As European markets remain relatively stable, with the pan-European STOXX Europe 600 Index ending flat amid ongoing trade discussions between the U.S. and Europe, investors are keenly observing opportunities in the small-cap segment. With economic indicators such as a rebound in Eurozone industrial output and an expanding trade surplus providing a backdrop of cautious optimism, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on Europe's evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sogefi (BIT:SGF)

Simply Wall St Value Rating: ★★★★★★

Overview: Sogefi S.p.A. is a company that specializes in designing, developing, and producing filtration systems, suspension components, air intake products, and engine cooling systems for the automotive industry across Europe, South America, North America, China, and other international markets; it has a market capitalization of approximately €286.28 million.

Operations: Sogefi generates revenue primarily from its Suspensions segment, contributing €556.61 million, and the Air and Cooling segment, adding €457.60 million.

Sogefi, a player in the automotive components industry, has shown resilience with its strategic positioning in the NAFTA region. This adaptability is crucial amidst potential challenges like market slowdowns and tariff impacts. The company's net debt to equity ratio stands at a satisfactory 4.6%, having reduced significantly from 218.5% over five years, which has helped cut financial expenses and boost profitability in its Suspension division. With earnings growth of 153.7% last year outpacing industry trends, Sogefi's shares are trading at €2.32—4.2% above current levels—indicating fair valuation by analysts despite inherent risks from market volatility and raw material costs.

Mayr-Melnhof Karton (WBAG:MMK)

Simply Wall St Value Rating: ★★★★☆☆

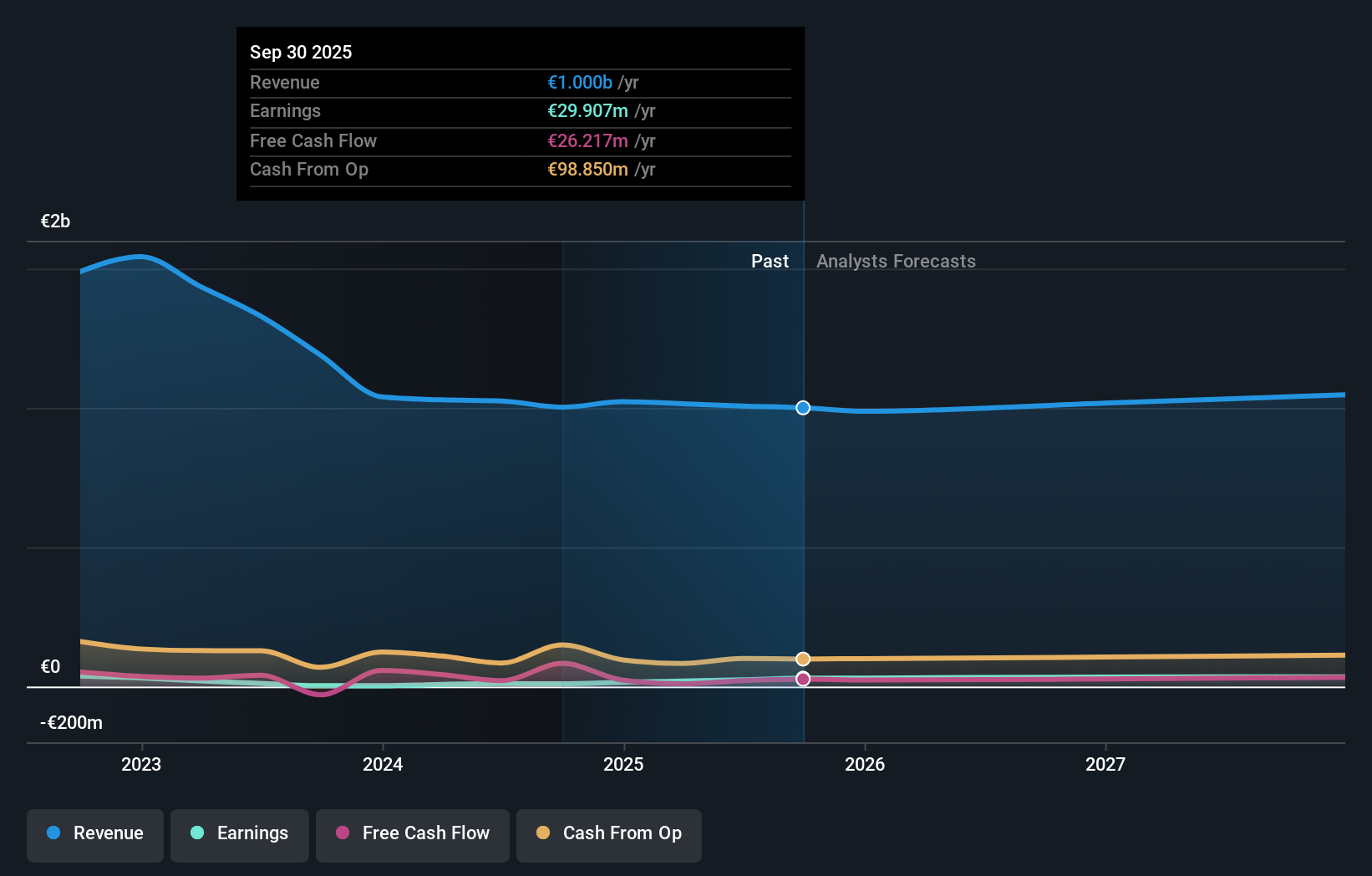

Overview: Mayr-Melnhof Karton AG is a company that manufactures and sells cartonboard and folding cartons in Germany, Austria, and internationally, with a market capitalization of approximately €1.50 billion.

Operations: Mayr-Melnhof Karton generates revenue primarily from its MM Board & Paper segment, contributing approximately €1.98 billion, and its MM Food & Premium Packaging segment, with €1.69 billion in revenue. The company's MM Pharma & Healthcare Packaging segment adds another €614.29 million to the total revenue stream.

Mayr-Melnhof Karton, a key player in the packaging industry, has demonstrated significant earnings growth of 86.9% over the past year, surpassing its industry peers. Despite a high net debt to equity ratio at 64.5%, interest payments are well-covered by EBIT at 3.9 times coverage. The company's strategic initiatives in its Pharma and Healthcare Packaging division have improved operational efficiency and net margins, with future profit margins expected to rise from 2.7% to 4.5%. Although trading at approximately 71% below estimated fair value suggests potential upside, investors should weigh risks like overcapacity and restructuring challenges carefully.

PFISTERER Holding (XTRA:PFSE)

Simply Wall St Value Rating: ★★★★★☆

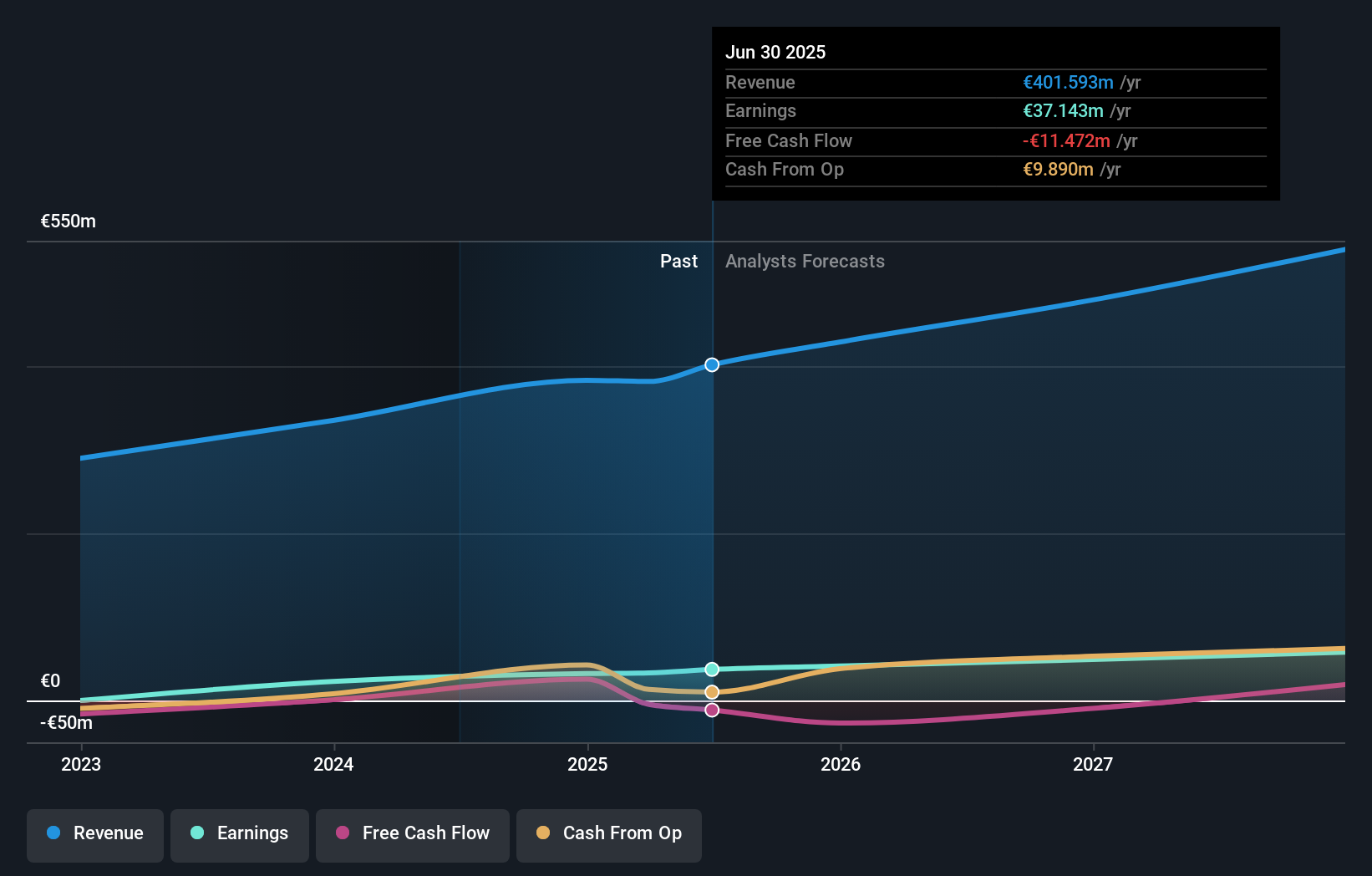

Overview: PFISTERER Holding SE specializes in manufacturing and selling cable fittings, insulators for overhead lines, and components for energy networks and renewable energy generation, with a market cap of €990.07 million.

Operations: PFISTERER generates revenue through four primary segments: Components (€100.70 million), Overhead Lines (€78.59 million), High Voltage Cable Accessories (€149.68 million), and Medium Voltage Cable Accessories (€52.72 million).

PFISTERER Holding, a notable player in the electrical industry, recently completed an IPO raising €167.1 million, with shares priced at €27 each. The company plans to channel approximately €101.5 million of this into growth initiatives like expanding manufacturing and pursuing strategic acquisitions. Over the past year, earnings surged by 32.1%, significantly outpacing the industry's 6.6% growth rate, showcasing robust performance in a competitive market environment. With its net debt to equity ratio at a satisfactory 23.1%, PFISTERER's financial health appears solid as it continues to seek opportunities for expansion and innovation within its sector.

- Dive into the specifics of PFISTERER Holding here with our thorough health report.

Evaluate PFISTERER Holding's historical performance by accessing our past performance report.

Taking Advantage

- Unlock our comprehensive list of 322 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:MMK

Mayr-Melnhof Karton

Manufactures and sells cartonboard and folding cartons in Germany, Austria, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives