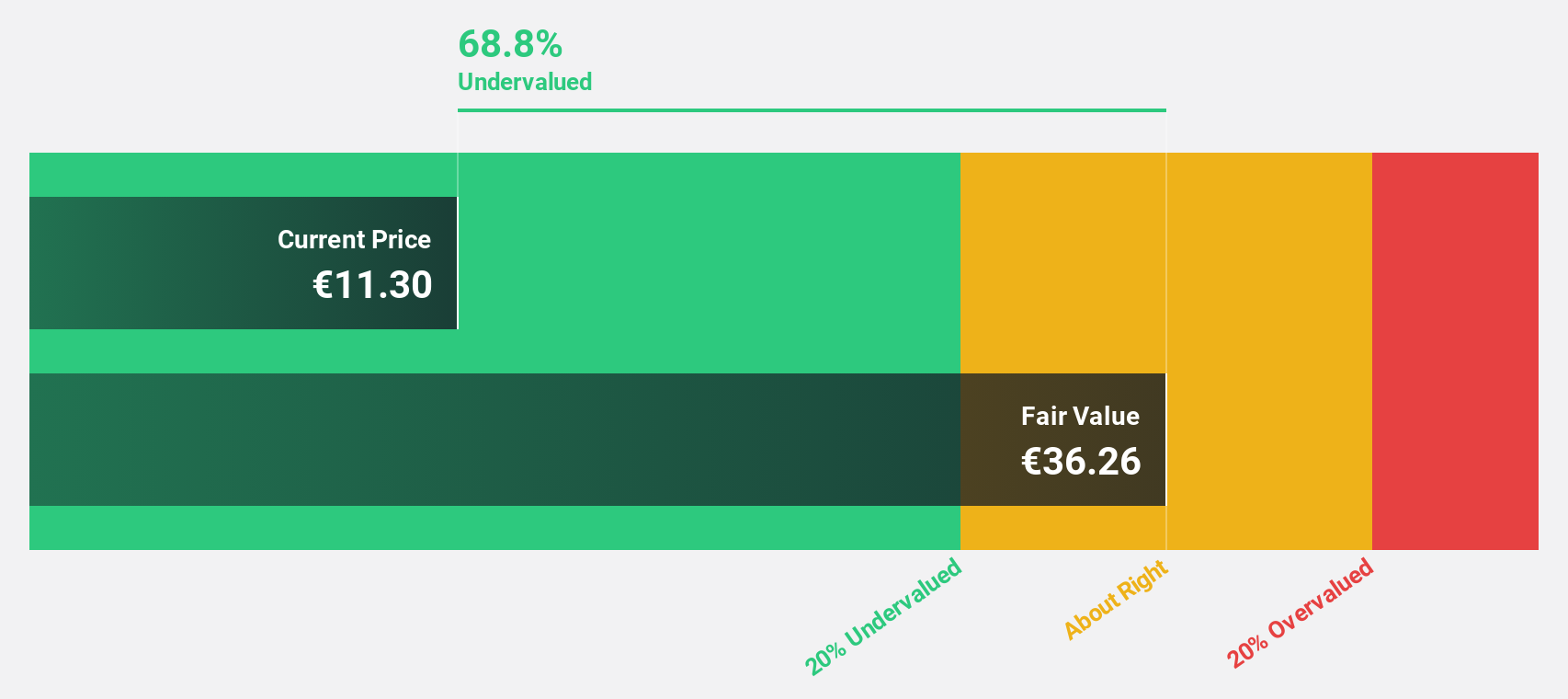

Estimated Discount To Fair Value: 48.5%

Verbio SE (€15.65) is trading at a 48.5% discount to its estimated fair value (€30.4). Despite recent volatility, the company’s earnings are forecast to grow significantly at 58% per year, well above the German market's 19.9%. However, profit margins have declined from 11.4% last year to 1.1%. Revenue is expected to grow at a steady rate of 6.3% annually, outpacing the broader market's growth of 5.4%.

- Insights from our recent growth report point to a promising forecast for Verbio's business outlook.

- Get an in-depth perspective on Verbio's balance sheet by reading our health report here.

Next Steps

- Embark on your investment journey to our 22 Undervalued German Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VBK

Verbio

Produces and supplies fuels and finished products in Germany and rest of Europe.

Excellent balance sheet with reasonable growth potential.