Singulus Technologies AG (ETR:SNG) Analysts Just Trimmed Their Revenue Forecasts By 34%

Today is shaping up negative for Singulus Technologies AG (ETR:SNG) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. Bidders are definitely seeing a different story, with the stock price of €7.28 reflecting a 31% rise in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

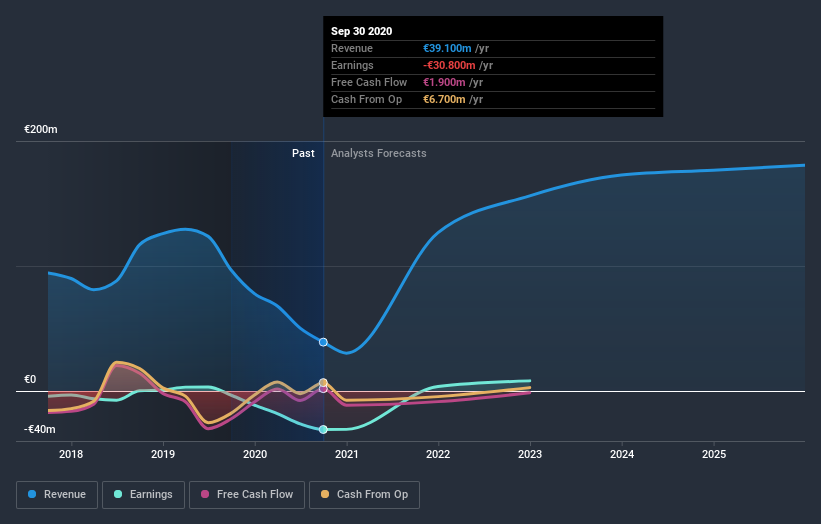

Following the latest downgrade, the twin analysts covering Singulus Technologies provided consensus estimates of €30m revenue in 2020, which would reflect a disturbing 23% decline on its sales over the past 12 months. Before the latest update, the analysts were foreseeing €46m of revenue in 2020. It looks like forecasts have become a fair bit less optimistic on Singulus Technologies, given the pretty serious reduction to revenue estimates.

See our latest analysis for Singulus Technologies

There was no particular change to the consensus price target of €9.10, with Singulus Technologies' latest outlook seemingly not enough to result in a change of valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Singulus Technologies analyst has a price target of €10.50 per share, while the most pessimistic values it at €7.70. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast revenue decline of 23%, a significant reduction from annual growth of 0.7% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 6.7% next year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Singulus Technologies is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Singulus Technologies going forwards.

Of course, there's always more to the story. We have estimates for Singulus Technologies from its twin analysts out until 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Singulus Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:SNG

Singulus Technologies

Develops and assembles machines and systems for thin-film coating and surface treatment processes worldwide.

Reasonable growth potential and fair value.

Market Insights

Community Narratives