- Germany

- /

- Capital Markets

- /

- XTRA:DBK

Deutsche Bank (XTRA:DBK): Exploring Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

Most Popular Narrative: 7% Overvalued

According to the most widely followed narrative, Deutsche Bank’s shares are currently viewed as modestly overvalued compared to the consensus analyst fair value estimate.

The imminent large-scale German fiscal stimulus and structural reforms (including the "Made for Germany" initiative) are expected to drive significant increases in corporate, infrastructure, and defense investment activity from 2026 onward. Deutsche Bank is poised to benefit due to its leading market position, strong corporate client relationships, and global reach. This should generate higher lending volumes, advisory, and fee-based revenues over time.

How are analysts projecting future value here? Their narrative relies on a set of aggressive assumptions about growth that could surprise even seasoned investors. Want to know which business lines and financial levers are baked into their outlook and what inflection points they expect for Deutsche Bank? Dig deeper to uncover the pivotal figures and bullish calls supporting this fair value.

Result: Fair Value of €27.95 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing litigation or a spike in credit losses could quickly shift the outlook. This could drive unpredictable swings in Deutsche Bank's future performance.

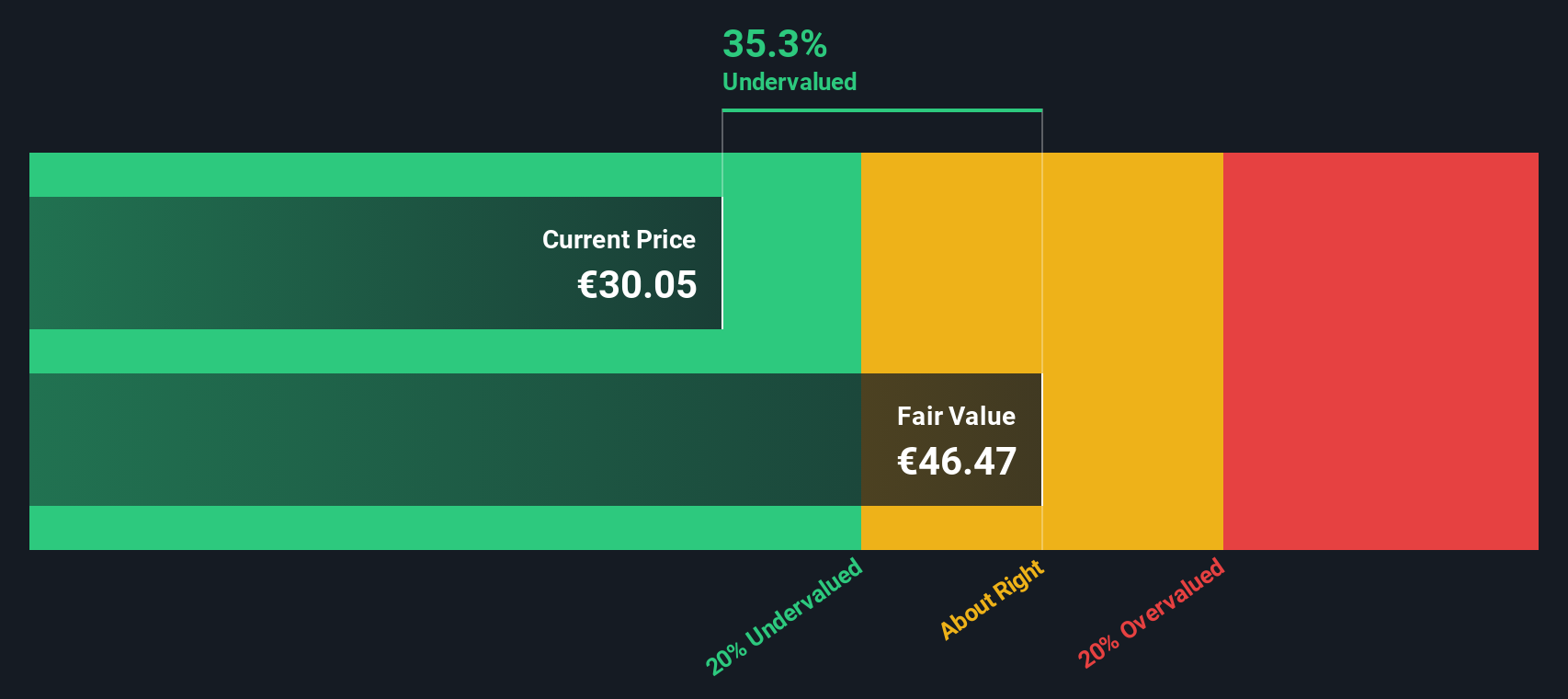

Find out about the key risks to this Deutsche Bank narrative.Another View: SWS DCF Model Points to Undervaluation

Switching gears, our DCF model paints a different picture. It suggests Deutsche Bank's shares may in fact be undervalued. Could the market be missing something, or does the analyst consensus reflect hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Deutsche Bank Narrative

If you are curious to dig into the numbers for yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Deutsche Bank research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Stepping beyond Deutsche Bank unlocks a wider world of investment possibilities. Don’t limit your portfolio; smart opportunities are waiting if you know where to look.

- Spot undervalued gems with steady cash flows by using our undervalued stocks based on cash flows before others catch on.

- Target reliable income by tapping into companies offering dividend stocks with yields > 3% and building a foundation for future growth.

- Get ahead of the curve with innovative companies powering the next wave of technology through quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About XTRA:DBK

Deutsche Bank

A stock corporation, provides corporate and investment banking, private clients, and asset management products and services in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives