- Germany

- /

- Capital Markets

- /

- XTRA:JDC

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 marking its best two-year stretch in decades despite recent economic contractions indicated by the Chicago PMI, investors are increasingly on the lookout for opportunities beyond traditional large-cap stocks. Amid this backdrop, small-cap companies often present intriguing possibilities due to their potential for growth and innovation within a dynamic market environment. Identifying a good stock in such conditions involves looking for companies that demonstrate resilience and adaptability, particularly those capable of capitalizing on niche markets or emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Value Rating: ★★★★☆☆

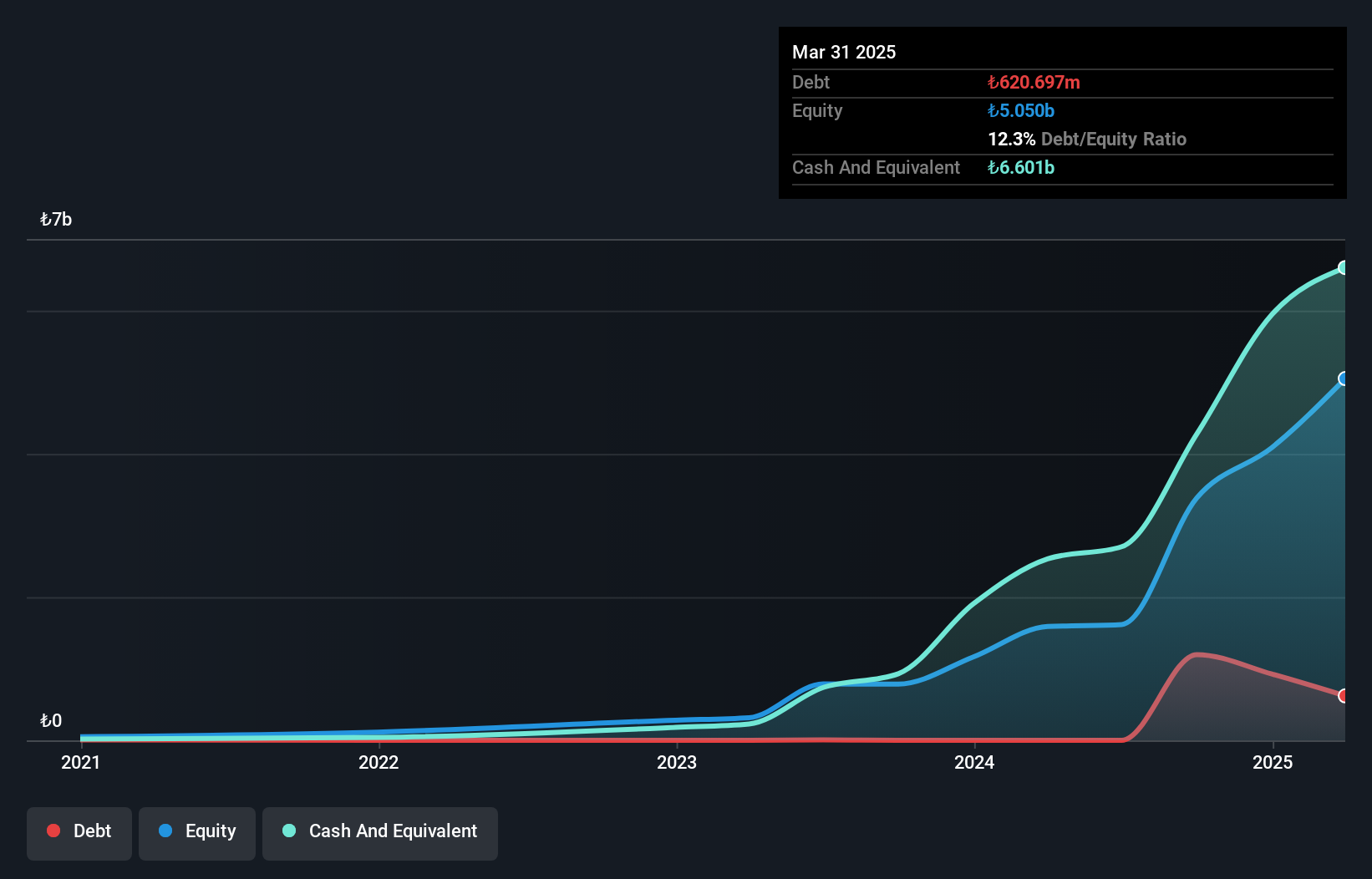

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi operates in Turkey, offering savings finance solutions for purchasing houses and cars, with a market capitalization of TRY9.88 billion.

Operations: Katilimevim generates revenue primarily from its financial services in the consumer sector, amounting to TRY3.34 billion.

Katilimevim Tasarruf Finansman Anonim Sirketi, a financial player in Turkey, has shown impressive earnings growth of 308% over the past year, far outpacing the Consumer Finance industry's 12%. Its price-to-earnings ratio stands at a favorable 6.1x compared to the Turkish market average of 16x. The company reported net income for Q3 2024 at TRY 459 million, up from TRY 198 million a year prior. With more cash than total debt and positive free cash flow, KTLEV appears financially robust despite insufficient data on its debt reduction over five years.

Saudi Arabian Amiantit (SASE:2160)

Simply Wall St Value Rating: ★★★★☆☆

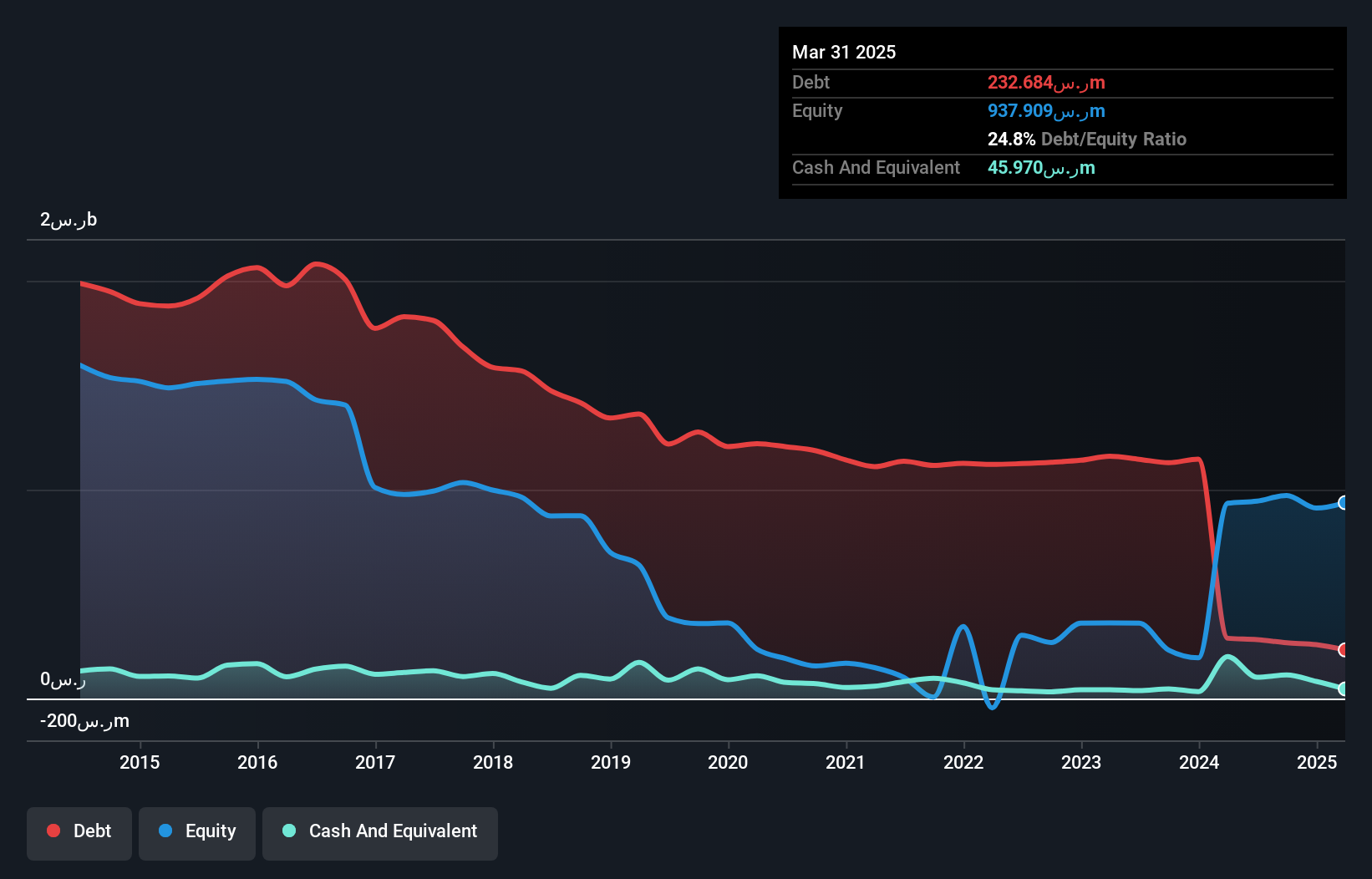

Overview: The Saudi Arabian Amiantit Company, with a market cap of SAR1.29 billion, manufactures and sells various types of pipes and related products in Saudi Arabia through its subsidiaries.

Operations: Amiantit's primary revenue stream is from Pipe Manufacturing and Technology, contributing SAR773.41 million, followed by Water Management at SAR68.81 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Amiantit has shown a significant turnaround, with net income reaching SAR 12.67 million for Q3 2024, bouncing back from a previous net loss of SAR 130.1 million. The company’s debt to equity ratio impressively dropped from 355.6% to just 27.4% over five years, indicating stronger financial health. Despite recent shareholder dilution, Amiantit’s price-to-earnings ratio at 2.8x is notably below the Saudi market average of 23.1x, suggesting potential undervaluation in the market context. With sales jumping to SAR 216.84 million compared to last year’s SAR 160.57 million, growth prospects seem promising amidst industry challenges.

JDC Group (XTRA:JDC)

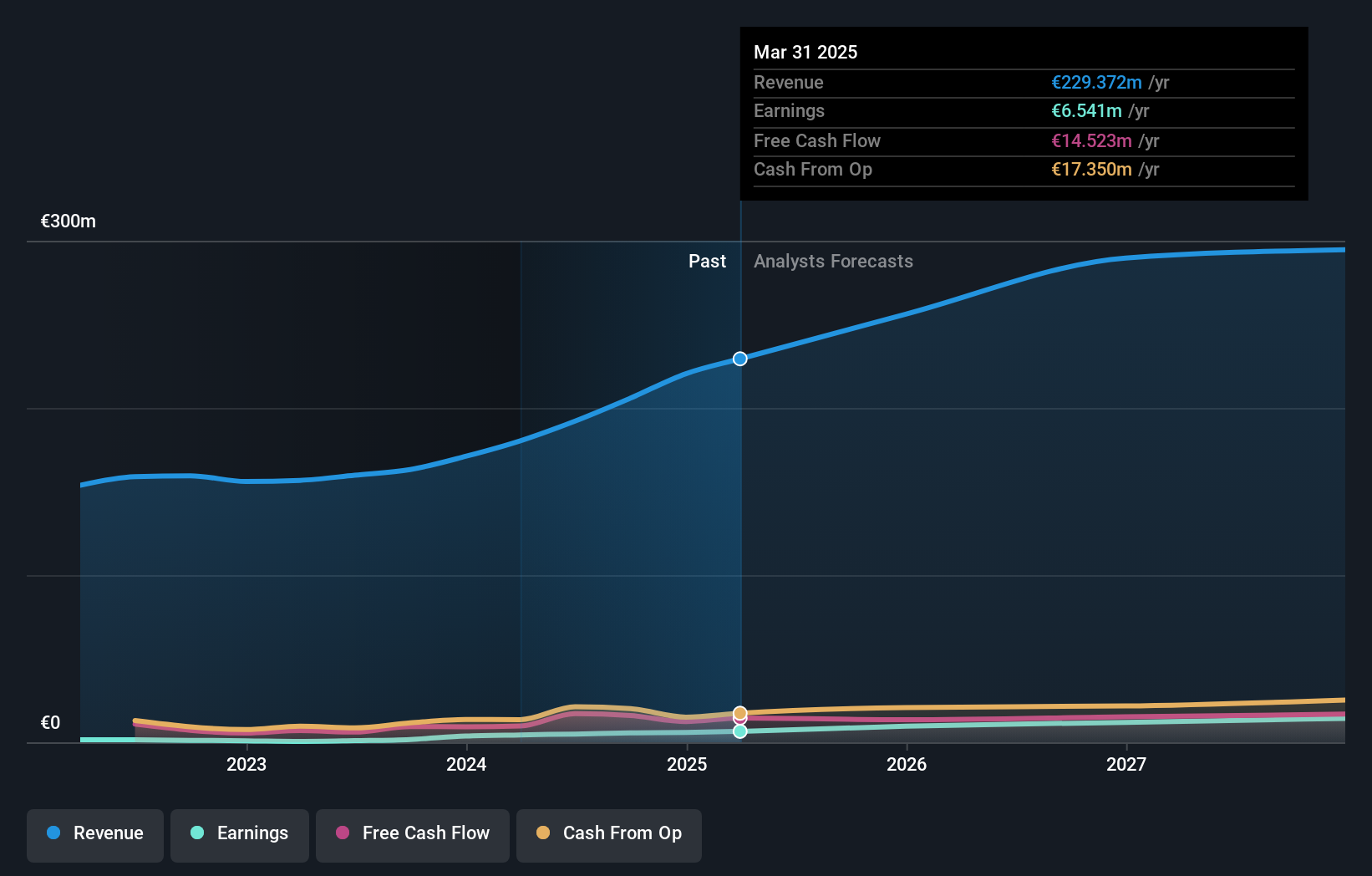

Simply Wall St Value Rating: ★★★★★☆

Overview: JDC Group AG is a financial services company operating in Germany and Austria with a market capitalization of approximately €312.34 million.

Operations: JDC Group AG generates revenue primarily through its Advisortech and Advisory segments, with €184.73 million and €37.05 million respectively. The Transfer segment shows a negative contribution of -€15.67 million, impacting overall financial performance.

JDC Group, a nimble player in the financial sector, has shown remarkable earnings growth of 235.9% over the past year, outpacing the Capital Markets industry's 11.6%. The company's debt to equity ratio improved significantly from 54% to 36.6% over five years, indicating better financial health. With high-quality earnings and positive free cash flow reported at €15.99 million as of September 2024, JDC is on solid ground financially. Recent results reveal a turnaround with Q3 net income of €0.28 million compared to last year's loss and nine-month net income rising to €3.05 million from €1.23 million previously.

Summing It All Up

- Dive into all 4656 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:JDC

JDC Group

Operates as a financial services company in Germany and Austria.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives