- Germany

- /

- Commercial Services

- /

- XTRA:BFSA

Befesa S.A. (ETR:BFSA) Stocks Shoot Up 27% But Its P/E Still Looks Reasonable

Befesa S.A. (ETR:BFSA) shares have had a really impressive month, gaining 27% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.1% in the last twelve months.

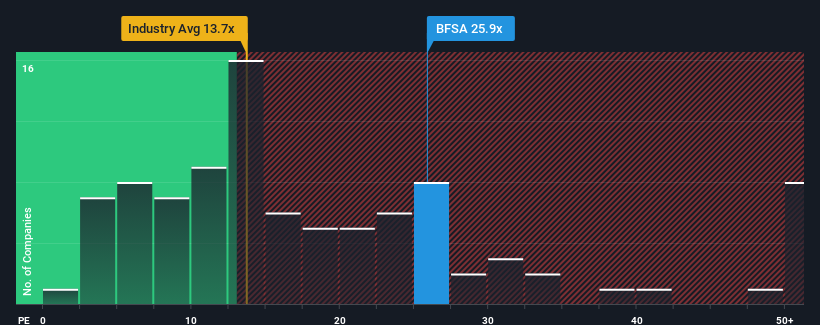

After such a large jump in price, Befesa may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 25.9x, since almost half of all companies in Germany have P/E ratios under 17x and even P/E's lower than 10x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Befesa could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Befesa

Is There Enough Growth For Befesa?

In order to justify its P/E ratio, Befesa would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 45% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 23% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 31% each year over the next three years. With the market only predicted to deliver 13% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Befesa is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Befesa's P/E

Befesa's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Befesa's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Befesa (1 doesn't sit too well with us!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Befesa, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Befesa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:BFSA

Befesa

Offers environmental recycling services to the steel and aluminum industries in the European, Asian, and North American markets.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives