Stock Analysis

- Germany

- /

- Oil and Gas

- /

- XTRA:VH2

3 High Insider Ownership German Stocks With Up To 74% Earnings Growth

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets and heightened trade tensions, the German market has experienced notable volatility, with the DAX index reflecting a significant downturn. In such uncertain times, investors might find reassurance in companies where insiders hold substantial stakes, suggesting confidence in the firm’s prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.2% | 34.7% |

| YOC (XTRA:YOC) | 24.8% | 21.8% |

| NAGA Group (XTRA:N4G) | 14.1% | 74.7% |

| Exasol (XTRA:EXL) | 25.3% | 105.4% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Stratec (XTRA:SBS) | 30.9% | 21.9% |

| elumeo (XTRA:ELB) | 25.8% | 99.1% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

Let's uncover some gems from our specialized screener.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG operates as a private equity firm with a market capitalization of approximately €296.71 million.

Operations: The company generates revenue primarily through its Security Technologies and Financial Technologies segments, which contributed €39.43 million and €153.43 million, respectively.

Insider Ownership: 26.6%

Earnings Growth Forecast: 74.2% p.a.

Brockhaus Technologies, a growth company in Germany with high insider ownership, is trading at €76.8% below its estimated fair value. Despite a forecasted low return on equity of 10.3%, the company's revenue and earnings are expected to grow significantly. Revenue is projected to increase by 17.8% annually, outpacing the German market's 5.2%, with earnings anticipated to surge by 74.21% per year as it moves towards profitability within three years.

- Click here to discover the nuances of Brockhaus Technologies with our detailed analytical future growth report.

- Our valuation report here indicates Brockhaus Technologies may be undervalued.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE is a technology-based financial service provider in Germany, with a market capitalization of approximately €2.16 billion.

Operations: The company generates revenue primarily through its Credit Platform and Insurance Platform, which brought in €155.60 million and €66.29 million respectively.

Insider Ownership: 35.1%

Earnings Growth Forecast: 31.9% p.a.

Hypoport SE, a German growth company with high insider ownership, has demonstrated robust financial performance with earnings soaring by 240.5% over the past year. Despite a modest forecasted return on equity of 9.2%, the company's future looks promising with expected annual earnings growth of 31.9% and revenue growth of 13.4%, both surpassing the German market averages significantly. Recent events include strong first-quarter results and significant presentations at international conferences, underscoring its dynamic market presence.

- Click to explore a detailed breakdown of our findings in Hypoport's earnings growth report.

- Our valuation report unveils the possibility Hypoport's shares may be trading at a premium.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE specializes in offering solutions for the transformation and transportation of energy across Germany and Europe, with a market capitalization of approximately €380 million.

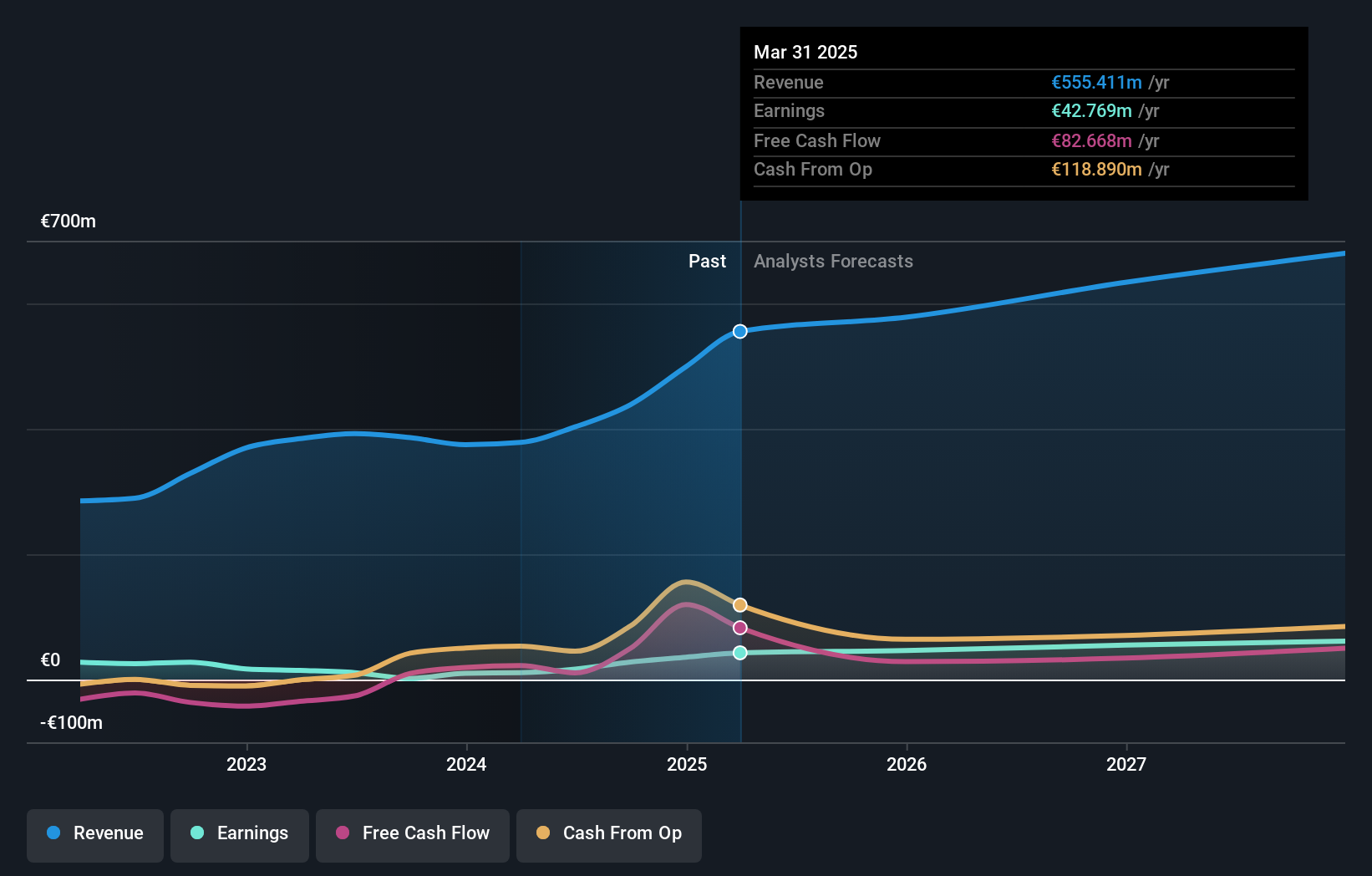

Operations: The company generates revenue through several segments, including Electricity (€72.07 million), Natural Gas (€157.60 million), Clean Hydrogen (€28.59 million), and Adjacent Opportunities (€118.73 million).

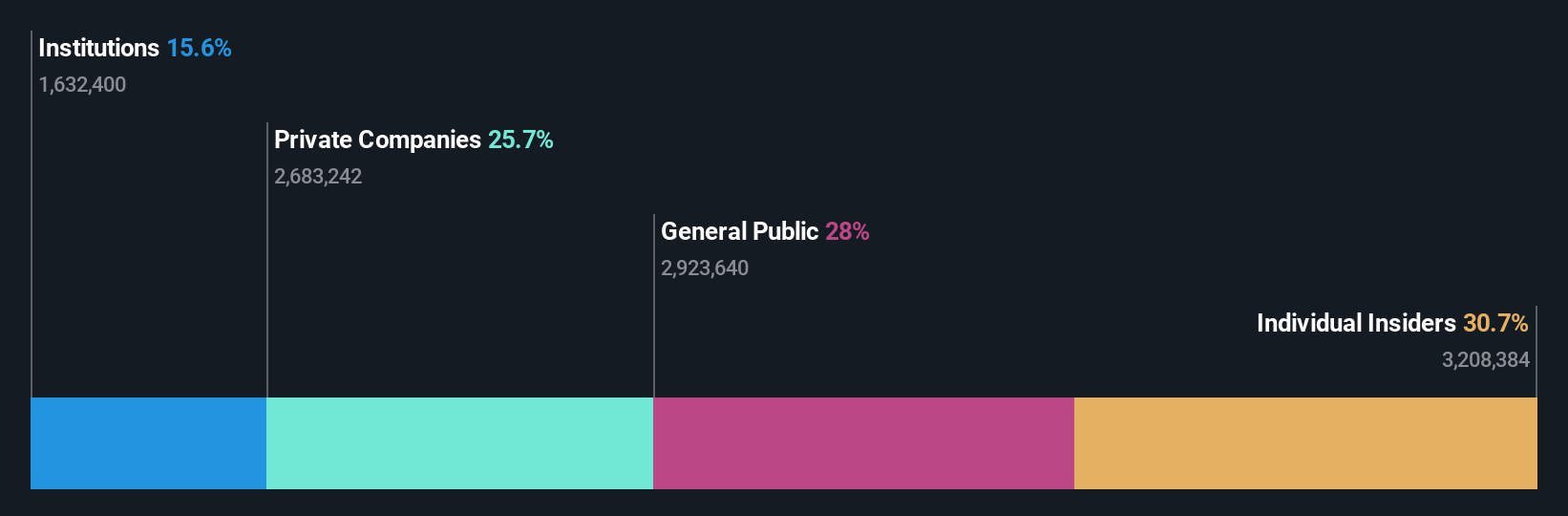

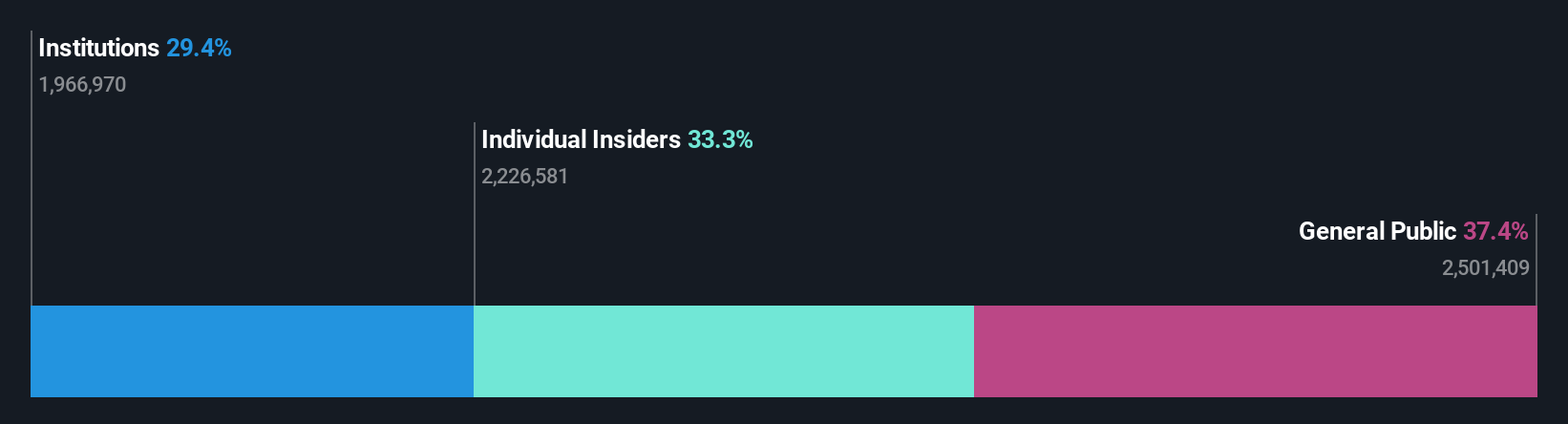

Insider Ownership: 18%

Earnings Growth Forecast: 30.4% p.a.

Friedrich Vorwerk Group SE, a German growth company with high insider ownership, has shown encouraging performance with a recent increase in sales and net income as reported in its Q1 2024 earnings. While its return on equity is forecasted to be low at 11%, the company's revenue and earnings are expected to grow faster than the German market at rates of 8.3% and 30.4% per year respectively. This suggests potential for significant growth despite some underwhelming metrics.

- Click here and access our complete growth analysis report to understand the dynamics of Friedrich Vorwerk Group.

- According our valuation report, there's an indication that Friedrich Vorwerk Group's share price might be on the expensive side.

Key Takeaways

- Unlock our comprehensive list of 18 Fast Growing German Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Friedrich Vorwerk Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VH2

Friedrich Vorwerk Group

Provides various solutions for transformation and transportation of energy in Germany and Europe.

Reasonable growth potential with adequate balance sheet.