- Germany

- /

- Medical Equipment

- /

- XTRA:SBS

European Market Insights Bénéteau And Two Other Stocks Possibly Priced Below Value Estimates

Reviewed by Simply Wall St

As European markets navigate a landscape of interest rate assessments and trade uncertainties, the pan-European STOXX Europe 600 Index remains relatively stable, with major indexes like Italy's FTSE MIB and Germany's DAX showing modest gains. In this environment, identifying stocks that are potentially undervalued can offer intriguing opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SBO (WBAG:SBO) | €27.15 | €53.18 | 48.9% |

| QPR Software Oyj (HLSE:QPR1V) | €0.602 | €1.17 | 48.5% |

| Profoto Holding (OM:PRFO) | SEK17.70 | SEK34.83 | 49.2% |

| Millenium Hospitality Real Estate SOCIMI (BME:YMHRE) | €2.04 | €4.05 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.22 | 48.3% |

| Kuros Biosciences (SWX:KURN) | CHF27.74 | CHF54.38 | 49% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.46 | €12.64 | 48.9% |

| Dynavox Group (OM:DYVOX) | SEK107.20 | SEK212.68 | 49.6% |

| Circle (BIT:CIRC) | €8.20 | €16.32 | 49.8% |

| Atea (OB:ATEA) | NOK142.20 | NOK280.79 | 49.4% |

Let's uncover some gems from our specialized screener.

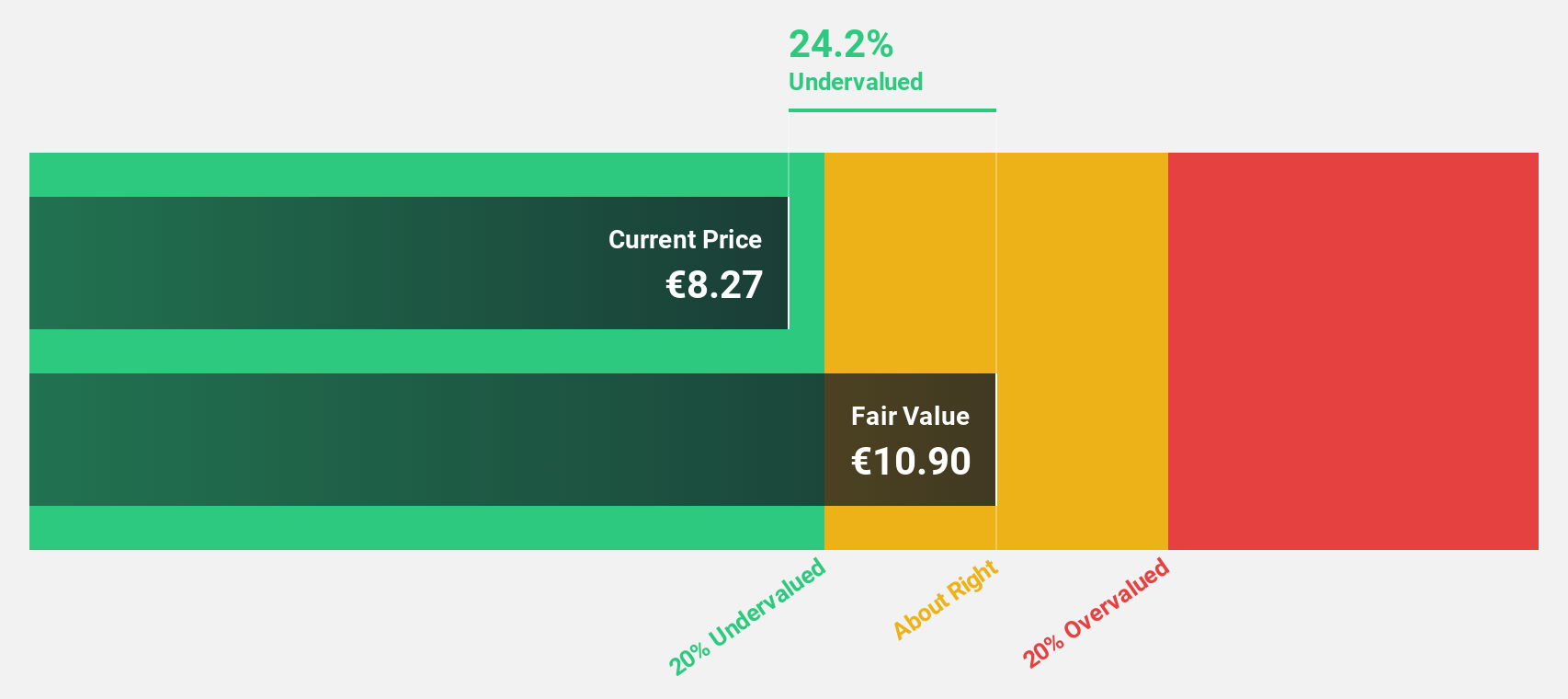

Bénéteau (ENXTPA:BEN)

Overview: Bénéteau S.A. designs, manufactures, and sells boats and leisure homes both in France and internationally, with a market cap of €665 million.

Operations: The company's revenue segments include the design, manufacture, and sale of boats and leisure homes across domestic and international markets.

Estimated Discount To Fair Value: 32.4%

Bénéteau is trading at €8.26, significantly below its estimated fair value of €12.22, indicating it may be undervalued based on cash flows. Despite a net loss of €24.81 million for the first half of 2025, the company is expected to become profitable within three years with earnings growth forecasted at 108% annually. However, revenue growth is anticipated to be moderate at 9.6% per year and its return on equity remains low at 6.2%.

- The growth report we've compiled suggests that Bénéteau's future prospects could be on the up.

- Get an in-depth perspective on Bénéteau's balance sheet by reading our health report here.

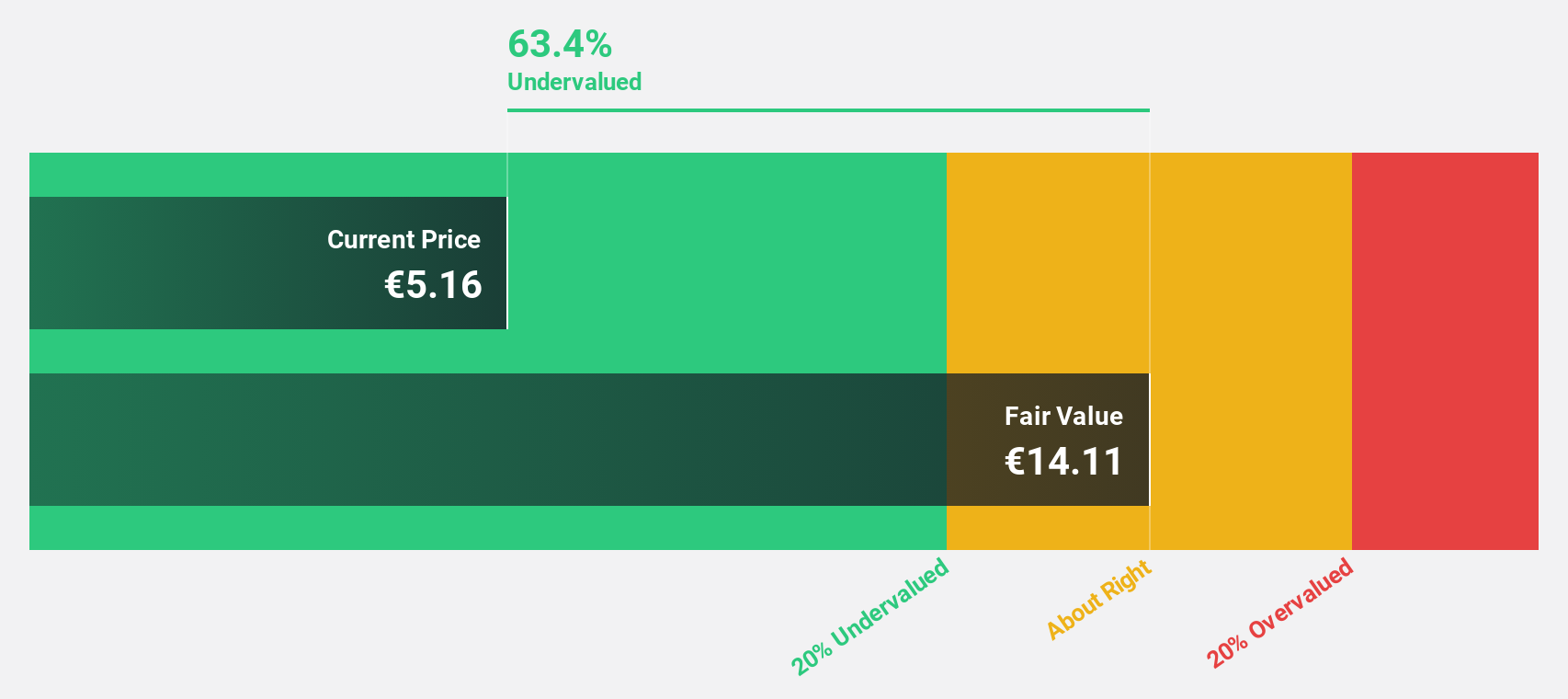

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG is a financial institution specializing in commercial real estate and public investment finance across Germany and the rest of Europe, with a market cap of €687.84 million.

Operations: The company's revenue segments include €58 million from Non-Core (NC) activities and €24 million from Real Estate Finance (REF).

Estimated Discount To Fair Value: 44.7%

Deutsche Pfandbriefbank, trading at €5.12, is valued well below its estimated fair value of €9.25, suggesting potential undervaluation based on cash flows. Despite reporting a net loss of €242 million for the first half of 2025 and a high bad loans ratio of 5.7%, revenue growth is forecasted at an impressive 35.7% annually, outpacing the German market significantly. However, its return on equity is expected to remain low at 3.9% in three years.

- Our expertly prepared growth report on Deutsche Pfandbriefbank implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Deutsche Pfandbriefbank with our comprehensive financial health report here.

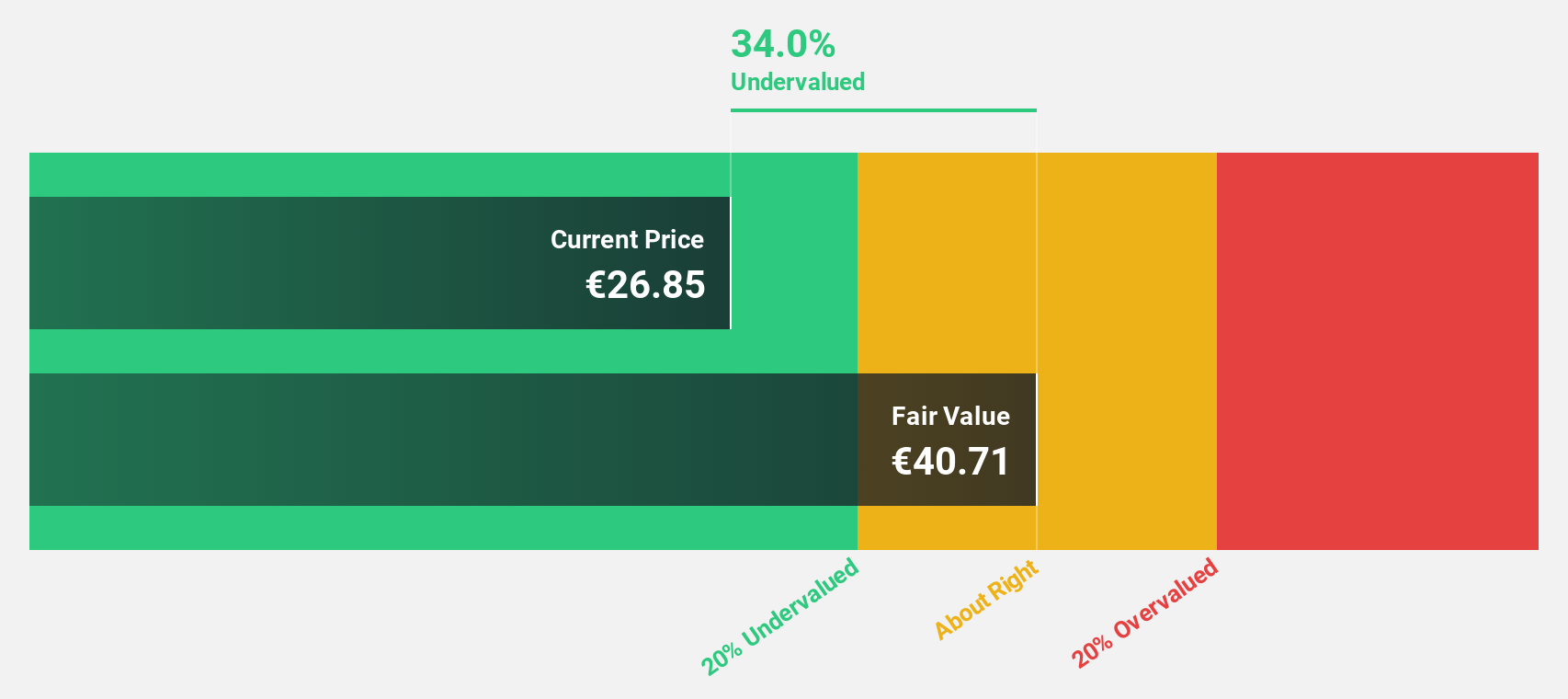

Stratec (XTRA:SBS)

Overview: Stratec SE, with a market cap of €371.36 million, provides automation solutions for in-vitro diagnostics and life science companies in Germany, the European Union, and internationally.

Operations: The company generates revenue of €263.52 million from its automation solutions for highly regulated laboratory environments within the in-vitro diagnostics and life science sectors.

Estimated Discount To Fair Value: 36.8%

Stratec, with shares at €30.55, is trading significantly below its estimated fair value of €48.35, highlighting potential undervaluation based on cash flows. Despite a decline in net income to €2.6 million for H1 2025 and low forecasted return on equity of 10.2%, the company anticipates strong earnings growth of over 21% annually, surpassing the German market average. However, debt coverage by operating cash flow remains a concern alongside an unsustainable dividend yield of 1.96%.

- In light of our recent growth report, it seems possible that Stratec's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Stratec.

Make It Happen

- Reveal the 206 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SBS

Stratec

Provides automation solutions for in-vitro diagnostics and life science companies in Germany, the European Union, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives