- Germany

- /

- Oil and Gas

- /

- XTRA:ETG

Undiscovered Gems in Europe to Explore This May 2025

Reviewed by Simply Wall St

As European markets continue to navigate the complexities of global trade tensions and fluctuating interest rates, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week. In this environment of cautious optimism, small-cap stocks have gained attention for their potential to offer unique opportunities amidst broader economic shifts. Identifying promising stocks often involves looking at companies with strong fundamentals and growth potential that can thrive even in uncertain market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.06 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the naturenergie brand both in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.03 billion) and Renewable Generation Infrastructure (€903.30 million). The company also earns from System Relevant Infrastructure, contributing €455.10 million to its revenue streams.

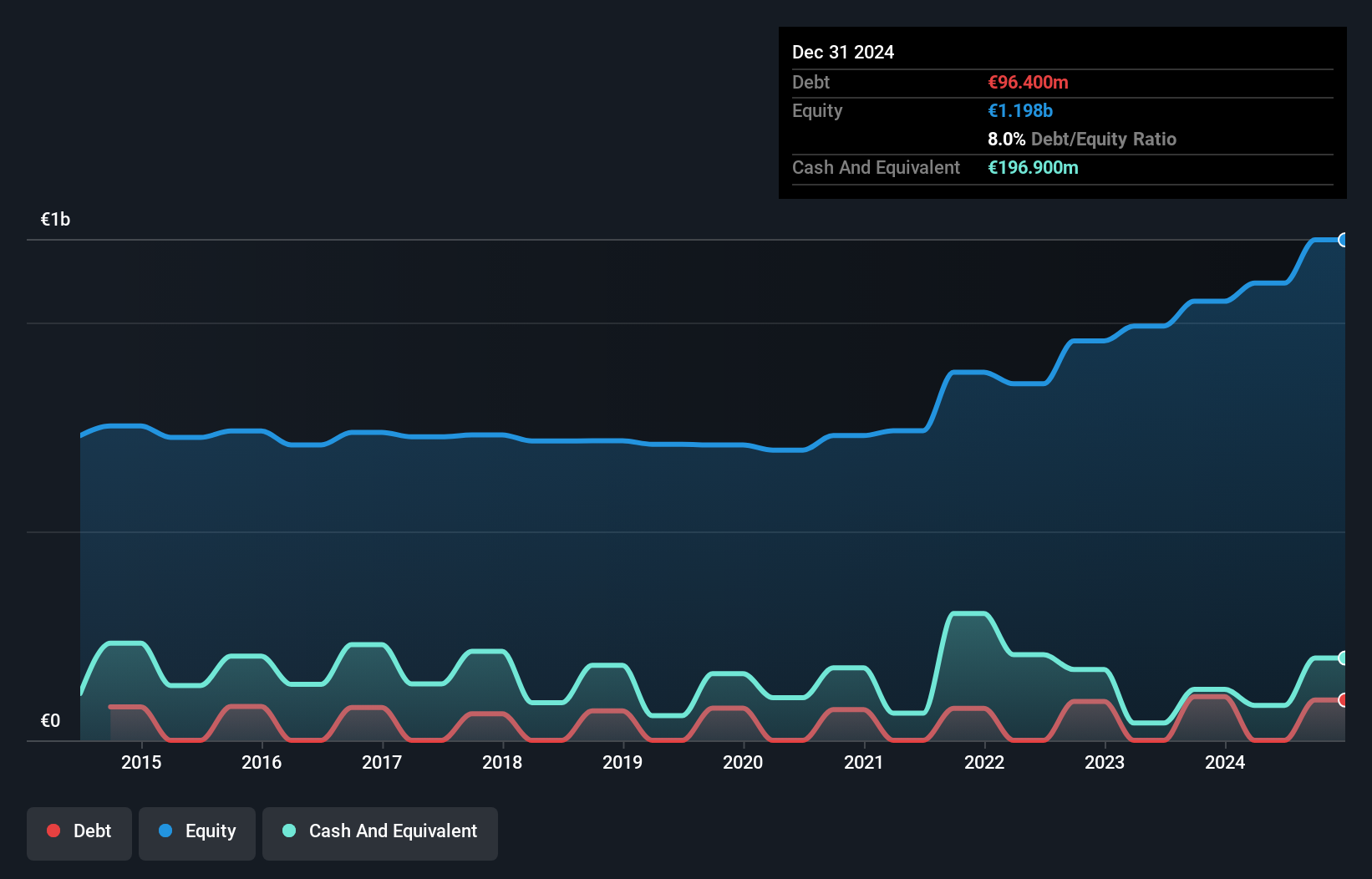

Naturenergie Holding, a European utility player, showcases robust financial health with cash exceeding its total debt and an impressive EBIT coverage of interest payments at 253 times. The company reported net income of €179 million for 2024, up from €107 million the previous year, reflecting high-quality earnings. Despite a revenue dip to €1.77 billion from €2 billion in 2023, it trades at nearly 40% below fair value estimates. With earnings growth outpacing the industry by a wide margin and a reduced debt-to-equity ratio from 10.9% to 8% over five years, NEAG remains an intriguing prospect amidst forecasted earnings challenges ahead.

- Dive into the specifics of naturenergie holding here with our thorough health report.

Evaluate naturenergie holding's historical performance by accessing our past performance report.

Grenevia (WSE:GEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Grenevia S.A. is a global manufacturer and seller of machinery and equipment for the mining, transport, handling, and power industries with a market cap of PLN1.67 billion.

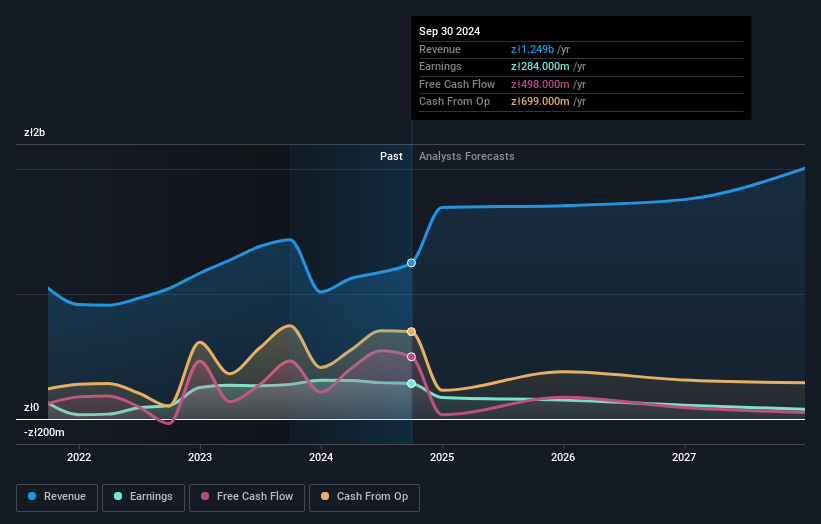

Operations: Grenevia generates revenue primarily from its Famur segment, contributing PLN1.04 billion, with additional income from Segment Adjustment and Holding and Other Activities totaling PLN206 million.

Grenevia, a smaller player in the European market, is trading at 71.3% below its estimated fair value, offering potential value for investors. Over the past year, earnings grew by 2.5%, outpacing the Machinery industry's -15.4%. Despite this growth, earnings are projected to decrease by an average of 44.1% annually over the next three years. The company has a satisfactory net debt to equity ratio of 5.7%, indicating manageable debt levels despite an increase from 36.6% to 41.8% over five years. Grenevia's profitability ensures that cash runway isn't a concern moving forward.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★☆

Overview: EnviTec Biogas AG specializes in the manufacturing and operation of biogas and biomethane plants across multiple countries, including Germany, Italy, and the United States, with a market capitalization of €577.67 million.

Operations: The company generates revenue primarily through the manufacturing and operation of biogas and biomethane plants. It operates in several countries, including Germany, Italy, and the United States.

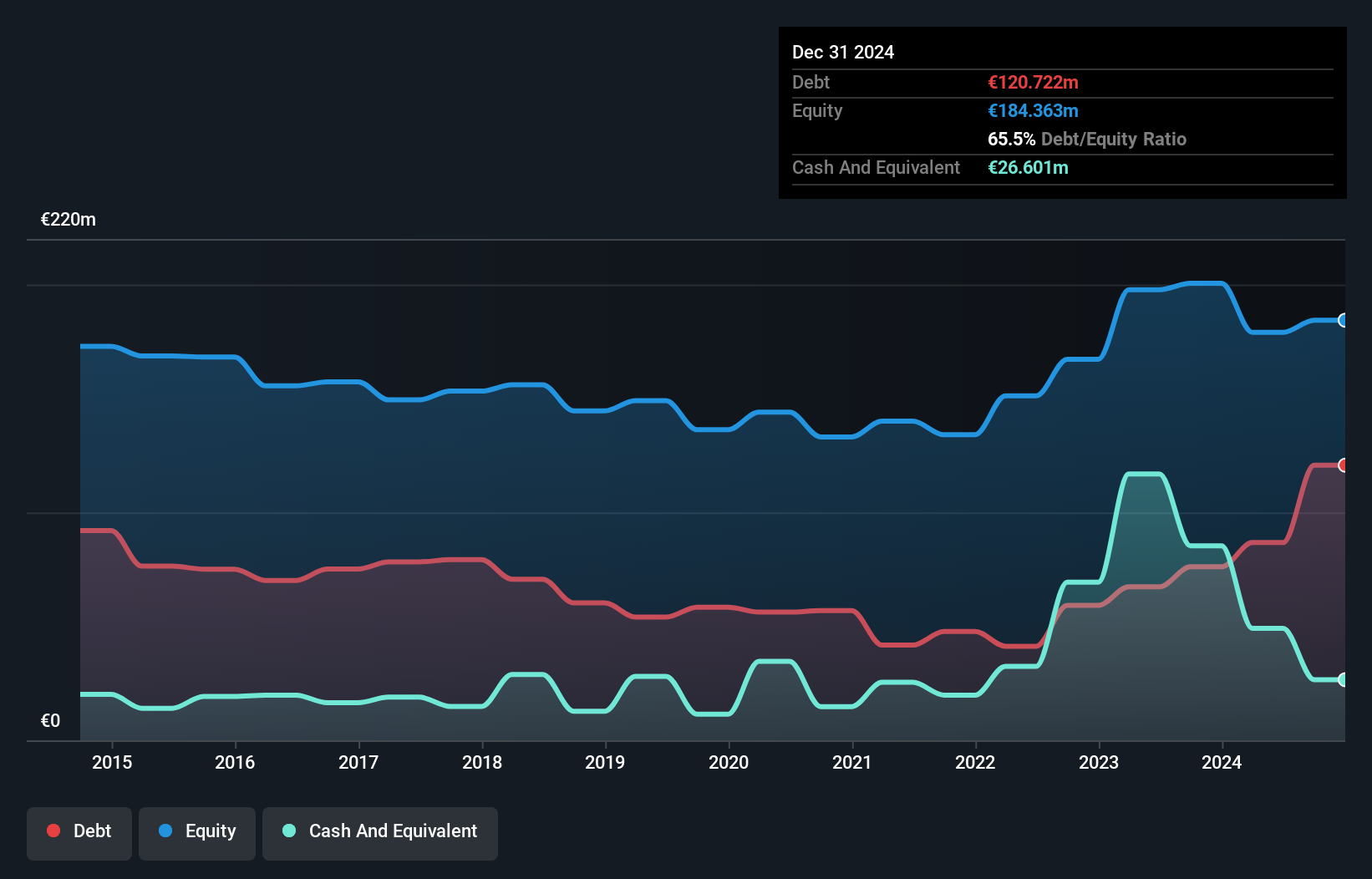

EnviTec Biogas, a small player in the renewable energy sector, is trading significantly below its estimated fair value by 58.6%. Over the past five years, its debt to equity ratio has climbed from 36% to 48.5%, yet it comfortably covers interest payments with profits. Despite high-quality earnings, recent financial data is outdated and indicates negative earnings growth of -16.5% last year compared to the broader industry's -23%. While its net debt to equity ratio stands at a satisfactory 21%, there's insufficient information on cash runway if free cash flow trends continue as before.

- Navigate through the intricacies of EnviTec Biogas with our comprehensive health report here.

Understand EnviTec Biogas' track record by examining our Past report.

Seize The Opportunity

- Explore the 323 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnviTec Biogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ETG

EnviTec Biogas

Manufactures and operates biogas and biomethane plants in Germany, Italy, Great Britain, the Czechia Republic, France, Denmark, the United States, China, Slovakia, Estonia, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives