German Exchange: 3 Stocks Estimated To Be Up To 49.1% Below Intrinsic Value

Reviewed by Simply Wall St

As European inflation nears the central bank's target and Germany’s DAX reaches new peaks, investors are increasingly focused on identifying undervalued opportunities within the market. In this context, finding stocks that are trading below their intrinsic value can be particularly appealing for those looking to capitalize on potential growth in a stabilizing economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MBB (XTRA:MBB) | €100.60 | €195.79 | 48.6% |

| technotrans (XTRA:TTR1) | €17.20 | €31.46 | 45.3% |

| Gerresheimer (XTRA:GXI) | €102.60 | €201.46 | 49.1% |

| ecotel communication ag (XTRA:E4C) | €12.55 | €21.95 | 42.8% |

| Verbio (XTRA:VBK) | €16.37 | €30.20 | 45.8% |

| Dr. Hönle (XTRA:HNL) | €14.80 | €28.25 | 47.6% |

| Schweizer Electronic (XTRA:SCE) | €4.12 | €7.40 | 44.3% |

| MTU Aero Engines (XTRA:MTX) | €265.50 | €496.00 | 46.5% |

| elumeo (XTRA:ELB) | €2.26 | €3.93 | 42.5% |

| LPKF Laser & Electronics (XTRA:LPK) | €8.17 | €12.49 | 34.6% |

We'll examine a selection from our screener results.

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG, with a market cap of €3.53 billion, manufactures and sells medicine packaging, drug delivery devices, and solutions in Germany and internationally through its subsidiaries.

Operations: The company's revenue segments include Plastics & Devices (€1.11 billion), Advanced Technologies (€6.21 million), and Primary Packaging Glass (€892.01 million).

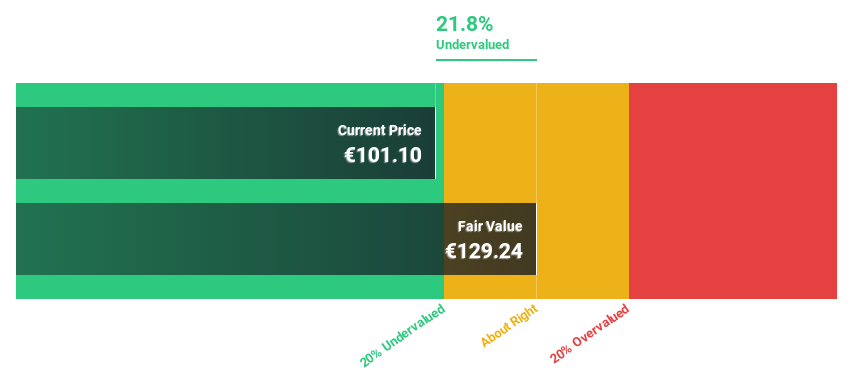

Estimated Discount To Fair Value: 49.1%

Gerresheimer AG, trading at €102.6, is significantly undervalued compared to its estimated fair value of €201.46. Despite recent earnings showing slight declines in net income and basic EPS from continuing operations, the company's revenue is forecast to grow 11% annually, outpacing the German market's 5.5%. Additionally, earnings are expected to increase by 22.3% per year over the next three years, indicating strong future cash flows despite a high debt level and low forecasted ROE of 14.2%.

- In light of our recent growth report, it seems possible that Gerresheimer's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Gerresheimer's balance sheet health report.

init innovation in traffic systems (XTRA:IXX)

Overview: Init innovation in traffic systems SE, with a market cap of €376.28 million, provides intelligent transportation systems solutions for public transportation globally through its subsidiaries.

Operations: Wireless communications equipment is the primary revenue segment, generating €235.67 million.

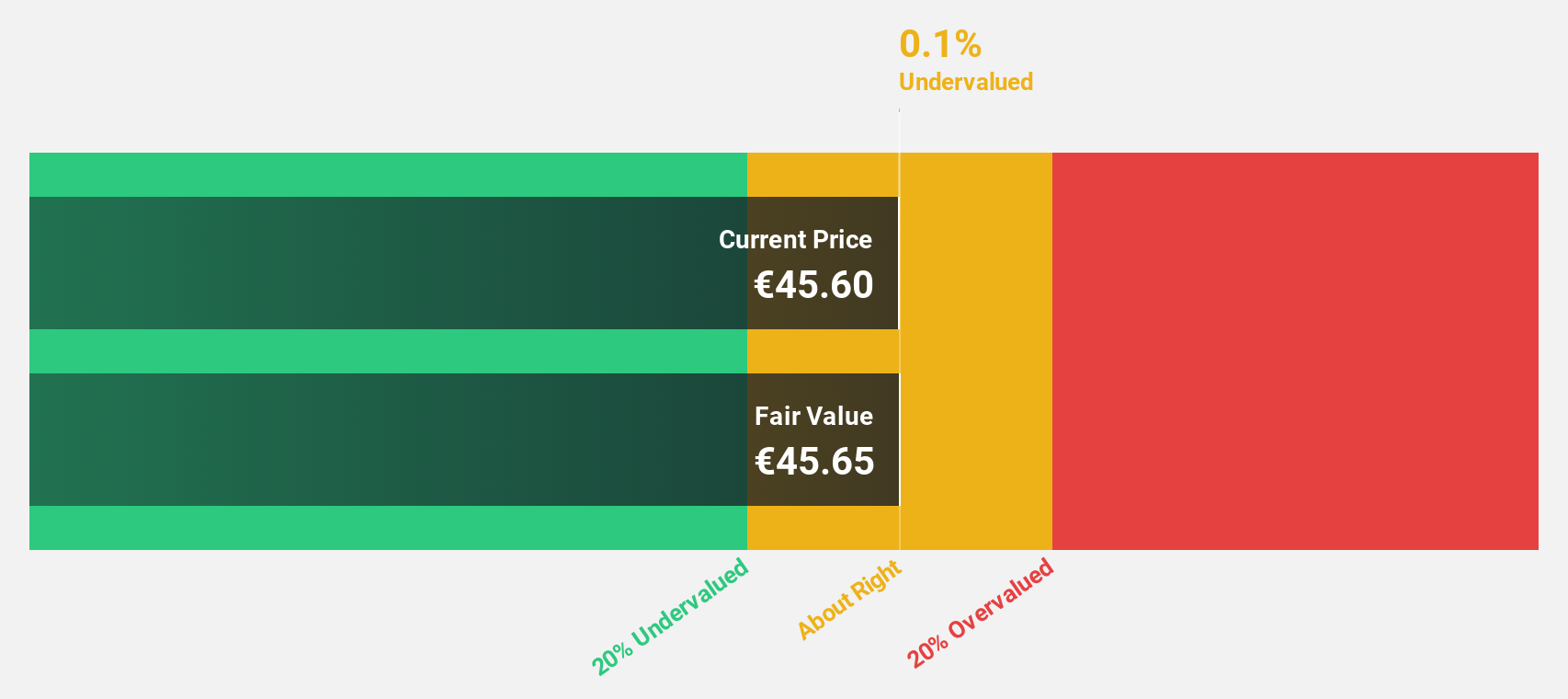

Estimated Discount To Fair Value: 28.4%

init innovation in traffic systems SE, trading at €38.1, is significantly undervalued compared to its estimated fair value of €53.18. Despite a recent dip in quarterly net income (€2.42 million from €3.03 million), the company's earnings are forecast to grow 21.62% annually over the next three years, outpacing the German market's 19.7%. However, its dividend yield of 1.84% is not well covered by free cash flows, and revenue growth (12.5%) lags behind its earnings growth projections.

- Our growth report here indicates init innovation in traffic systems may be poised for an improving outlook.

- Get an in-depth perspective on init innovation in traffic systems' balance sheet by reading our health report here.

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG offers commercial real estate and public investment finance across Europe and the United States, with a market cap of €759.11 million.

Operations: Deutsche Pfandbriefbank AG's revenue segments include €223 million from Real Estate Finance and €103 million from Non-Core activities.

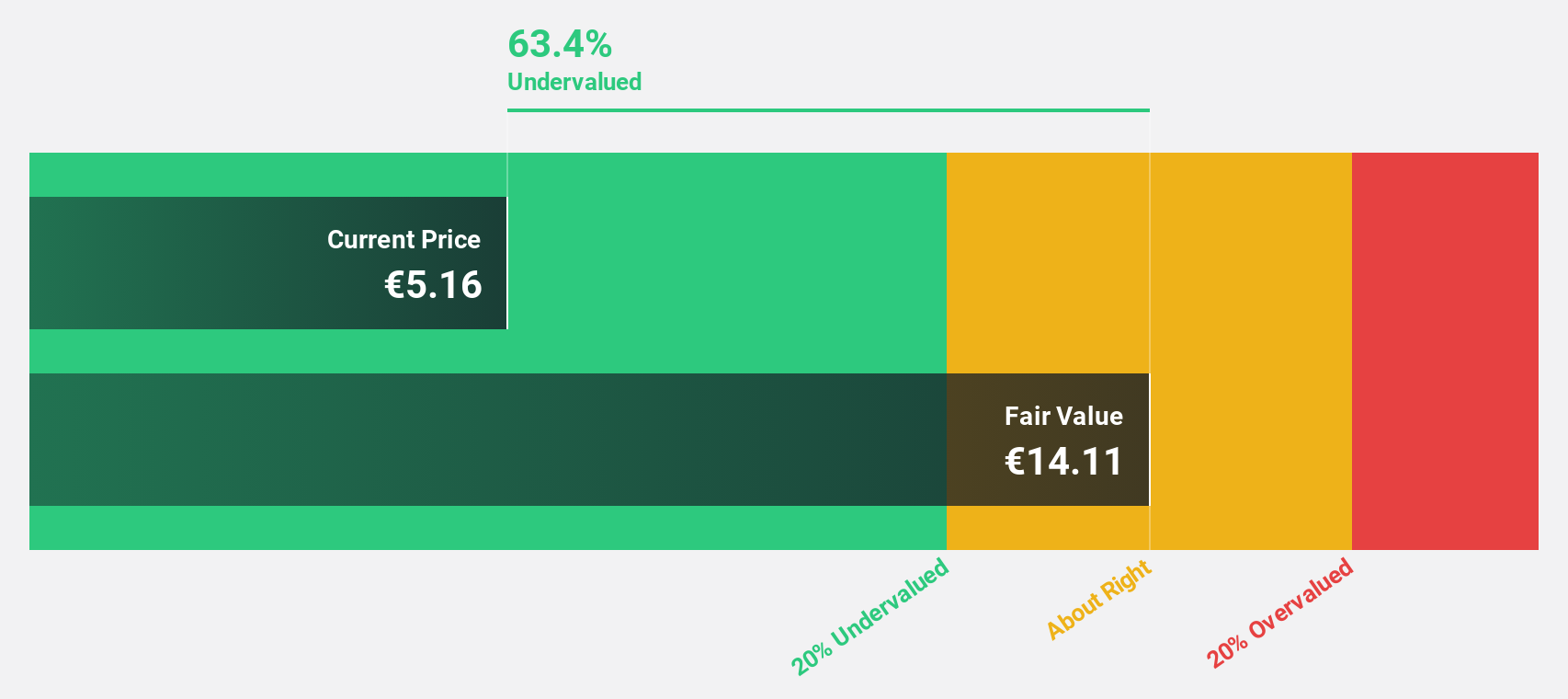

Estimated Discount To Fair Value: 18.7%

Deutsche Pfandbriefbank AG, trading at €5.65, is undervalued relative to its estimated fair value of €6.94. Despite a drop in net income to €40 million for H1 2024 from €69 million a year ago, earnings are forecasted to grow significantly at 40.2% annually over the next three years, outpacing the German market's growth rate. However, the company faces challenges with high bad loans (4.1%) and lower profit margins (11% vs. 31.1% last year).

- Our expertly prepared growth report on Deutsche Pfandbriefbank implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Deutsche Pfandbriefbank with our detailed financial health report.

Next Steps

- Click here to access our complete index of 23 Undervalued German Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

Undervalued with high growth potential.