NORMA Group (XTRA:NOEJ): Profitability Forecast to Rebound, Challenging Market Skepticism on Growth Path

Reviewed by Simply Wall St

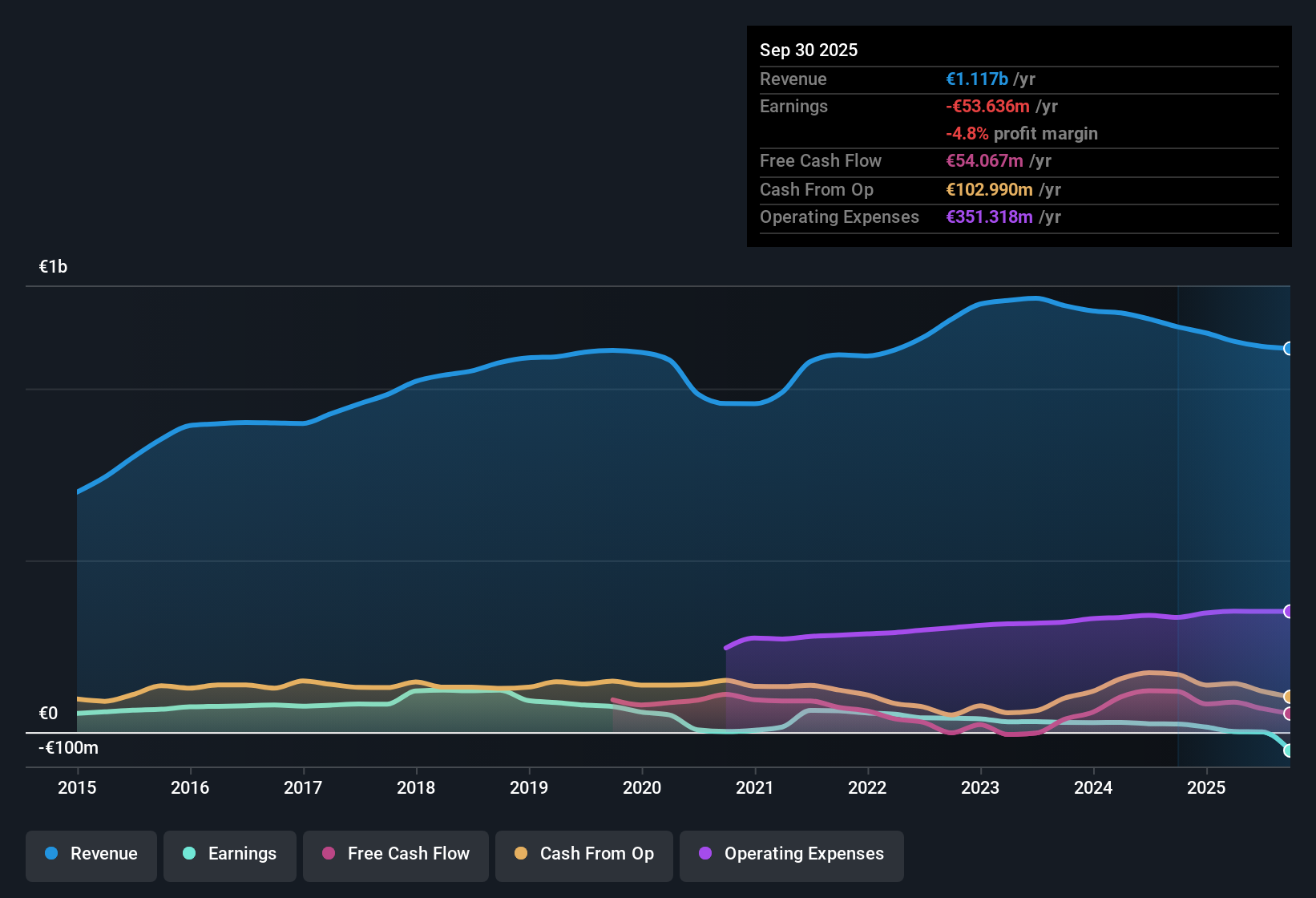

NORMA Group (XTRA:NOEJ) is expected to see revenue growth of 4.6% per year, which trails the broader German market’s 6.1% annual pace. The company remains unprofitable, with losses increasing at an average rate of 27.1% per year over the past five years. However, the outlook is brighter as analysts project a turnaround to profitability within three years, supported by robust expected earnings growth of 113.46% per year. In this context, the stock’s current valuation appears attractive relative to peers and industry benchmarks, signaling investor anticipation for a swift profitability rebound.

See our full analysis for NORMA Group.Now let’s see how these latest earnings projections measure up to the community narrative at Simply Wall St, and where the data might confirm or upend familiar market stories.

See what the community is saying about NORMA Group

Margins Poised for a Comeback

- Analysts expect profit margins to rise meaningfully from 0.1% now to 6.6% by 2028. This indicates a targeted turnaround in underlying earnings quality.

- According to the analysts' consensus narrative, this margin expansion is attributed to:

- Transformation initiatives such as manufacturing site consolidation and targeted operational savings. These are projected to yield cumulative cost reductions of €82.5 million to €91.5 million by 2028.

- A shift in business mix toward higher-growth, higher-margin segments in industry applications and electrified vehicles. This move lowers exposure to cyclical automotive sales and is expected to drive more stable, recurring revenues along with sustained margin improvement.

- The consensus narrative highlights execution risk. It notes that failure to deliver on restructuring and cost-saving targets could leave margins stagnant, particularly if market volatility or delays occur in planned organizational streamlining.

Consensus narrative questions if NORMA can actually meet these ambitious margin goals as planned, especially with operational transformation still in progress. 📊 Read the full NORMA Group Consensus Narrative.

Transformation Savings Set High Bar

- The company’s transformation program aims for cumulative savings between €82.5 million and €91.5 million by 2028, which is a crucial driver to support earnings improvement over the next three years.

- According to the analysts' consensus view, the transformation’s success depends on two key factors:

- Effective consolidation of production sites and administrative streamlining, which must materially lower ongoing costs to support higher future profitability and enable targeted double-digit group margins.

- Targeted M&A and divestments, such as the sale of the Water Management unit. These actions need to accelerate diversification across less cyclical, higher-margin sectors, with reinvested proceeds boosting the scale and scope of core operations and offsetting lost revenues from divested units.

Share Price Lags Target, Valuation Looks Cheap

- With a current share price of €13.44, NORMA Group trades at a notable discount compared to the one analyst target of €17.44. This suggests an implied upside of 29.7% for investors who agree with forward earnings estimates.

- The consensus narrative points out this valuation discount comes with conditions:

- To justify the analysts’ target, NORMA must deliver €1.3 billion in annual revenues and €84.6 million in earnings by 2028. Achieving this path is contingent on margin expansion and successful program execution.

- The market currently reflects skepticism about these optimistic projections, indicating investor caution given the heavy reliance on transformation gains and ongoing market volatility.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NORMA Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on the numbers? Bring your insights to the table and shape the story in just a few minutes. Do it your way.

A great starting point for your NORMA Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While analysts are optimistic, NORMA Group's earnings recovery is highly dependent on delivering ambitious cost savings and margin improvements. These goals remain uncertain.

If you want greater consistency, check out stable growth stocks screener (2083 results) to spot companies with proven records of steady revenue and earnings across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NORMA Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NOEJ

NORMA Group

Manufactures and sells engineered joining technology solutions in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives