- Germany

- /

- Oil and Gas

- /

- XTRA:ETG

Undiscovered Gems In Germany To Watch This August 2024

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts and small-cap stocks outperform their larger counterparts, Germany's DAX has also seen a notable uptick. Amid this positive market sentiment, investors are increasingly looking toward lesser-known opportunities that could offer substantial growth potential. In the current climate, identifying a good stock often involves finding companies with strong fundamentals and unique market positions that can thrive even in fluctuating economic conditions. With this in mind, here are three undiscovered gems in Germany worth watching this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★★

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across various countries including Germany, Italy, Great Britain, the United States, and China with a market cap of €498.96 million.

Operations: EnviTec Biogas AG generates revenue from three main segments: Service (€48.58 million), Plant Engineering (€132.13 million), and Own Operation including Energy (€236.10 million). The company's market cap stands at €498.96 million.

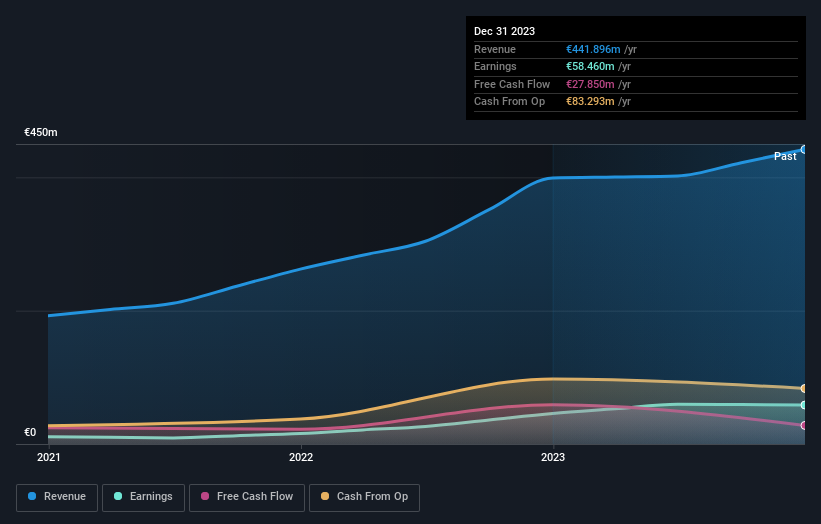

EnviTec Biogas, a small German company in the renewable energy sector, has seen its earnings grow by 27.6% over the past year, outpacing the Oil and Gas industry. The company's debt to equity ratio improved from 41.7% to 38% over five years, indicating better financial health. With a price-to-earnings ratio of 8.5x compared to the German market's 16.6x, EnviTec appears undervalued and offers high-quality earnings with strong interest coverage (419x EBIT).

- Click to explore a detailed breakdown of our findings in EnviTec Biogas' health report.

Assess EnviTec Biogas' past performance with our detailed historical performance reports.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of approximately €929.29 million.

Operations: Eckert & Ziegler SE generates revenue primarily from its Medical segment (€132.80 million) and Isotope Products segment (€150.97 million), with a total revenue of €273.76 million after accounting for eliminations and adjustments.

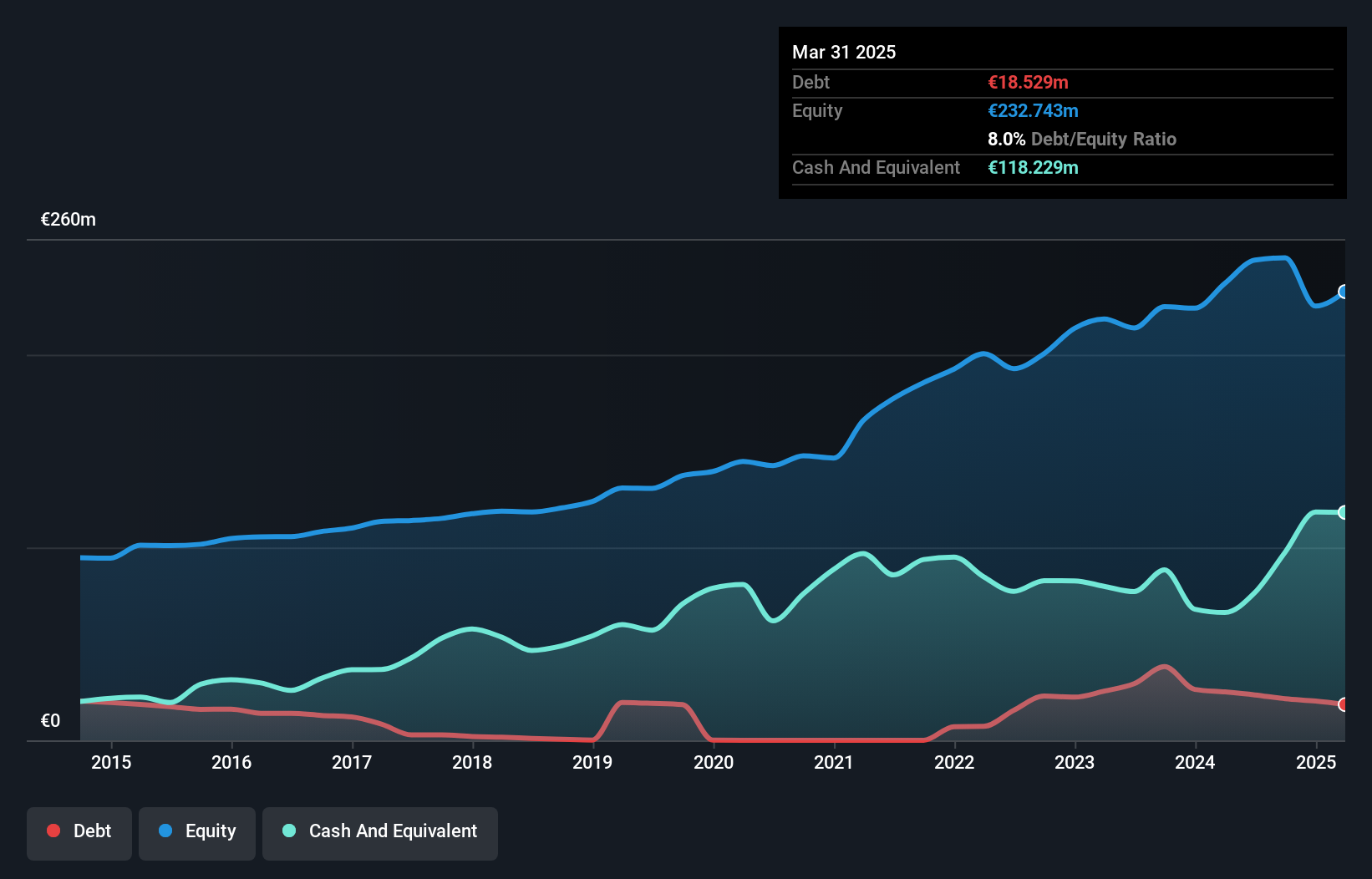

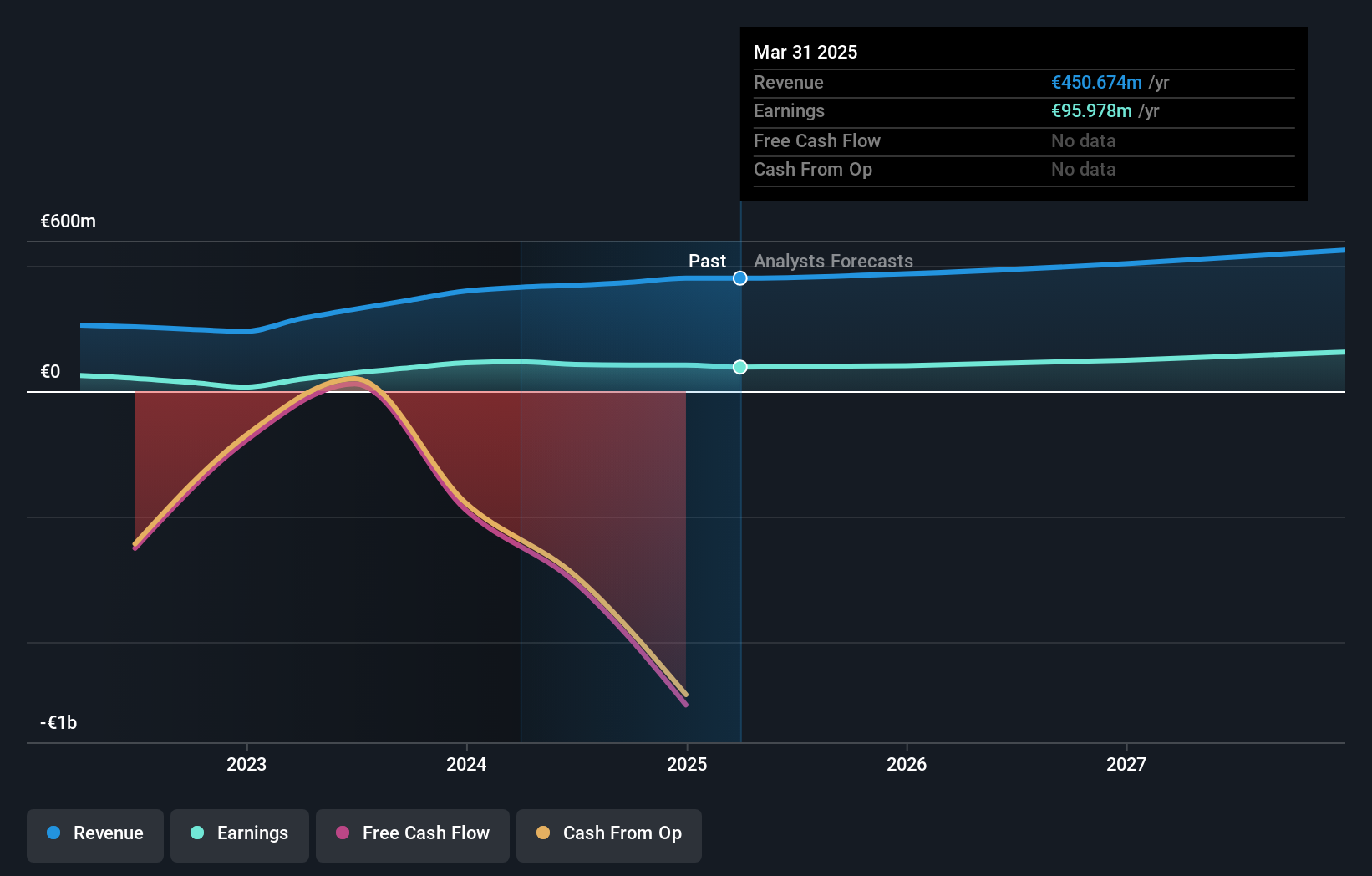

Eckert & Ziegler's recent performance highlights its strong position in the medical equipment sector. The company reported second-quarter sales of €77.76 million, up from €60.03 million last year, with net income rising to €9.54 million from €6.17 million. Basic earnings per share increased to €0.52 compared to €0.34 previously, showcasing robust growth and profitability. Additionally, their debt-to-equity ratio improved from 14.7% to 9.5% over five years, indicating prudent financial management and a solid foundation for future expansion.

- Unlock comprehensive insights into our analysis of Eckert & Ziegler stock in this health report.

Examine Eckert & Ziegler's past performance report to understand how it has performed in the past.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProCredit Holding AG, with a market cap of €524.20 million, offers commercial banking services to small and medium enterprises and private customers across Europe, South America, and Germany through its subsidiaries.

Operations: ProCredit Holding AG generated €422.15 million in revenue from its banking services segment. The company focuses on commercial banking for small and medium enterprises and private customers across multiple regions.

ProCredit Holding, with total assets of €10.1B and equity of €1.0B, has a solid footing in the banking sector. Total deposits stand at €7.5B, while loans amount to €6.5B, earning a Net Interest Margin of 3.6%. The company boasts sufficient allowance for bad loans at 2.4% of total loans and trades at 70.8% below its estimated fair value. Despite net income dropping to €57.6M from €64M last year, it remains attractive due to its high-quality earnings and low-risk funding sources (83%).

Where To Now?

- Delve into our full catalog of 46 German Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnviTec Biogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ETG

EnviTec Biogas

Manufactures and operates biogas and biomethane plants in Germany, Italy, Great Britain, the Czechia Republic, France, Denmark, the United States, China, Greece, Estonia, and internationally.

Excellent balance sheet and fair value.