Stock Analysis

- Germany

- /

- Capital Markets

- /

- XTRA:O4B

Exploring Top Dividend Stocks In Germany May 2024

Reviewed by Simply Wall St

As of May 2024, Germany's DAX index has experienced a slight downturn, reflecting a cautious sentiment among European markets due to mixed signals from the European Central Bank on future monetary policies. This context is crucial for investors considering dividend stocks, as stable, high-yielding investments become particularly attractive in times of market uncertainty and modest economic growth forecasts.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.15% | ★★★★★★ |

| Edel SE KGaA (XTRA:EDL) | 6.44% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.64% | ★★★★★★ |

| MLP (XTRA:MLP) | 4.64% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.47% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.08% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.06% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.80% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 7.90% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

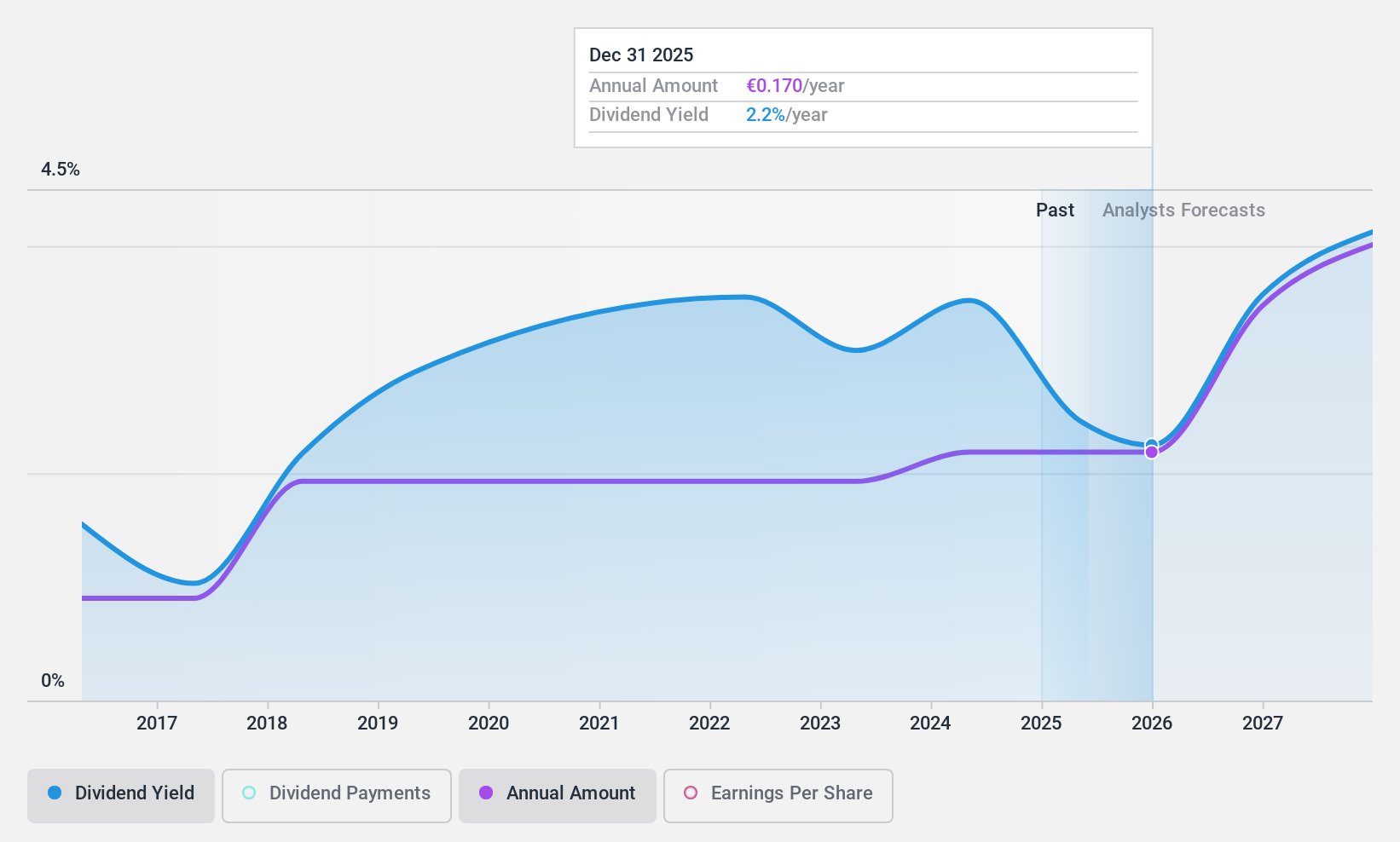

DEUTZ (XTRA:DEZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DEUTZ Aktiengesellschaft is a company that develops, manufactures, and sells diesel and gas engines across various regions including Europe, the Middle East, Africa, the Asia Pacific, and the Americas, with a market capitalization of approximately €686.24 million.

Operations: DEUTZ Aktiengesellschaft generates revenue primarily through its Classic segment, which brought in €2.01 billion, and its Green segment, contributing €5.30 million.

Dividend Yield: 3.1%

DEUTZ's recent financial performance shows a decline, with Q1 2024 sales dropping to €454.7 million from €507 million the previous year and net income falling to €8.8 million from €23.8 million. Despite this downturn, DEUTZ anticipates 2024 revenues between €1.9 billion and €2.1 billion with engine unit sales targets of 160,000 to 180,000. The company maintains a low dividend yield of 3.13% against a German market top-tier average of 4.61%. However, the dividends are well-covered by earnings with a payout ratio of only 22.7%, suggesting sustainability despite past volatility in dividend payments and an unstable track record over the last decade.

- Unlock comprehensive insights into our analysis of DEUTZ stock in this dividend report.

- The valuation report we've compiled suggests that DEUTZ's current price could be quite moderate.

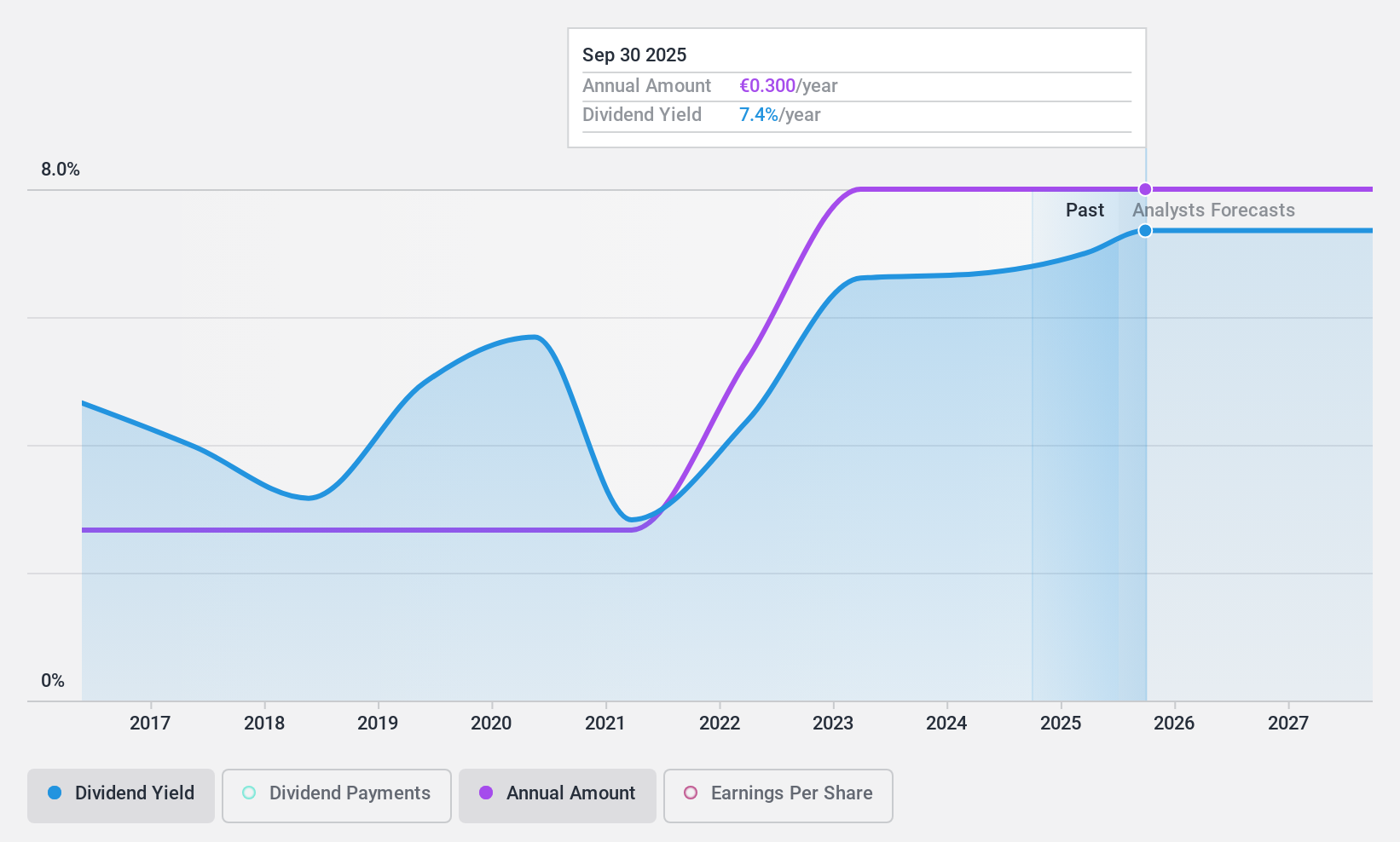

Edel SE KGaA (XTRA:EDL)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Edel SE & Co. KGaA is an independent music company operating in Europe with a market capitalization of approximately €99.14 million.

Operations: Edel SE & Co. KGaA generates revenue primarily through two segments: Marketing and Sales, which brought in €135.56 million, and Manufacturing and Logistics, contributing €144.67 million.

Dividend Yield: 6.4%

Edel SE KGaA offers a compelling dividend yield of 6.44%, ranking in the top 25% in Germany. Over the past decade, both the dividend amount and its payouts have shown growth and stability, supported by a payout ratio of 52.6% and a cash payout ratio of 49.3%. This indicates that dividends are well-covered by both earnings and cash flows. Despite trading at a significant discount to its estimated fair value, investors should note the company's high debt levels.

- Delve into the full analysis dividend report here for a deeper understanding of Edel SE KGaA.

- Our comprehensive valuation report raises the possibility that Edel SE KGaA is priced lower than what may be justified by its financials.

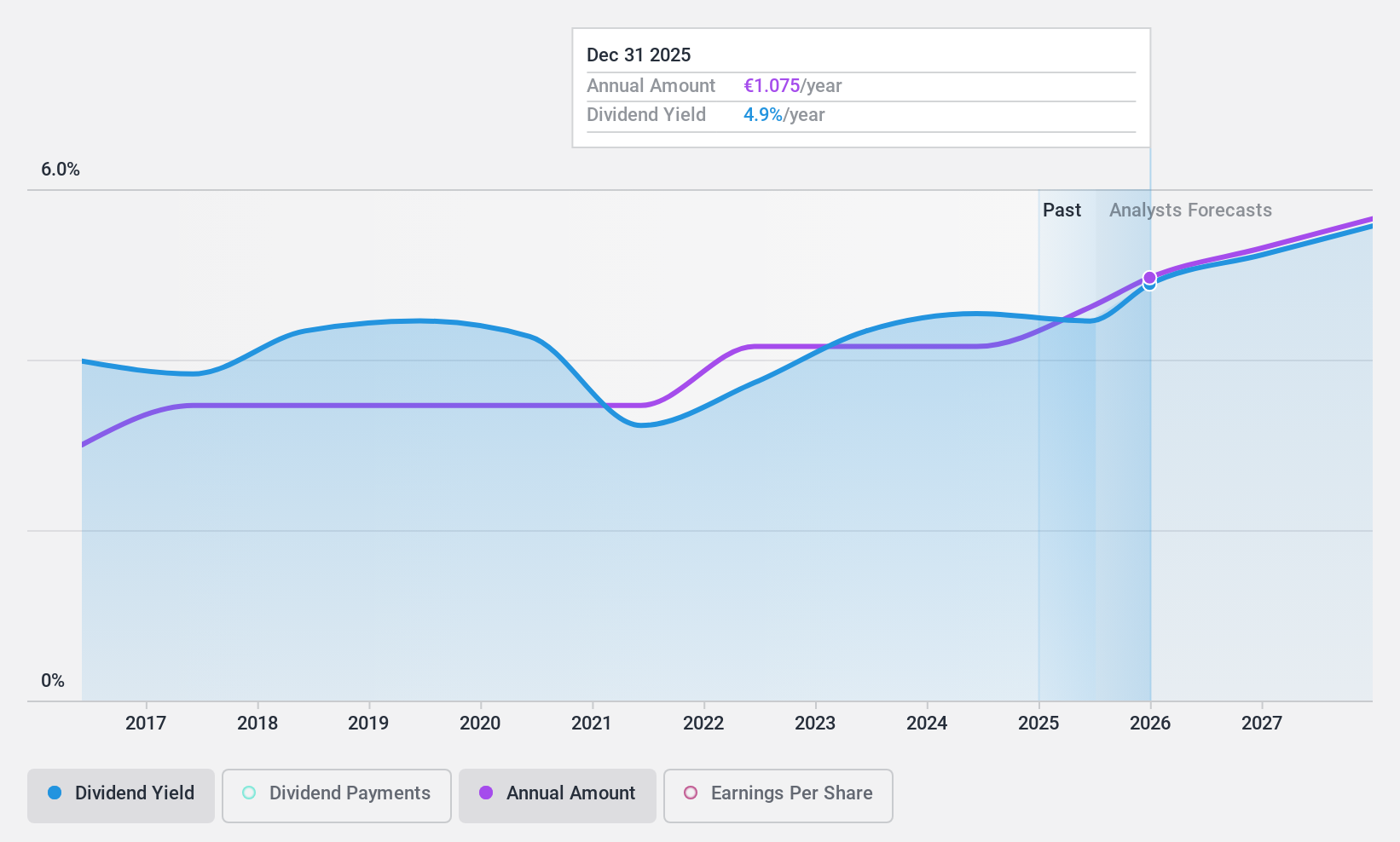

OVB Holding (XTRA:O4B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OVB Holding AG operates in Europe, offering advisory and brokerage services to private households, with a market capitalization of approximately €282.18 million.

Operations: OVB Holding AG generates its revenue by providing advisory and brokerage services across Europe.

Dividend Yield: 4.5%

OVB Holding has demonstrated a consistent dividend track record over the past decade, with its dividends per share showing stability and growth. However, the current dividend yield of 4.52% is slightly below the top quartile in Germany's market. The dividends are covered by earnings at a payout ratio of 78.4%, but a cash payout ratio of 107.3% raises concerns about sustainability from cash flow perspectives. Additionally, while OVB's revenue increased to €367.66 million in 2023 from €346.92 million, net income slightly decreased to €14.32 million from €14.67 million year-over-year.

- Take a closer look at OVB Holding's potential here in our dividend report.

- Our valuation report unveils the possibility OVB Holding's shares may be trading at a premium.

Key Takeaways

- Explore the 29 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether OVB Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:O4B

OVB Holding

Through its subsidiaries, provides advisory and brokerage services to private households in Europe.

Flawless balance sheet with solid track record and pays a dividend.