- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

Rheinmetall (XTRA:RHM): Assessing Valuation After Strong Financial Performance and Investor Momentum

Reviewed by Simply Wall St

See our latest analysis for Rheinmetall.

After delivering a remarkable year, Rheinmetall's 1-year total shareholder return of 216.84% and a sustained five-year total return above 2,300% point to strong momentum behind the stock. Though the recent 30-day share price return dipped, longer-term performance remains robust as investors appear to be pricing in both growth prospects and sector tailwinds.

If recent defense sector moves have your attention, you might find it timely to explore the broader aerospace and defense landscape with our curated list: See the full list for free.

With shares soaring on strong fundamentals, investors are now left to wonder whether Rheinmetall is still trading at a bargain or if the market has already accounted for its future growth, leaving limited room for upside.

Most Popular Narrative: 78.8% Undervalued

According to EUinvestor, Rheinmetall's current share price sits far below the fair value estimate calculated in the most followed narrative. The implied upside is striking, given the narrative’s assumption that order growth and defense spending will push the company's valuation to new heights by 2030.

"450% in 5 years. On April 17, 2025, Armin Papperger, Rheinmetall's CEO, said he expects orders to grow 450% by 2030. Source: https://finance.yahoo.com/news/rheinmetall-ceo-expects-order-book-113644072.html Price 8,052 EUR. The share price at the time of this information on 17/04/2025 was 1,464 EUR. Price estimate for 2030: 1,464 + 450% = 8,052 EUR. NATO spending in Europe. 17/04/2025 The results of the NATO Summit held 24-26 June 2025 in The Hague, where it was agreed to increase defence spending to 3.5% of GDP and transport and IT infrastructure spending at 1.5% each year until 2035, were not yet known. Source: https://www.nato.int/cps/en/natohq/official_texts_236705.htm But there is one discrepancy: while the official NATO report talks about this budget increase to 3.5% plus 1.5% annually, the European media talks about 3.5% plus 1.5% as a target to be gradually reached by 2030-2035. Price more than 8,052 EUR. Armin Papperger himself said in interviews around 17.04.2025 that his future order estimates do not include increased NATO spending or the German government's spending package of €500 bn for defence already approved on 18.03.2025. Source: https://www.theguardian.com/world/2025/mar/18/german-mps-approve-500bn-spending-boost-to-counter-putin-war-of-aggression Big Advantages of Rheinmetall within EU. The advantage of Rheinmetall is that it can cover all the needs of NATO, which mainly requires ammunition, air defence, drones and IT defence. In addition, it owns the entire munitions production chain, including the production of explosive compounds (nitrocellulose). Source: https://www.rheinmetall.com/en/products/propellants/propulsion/nc-rm-pvk Source: https://www.rheinmetall.com/en/products/overview Share Split. The most expensive, commonly traded stock in Europe is Hermès, with a price trading in June at around €2,300. I assume that when the shares of Rheinmetall reach €3,000, there will be a 1:10 split, so the price of one share will be €300, but you will have 10 of them."

What aggressive expansion assumptions fuel this sky-high projection? The narrative teases explosive order growth, bold sector spending, and ambitious margin targets. There are surprising factors behind this price—want to see what they are?

Result: Fair Value of $8,052 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions or a sudden Ukraine ceasefire could quickly undermine the bullish outlook. This poses real risks to these high expectations.

Find out about the key risks to this Rheinmetall narrative.

Another View: Eyeing the Multiples

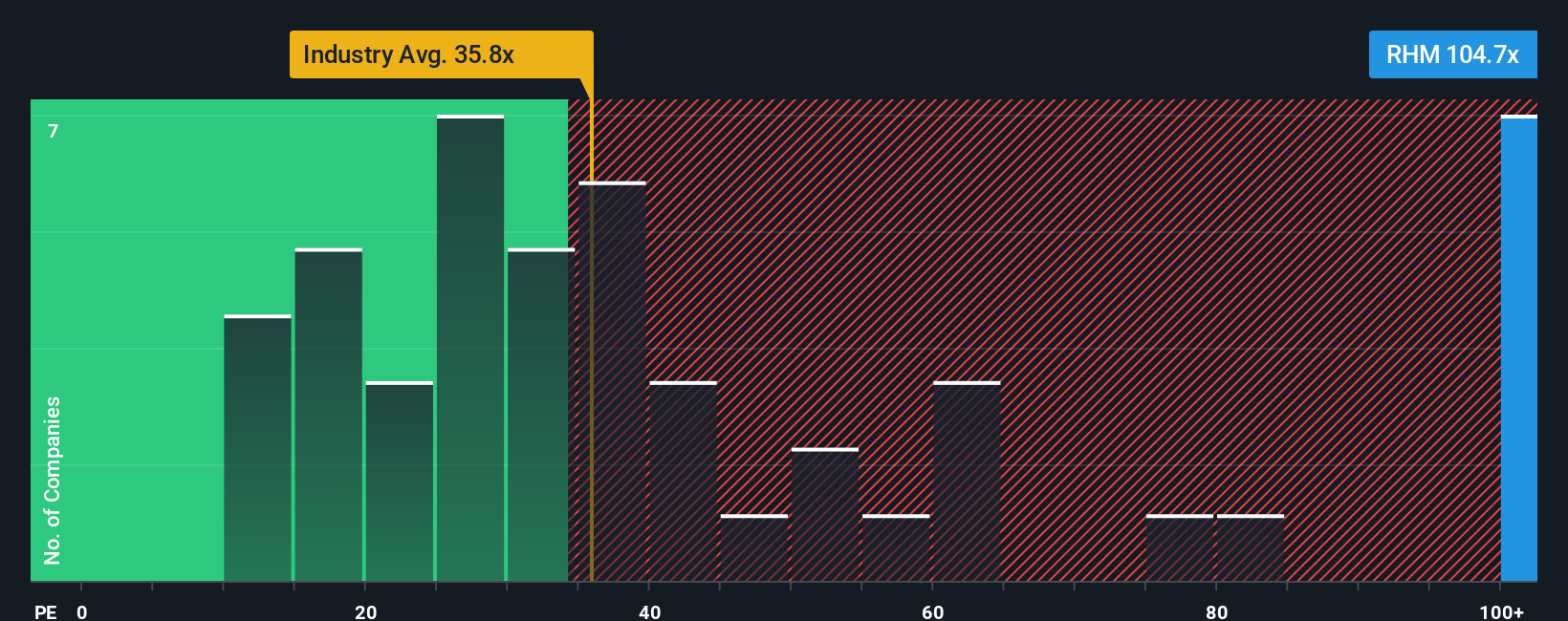

While narrative fans see major upside, valuation multiples tell a different story. Rheinmetall trades at a price-to-earnings ratio of 92.7x, nearly triple the European aerospace and defense industry average of 32.3x and well above the fair ratio of 53.4x. This hefty premium suggests that much optimism may already be in the price, leaving investors to decide if current levels still offer real value.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rheinmetall Narrative

If you have a different perspective or want to analyze Rheinmetall on your own terms, crafting your own narrative with our tools takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rheinmetall.

Looking for More Investment Ideas?

Don’t let great opportunities slip past you. Expand your horizons and uncover smart alternatives right now. Miss these, and you may regret it later.

- Capture growth by tapping into these 25 AI penny stocks, featuring companies driving artificial intelligence breakthroughs and reshaping entire industries.

- Unlock steady income streams with these 17 dividend stocks with yields > 3%, showcasing stocks offering robust yields for long-term wealth building.

- Seize untapped upside by targeting these 861 undervalued stocks based on cash flows, where strong financials meet attractive price points for potential outperformance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany, Rest of Europe, North, Middle, and South America, Asia and the Near East, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives