Is Adidas a Bargain After Shares Fall 18.5% in the Past Month?

Reviewed by Bailey Pemberton

- If you have ever wondered whether adidas stock is actually a bargain or just another brand trading on its reputation, you are not alone. There is a lot more to the price tag than meets the eye.

- Shares have retreated noticeably, with a 3.8% dip over the last week and a steep 18.5% slide in the past month, bringing year-to-date returns to -33.4%.

- These declines have been influenced by ongoing challenges in the global athletic apparel market and renewed concerns about competition from both established giants and emerging disruptors. Recent headlines about shifting consumer demand and the fierce battle for market share are fueling investor debate about adidas’ future trajectory.

- On a pure numbers basis, adidas has a valuation score of 4 out of 6 checks for being undervalued. However, traditional metrics only tell part of the story, and we will dig into the methods behind these figures and reveal an even smarter way of approaching the company’s value by the end of this article.

Approach 1: adidas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s value, using a rate that reflects the riskiness of those cash flows. This approach provides a data-driven view of what the company might truly be worth, based on how much cash it can generate over time.

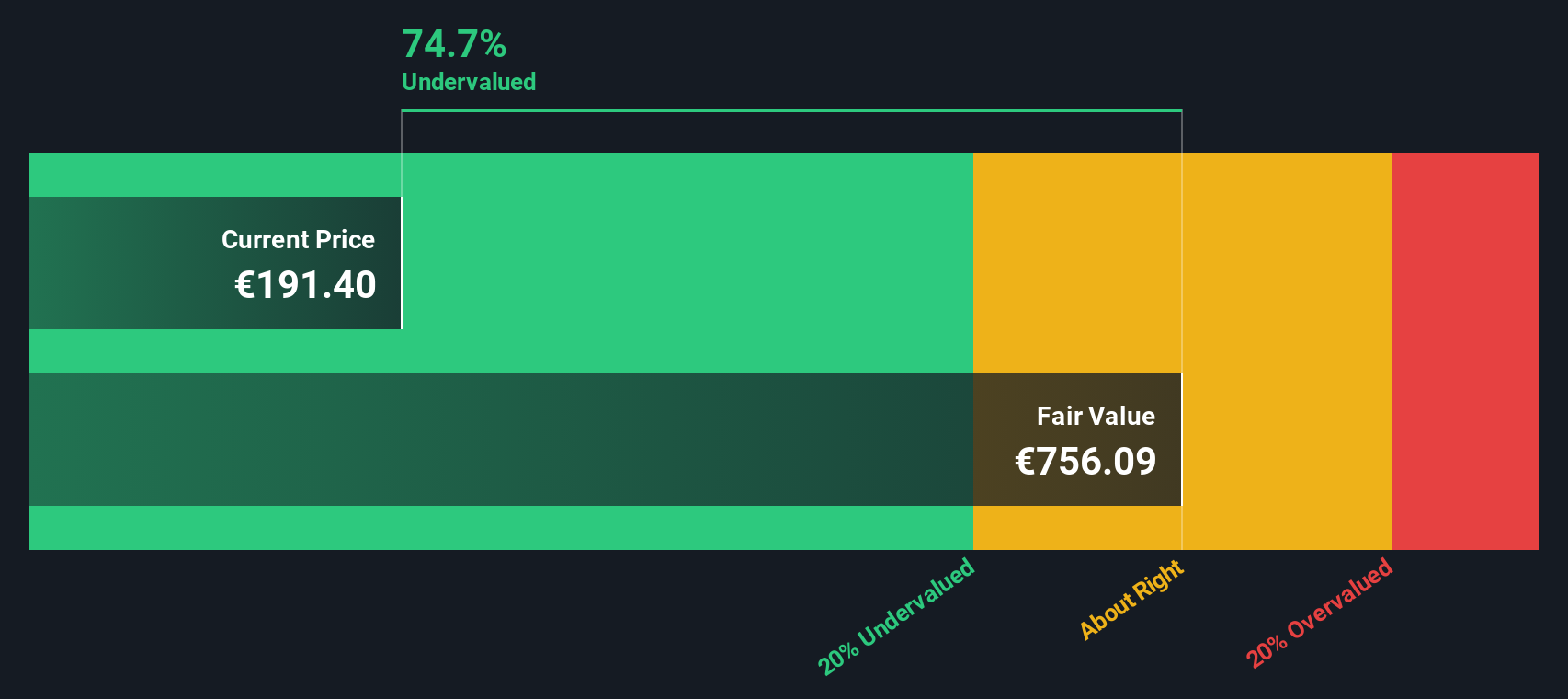

For adidas, the model uses a 2 Stage Free Cash Flow to Equity methodology. The company generated Free Cash Flow of €363.7 Million over the last twelve months. Looking ahead, analyst and model projections expect annual cash flows to grow, reaching approximately €8.95 Billion by 2035. However, the most robust analyst estimates cover only the next five years. Longer-term forecasts are extrapolated by Simply Wall St. All figures are reported in euros, adidas’ reporting currency.

Based on these inputs, the model calculates an intrinsic value of €734.12 per share for adidas. This figure suggests the stock is currently trading at a discount of 78.5 percent, meaning the share price is well below what the model considers fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests adidas is undervalued by 78.5%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: adidas Price vs Earnings (PE)

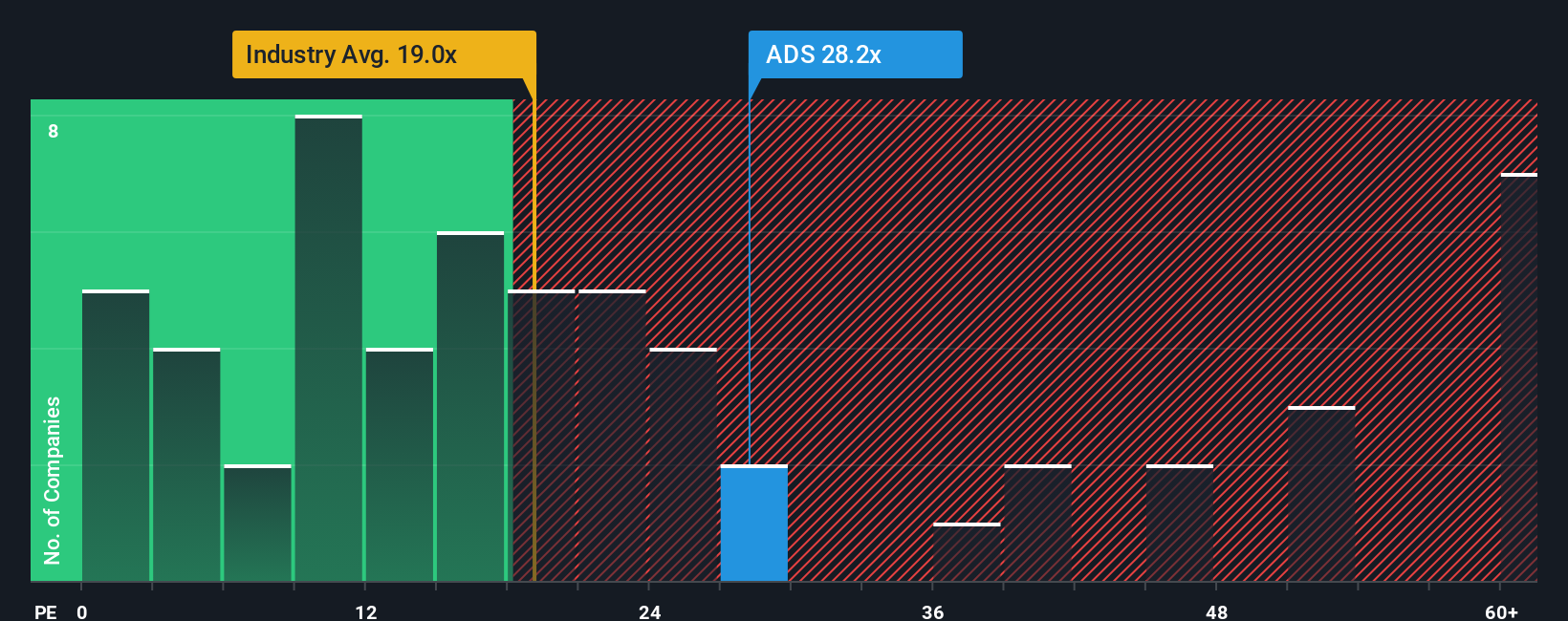

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies because it directly connects a company’s share price to its earnings power. For established businesses like adidas, the PE ratio helps investors quickly compare how much they are paying for each euro of earnings. This makes it a useful starting point for judging valuation.

Growth expectations and risk play a significant role in determining what a “normal” or “fair” PE ratio should be. Higher earnings growth and lower risk can justify higher multiples, while slower growth and greater risk typically result in lower ones.

Currently, adidas trades at a PE ratio of 23.23x. This is above the luxury industry average of 18.54x, but still below the peer group average of 28.35x. These benchmarks provide some context, but do not always capture the nuances that differentiate adidas from its rivals.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is a proprietary measure, set at 21.56x for adidas, that takes into account a much broader set of factors, including the company’s expected earnings growth, operating risks, profit margins, industry classification, and market capitalization. Unlike basic peer or industry comparisons, the Fair Ratio is tailored to the business and provides a more accurate view of where the PE ratio should reasonably fall.

Comparing adidas’ current PE of 23.23x to its Fair Ratio of 21.56x, the valuation appears to be about right. The difference is not material, suggesting that the stock is trading close to what would be considered a reasonable multiple given its profile today.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your adidas Narrative

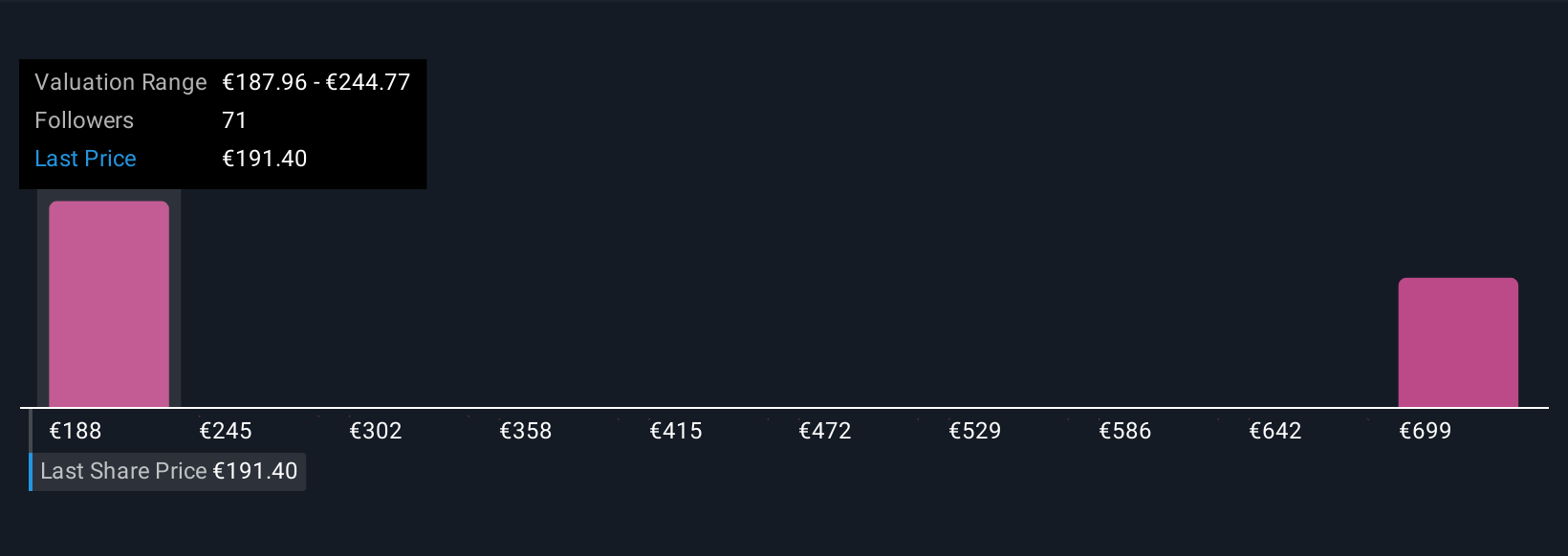

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal, data-backed “story” about the future of adidas, where you map out your own expectations for fair value and key financial drivers like revenue, earnings, and profit margins.

Unlike traditional metrics, Narratives empower you to bring your outlook to life; you can connect the company’s story, such as new products, global shifts, or competitive threats, directly to specific forecasts. These forecasts, in turn, shape your estimate of what the stock should be worth.

This approach is easy to use and available to everyone on Simply Wall St’s Community page, where millions of investors build and share their Narratives. It allows you to see in real time whether your fair value aligns with or differs from the current share price, helping you decide if adidas is a buy, hold, or sell for your unique perspective.

Narratives are dynamic and continuously update as new information emerges from earnings, news, or broader market shifts, so your outlook always stays relevant. For instance, some investors, expecting accelerating growth and margin improvement, see fair value near €280. The most cautious, concerned about competition and risk, estimate just €182 per share.

Do you think there's more to the story for adidas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets a range of athletic and sports lifestyle products in Europe, Greater China, Japan, South Korea, Latin America, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives