technotrans SE's (ETR:TTR1) 29% Share Price Surge Not Quite Adding Up

technotrans SE (ETR:TTR1) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

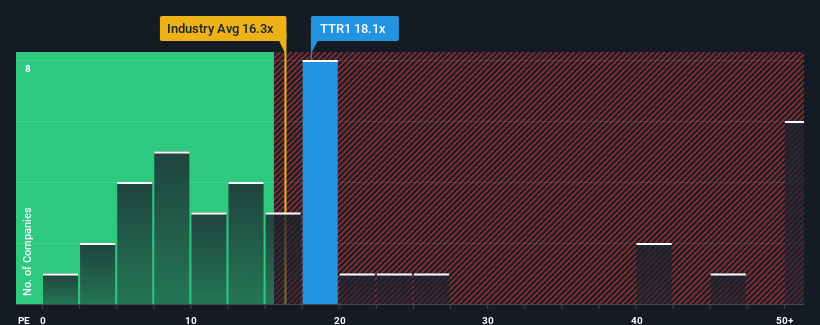

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about technotrans' P/E ratio of 18.1x, since the median price-to-earnings (or "P/E") ratio in Germany is also close to 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, technotrans has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for technotrans

How Is technotrans' Growth Trending?

technotrans' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.1%. Even so, admirably EPS has lifted 72% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 10% each year during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to expand by 13% per annum, which is noticeably more attractive.

In light of this, it's curious that technotrans' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On technotrans' P/E

technotrans appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that technotrans currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware technotrans is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on technotrans, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:TTR1

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives