The European market has recently experienced mixed results, with the pan-European STOXX Europe 600 Index ending slightly lower as hopes for further interest rate cuts from the European Central Bank diminished. Despite these fluctuations, penny stocks—often representing smaller or newer companies—remain a compelling investment area due to their affordability and growth potential. While the term 'penny stocks' may seem outdated, these investments can still offer significant value when supported by strong financial foundations, making them an intriguing option for investors seeking opportunities in under-the-radar companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 4 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.30 | €43.83M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.61 | DKK116.56M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.937 | €75.61M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €3.95 | €77.27M | ✅ 1 ⚠️ 5 View Analysis > |

| Faes Farma (BME:FAE) | €4.46 | €1.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.43M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 280 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

QPR Software Oyj (HLSE:QPR1V)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: QPR Software Oyj offers services and software tools for business process development and enterprise architecture across Finland, Europe, Russia, Turkey, and other international markets with a market cap of €12.66 million.

Operations: QPR Software Oyj does not report specific revenue segments, but it operates in Finland, Europe, Russia, Turkey, and other international markets.

Market Cap: €12.66M

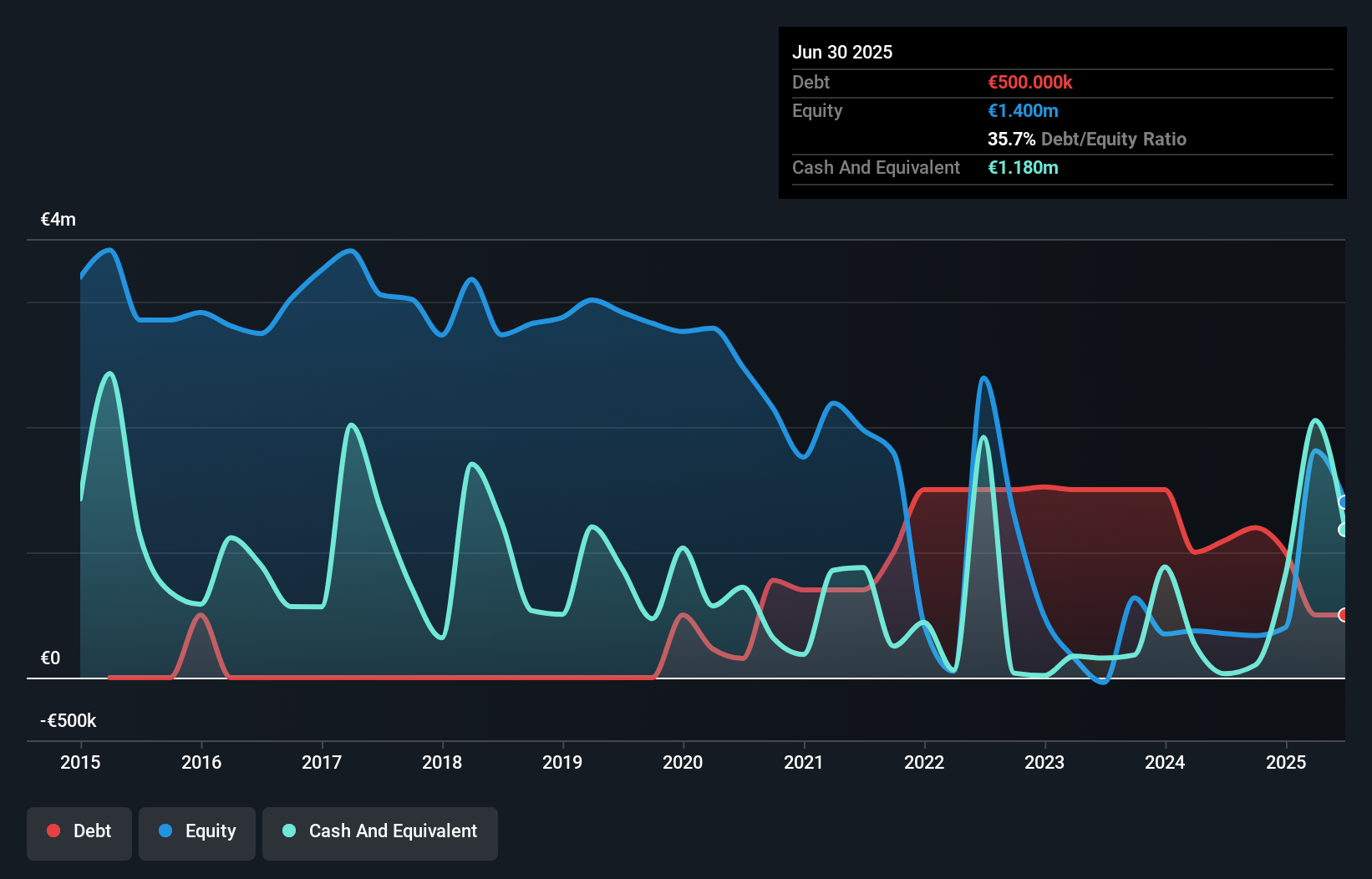

QPR Software Oyj, with a market cap of €12.66 million, has shown some progress despite its challenges. The company reported a net income of €0.081 million for the third quarter of 2025, marking an improvement from the previous year's loss. However, it still faces financial hurdles with short-term liabilities exceeding assets by €0.5 million and ongoing restructuring efforts to enhance profitability and competitiveness through potential layoffs and operational changes. Recent strategic partnerships in Saudi Arabia and Central Europe highlight its expanding international footprint in performance management and process mining solutions, potentially bolstering future growth prospects amidst volatility concerns.

- Click here to discover the nuances of QPR Software Oyj with our detailed analytical financial health report.

- Evaluate QPR Software Oyj's prospects by accessing our earnings growth report.

Tobii (OM:TOBII)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tobii AB (publ) is a company that develops and sells eye-tracking technology and solutions across Sweden, Europe, the Middle East, Africa, the United States, and internationally with a market cap of approximately SEK411.38 million.

Operations: Tobii generates revenue from three main segments: Autosense (SEK55 million), Integrations (SEK446 million), and Products and Solutions (SEK423 million).

Market Cap: SEK411.38M

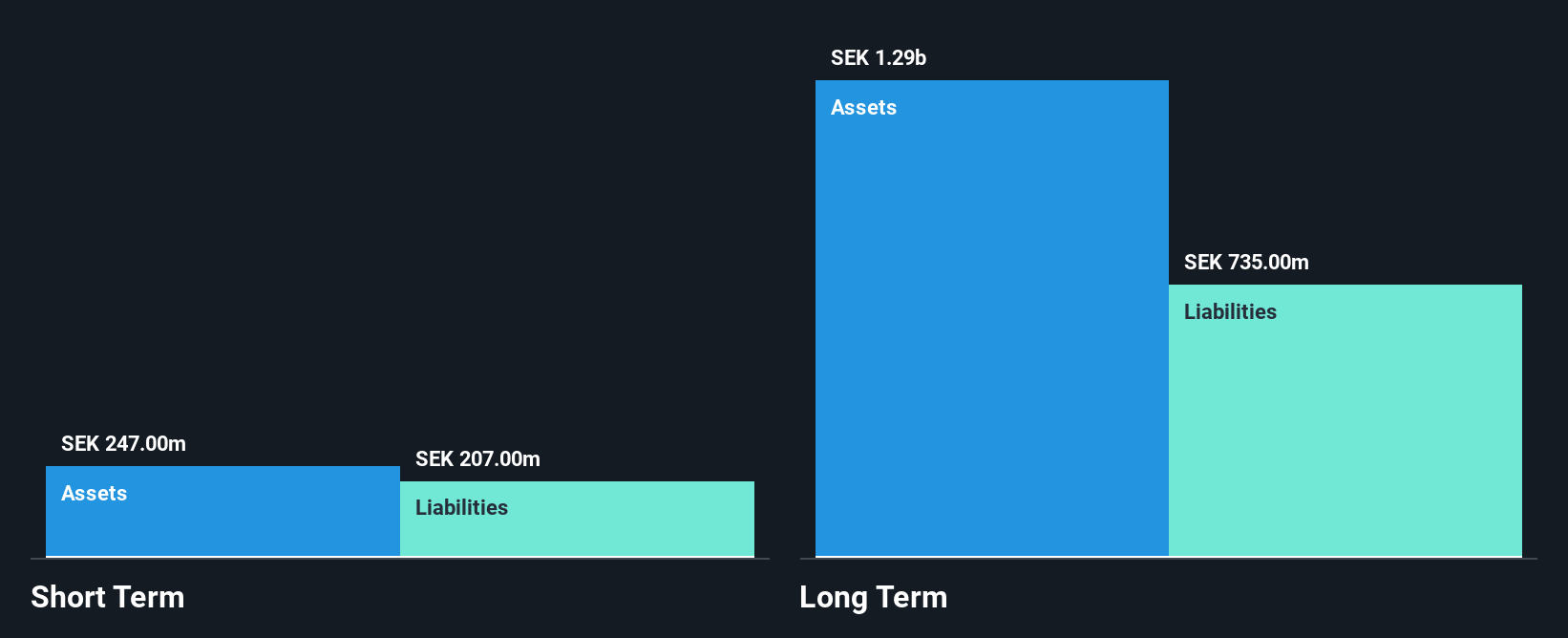

Tobii AB, with a market cap of approximately SEK411.38 million, is navigating the penny stock landscape with its eye-tracking technology. The company reported third-quarter sales of SEK158 million, down from SEK211 million the previous year, and a net loss of SEK48 million. Despite being unprofitable, Tobii has reduced losses over five years by 19% annually and maintains a positive cash flow runway exceeding three years. Recent collaborations in automotive interior sensing showcase its technological advancements and industry relevance. However, high debt levels and volatility remain challenges as it continues to refine its strategic focus amidst evolving market dynamics.

- Jump into the full analysis health report here for a deeper understanding of Tobii.

- Review our growth performance report to gain insights into Tobii's future.

11880 Solutions (XTRA:TGT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 11880 Solutions AG, with a market cap of €16.79 million, provides telephone directory assistance services to both private and business customers in Germany through its subsidiaries.

Operations: The company's revenue is derived from two main segments: Digital services, generating €44.09 million, and Directory Assistance, contributing €10.95 million.

Market Cap: €16.79M

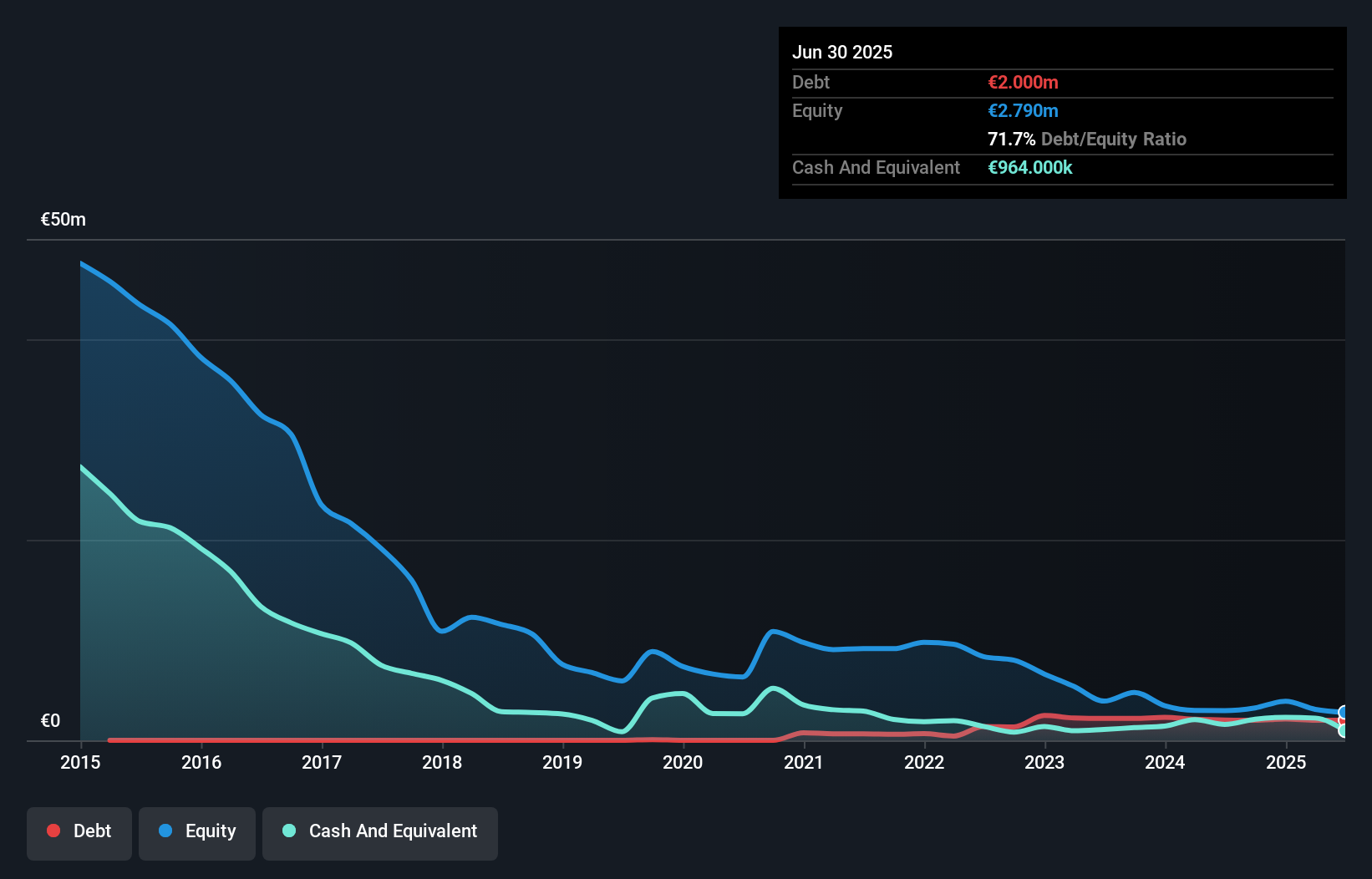

11880 Solutions AG, with a market cap of €16.79 million, operates in the directory assistance sector in Germany. The company reported second-quarter sales of €13.41 million and a net loss of €0.298 million, reflecting ongoing challenges despite reducing losses over five years by 7.5% annually. While its board is experienced and short-term assets exceed long-term liabilities, high weekly volatility and increased debt levels present risks for investors. The appointment of Martin Walter as CEO may bring strategic shifts to leverage digital services growth potential amidst industry competition and financial pressures as the company remains unprofitable yet maintains positive free cash flow growth.

- Get an in-depth perspective on 11880 Solutions' performance by reading our balance sheet health report here.

- Explore historical data to track 11880 Solutions' performance over time in our past results report.

Summing It All Up

- Jump into our full catalog of 280 European Penny Stocks here.

- Looking For Alternative Opportunities? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QPR Software Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:QPR1V

QPR Software Oyj

Provides services and software tools for developing business processes and enterprise architecture in Finland, rest of Europe, Russia, Turkey, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives