- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3211

Undiscovered Gems Three Promising Stocks In February 2025

Reviewed by Simply Wall St

In February 2025, global markets have been navigating a complex landscape marked by tariff uncertainties and mixed economic indicators, with U.S. stocks ending the week lower amid concerns over new trade policies. Despite these challenges, certain indices like the S&P 500 have shown resilience, while manufacturing activity in the U.S. has expanded for the first time in over two years. In such an environment, identifying promising stocks often involves looking for companies that demonstrate strong fundamentals and adaptability to shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Komori | 9.28% | 8.79% | 64.70% | ★★★★★☆ |

| CMC | 1.42% | 1.60% | 10.14% | ★★★★★☆ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 43.84% | 7.58% | 32.78% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dynapack International Technology (TPEX:3211)

Simply Wall St Value Rating: ★★★★★★

Overview: Dynapack International Technology Corporation manufactures and sells lithium-ion battery packs in Taiwan, the United States, and internationally, with a market cap of NT$28.24 billion.

Operations: The primary revenue stream for Dynapack International Technology comes from the production and sales of hammer battery packs, generating NT$15.41 billion.

Dynapack International Technology, a smaller player in the electronics sector, has shown impressive financial performance recently. Its earnings surged by 290%, significantly outpacing the industry's 6.6% growth rate. The company reported a net income of NT$966.7 million for Q3 2024, up from NT$156.36 million the previous year, with basic EPS jumping to NT$6.36 from NT$1.04. A substantial one-off gain of NT$1.9 billion influenced these results over the past year, yet its debt-to-equity ratio improved remarkably from 75% to just under 9%. However, share price volatility remains a concern despite its attractive P/E ratio of 10x against the TW market's average of 21x.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

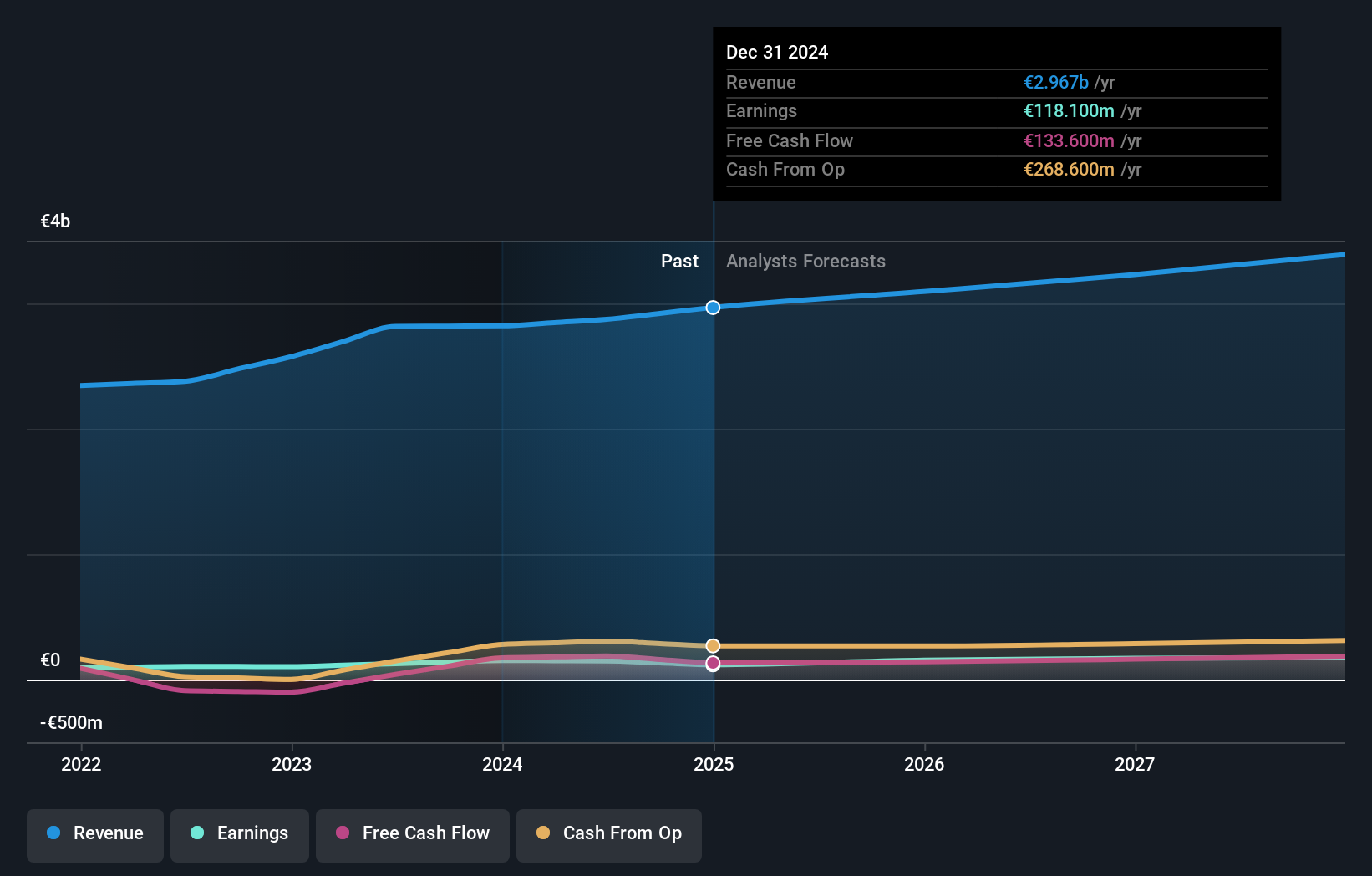

Overview: KSB SE & Co. KGaA, along with its subsidiaries, is a global manufacturer and supplier of pumps, valves, and related services with a market capitalization of approximately €1.17 billion.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million). The company's financial performance is influenced by these diverse revenue streams, with each contributing significantly to its overall income structure.

KSB SE KGaA, a notable player in the machinery sector, has seen earnings grow by 16.8% over the past year, outpacing industry averages. Despite a one-off loss of €102 million impacting recent financials, its debt to equity ratio impressively reduced from 9.2% to 0.8% over five years, indicating strong financial management. The company trades at an estimated 74.5% below fair value and holds more cash than total debt, suggesting robust fiscal health. With earnings growth forecasted at 7.62% annually and interest payments well-covered by profits, KSB seems poised for steady progress despite past challenges.

- Dive into the specifics of KSB SE KGaA here with our thorough health report.

Understand KSB SE KGaA's track record by examining our Past report.

OHB (XTRA:OHB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: OHB SE is a space and technology company operating in Germany, the rest of Europe, and internationally, with a market cap of approximately €1.11 billion.

Operations: OHB SE generates revenue primarily from its Space Systems segment, contributing €818.74 million, and the Aerospace segment, adding €129.26 million. The Digital division also contributes with €117.41 million in revenue.

OHB's recent performance paints a compelling picture, with earnings growth of 155.2% over the past year, outpacing the Aerospace & Defense sector's 25%. Despite a one-off loss of €37.8M impacting its financials, OHB reported a net income of €12.01M for Q3 2024, up from €5.31M the previous year. The price-to-earnings ratio stands at 16.6x, slightly below Germany's market average of 16.9x, indicating potential value for investors. While debt to equity has improved from 102.6% to 57.9% over five years, high net debt remains a concern at 52.6%, suggesting cautious optimism is warranted moving forward.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4687 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3211

Dynapack International Technology

Manufactures and sells lithium-ion battery packs in Taiwan, the United States, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success