- Germany

- /

- Hospitality

- /

- XTRA:TIMA

ZEAL Network (XTRA:TIMA): Margin Drop Challenges Bullish Narratives Despite High-Quality Earnings Growth

Reviewed by Simply Wall St

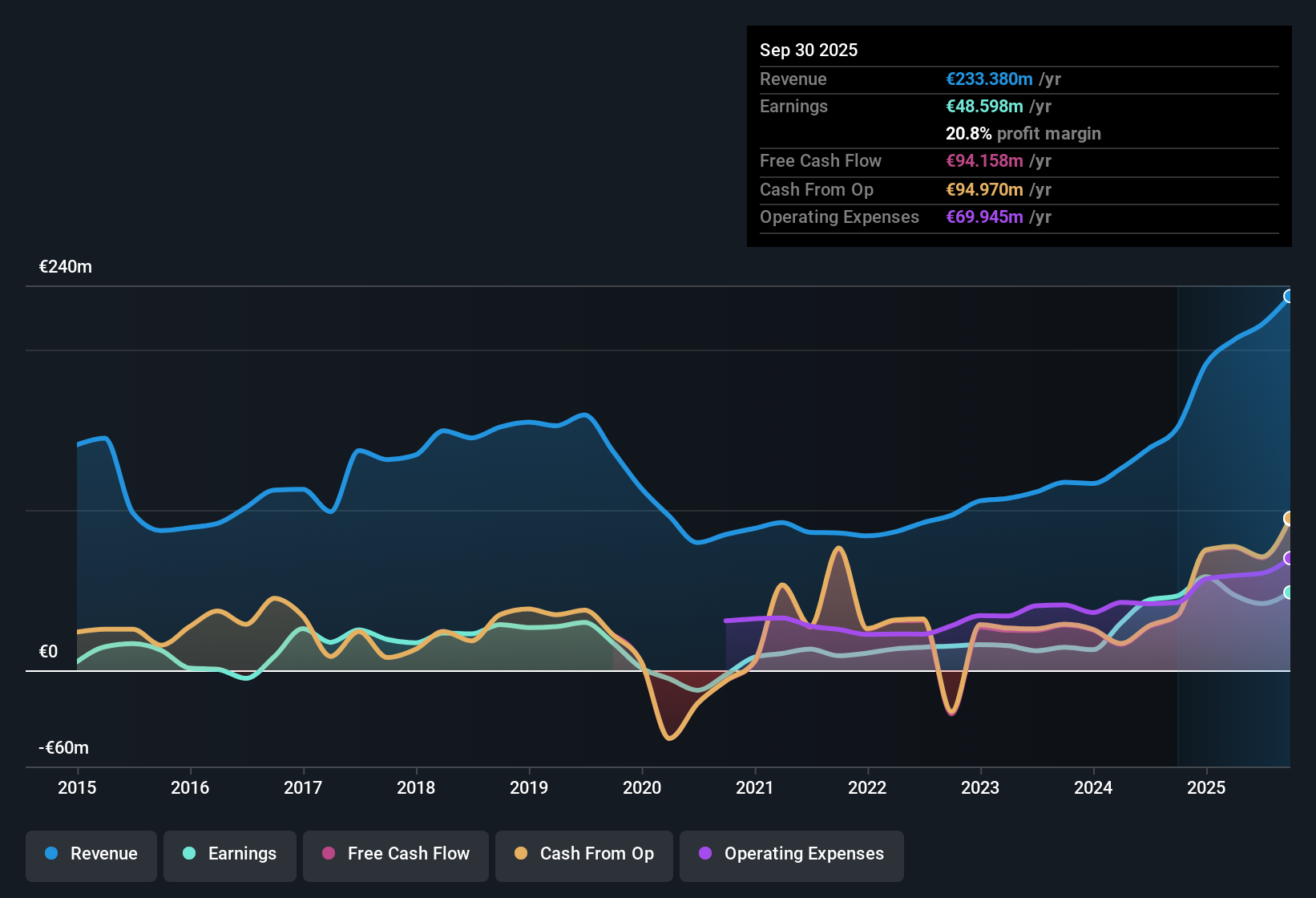

ZEAL Network (XTRA:TIMA) reported annual earnings growth of 6.68% and revenue growth of 8.3%, outperforming the German market’s 6.1% revenue expansion forecast. Net profit margins stand at 20.8%, down from 30.7% a year earlier. This highlights recent pressures despite a five-year stretch of 42.2% annualized earnings growth and persistent high-quality results. Investors are weighing this mix of sustained top-line progress, sliding margins, and flagged concerns around dividend sustainability as the market judges whether growth momentum can offset profitability headwinds.

See our full analysis for ZEAL Network.The next section lines up these earnings results with Simply Wall St's most widely followed narratives for ZEAL Network, offering a closer look at where expectations are confirmed and where they are called into question.

See what the community is saying about ZEAL Network

Jackpot Reliance Drives Revenue Volatility

- ZEAL Network’s reliance on jackpot-driven growth introduces notable cyclicality, with risks flagged around unpredictable revenues and EBITDA in periods of fewer or smaller jackpots.

- According to the analysts' consensus view, the company’s successful online migration and record 1.5 million monthly active users show clear traction for digital channels.

- However, the consensus narrative notes the potential for revenue swings given ongoing jackpot dependence and heavy marketing needs.

- Expansion of proprietary products such as Traumhausverlosung and a robust Games segment (up 49% year over year) highlight promising sources for growth, but do not fully offset structural volatility tied to industry jackpots.

- For a deeper look at how bulls and bears see ZEAL's long-term trajectory, see which arguments dominate in the full narrative. 📊 Read the full ZEAL Network Consensus Narrative.

Marketing Spend Pressures Margins

- Heavy investment in technology, targeted marketing, and customer acquisition has contributed to shrinking net profit margins, now at 20.8% compared to 30.7% a year earlier, as well as a notably higher cost per lead for new segments versus the core lottery business.

- Analysts’ consensus view calls out the tension between strategic spending, which enables operational efficiency and user retention, and the bear concern that persistently high acquisition costs, especially in expanding offerings like Traumhausverlosung and Games, could continue to erode overall profitability.

- Focused marketing initiatives and growing user numbers support scale, but margin improvements and efficiency gains remain critical for realizing long-term EBITDA and net profit expansion.

- Regulatory constraints around cross-selling further limit margin recovery, underlining the importance of ongoing improvements in marketing effectiveness and product mix.

Share Price Lags Analyst Target

- ZEAL Network’s current share price is 49.40, positioned 24.6% below the latest analyst price target of 65.50, potentially pointing to a discounted valuation despite growth and profitability risks.

- The analysts’ consensus narrative highlights that bullish assumptions around annual revenue growth (expected at 8.2%) and future profitability underpin the target price.

- It also cautions that for this valuation to hold, ZEAL must hit projected 2028 earnings (48.9 million) and be valued at a 25.2x PE, above the GB Hospitality sector average.

- Investors are encouraged to cross-check their own expectations against these projections for a fair appraisal of upside potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ZEAL Network on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on ZEAL Network's results? Share your insights and craft your own narrative in just a few minutes. Do it your way

A great starting point for your ZEAL Network research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

ZEAL Network’s earnings momentum is challenged by shrinking profit margins, concerns about dividend sustainability, and revenue volatility related to jackpot dependence.

If steady results are more your style, focus on companies known for reliable expansion and consistent returns by checking out stable growth stocks screener (2082 results) built to weather market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZEAL Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TIMA

ZEAL Network

Engages in the online lottery brokerage business in Germany.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives