Stock Analysis

Exploring Undervalued Stocks On The German Exchange With Discounts Ranging From 24.5% To 44.5%

Reviewed by Simply Wall St

Amid a backdrop of global economic fluctuations and regional tensions, Germany's DAX index recently experienced a notable decline, shedding 3.07% as investors navigated through a complex landscape of trade disputes and shifting market dynamics. This environment may present opportunities for astute investors to identify undervalued stocks that could be poised for recovery or growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stabilus (XTRA:STM) | €42.25 | €79.06 | 46.6% |

| technotrans (XTRA:TTR1) | €17.00 | €29.29 | 42% |

| Stratec (XTRA:SBS) | €41.45 | €81.52 | 49.2% |

| CHAPTERS Group (XTRA:CHG) | €24.00 | €43.25 | 44.5% |

| MTU Aero Engines (XTRA:MTX) | €253.10 | €421.48 | 39.9% |

| R. STAHL (XTRA:RSL2) | €18.50 | €29.24 | 36.7% |

| Vitesco Technologies Group (XTRA:VTSC) | €56.55 | €112.38 | 49.7% |

| INTERSHOP Communications (XTRA:ISHA) | €2.04 | €3.86 | 47.2% |

| Your Family Entertainment (DB:RTV) | €2.48 | €4.56 | 45.6% |

| Dr. Hönle (XTRA:HNL) | €17.60 | €34.78 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

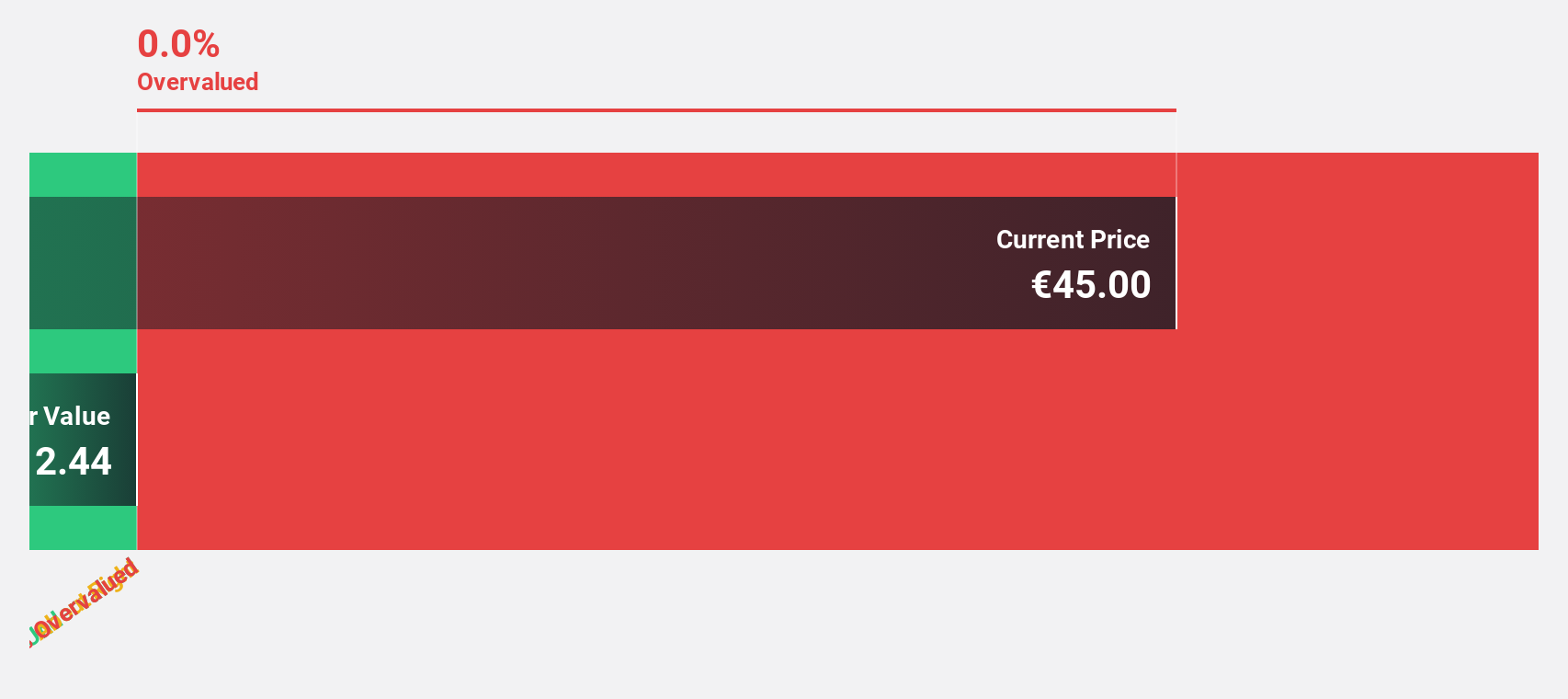

CHAPTERS Group (XTRA:CHG)

Overview: CHAPTERS Group AG operates in the DACH region, offering software solutions through its subsidiaries, with a market capitalization of approximately €0.47 billion.

Operations: The company generates €70.77 million from its data processing segment.

Estimated Discount To Fair Value: 44.5%

CHAPTERS Group AG, currently trading at €24, significantly below the estimated fair value of €43.25, shows promise as an undervalued stock based on cash flows in Germany. Despite a net loss of €4.08 million in 2023, improvements are evident with reduced losses from the previous year and a substantial increase in sales to €70.77 million from €42.07 million. The company's revenue is expected to grow by 20.8% annually, outpacing the German market average of 5.3%. However, shareholder dilution over the past year and a forecasted low return on equity at 13% suggest potential concerns.

- Our earnings growth report unveils the potential for significant increases in CHAPTERS Group's future results.

- Get an in-depth perspective on CHAPTERS Group's balance sheet by reading our health report here.

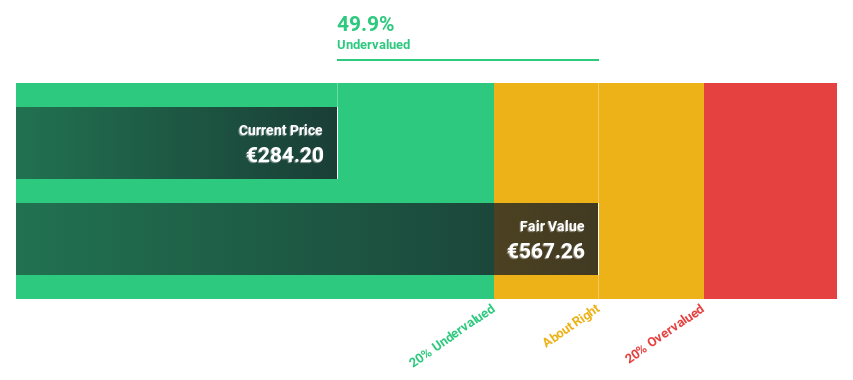

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG operates in the development, manufacture, marketing, and support of commercial and military aircraft engines and industrial gas turbines globally, with a market capitalization of approximately €13.62 billion.

Operations: The company generates revenue primarily from two segments: the Commercial Maintenance Business (MRO) which brought in €4.35 billion and the Commercial and Military Engine Business (OEM) which contributed €1.27 billion.

Estimated Discount To Fair Value: 39.9%

MTU Aero Engines AG, priced at €253.1, is valued below its estimated fair value of €421.48, indicating a significant undervaluation based on cash flows. The company's recent financials show a slight decline in net income from €134 million to €126 million year-over-year despite increased sales from €1.54 billion to €1.65 billion. Forecasted revenue growth at 12.1% annually surpasses the German market's 5.3%, and profitability is expected within three years with robust earnings growth projected at 34.95% annually.

- Our expertly prepared growth report on MTU Aero Engines implies its future financial outlook may be stronger than recent results.

- Take a closer look at MTU Aero Engines' balance sheet health here in our report.

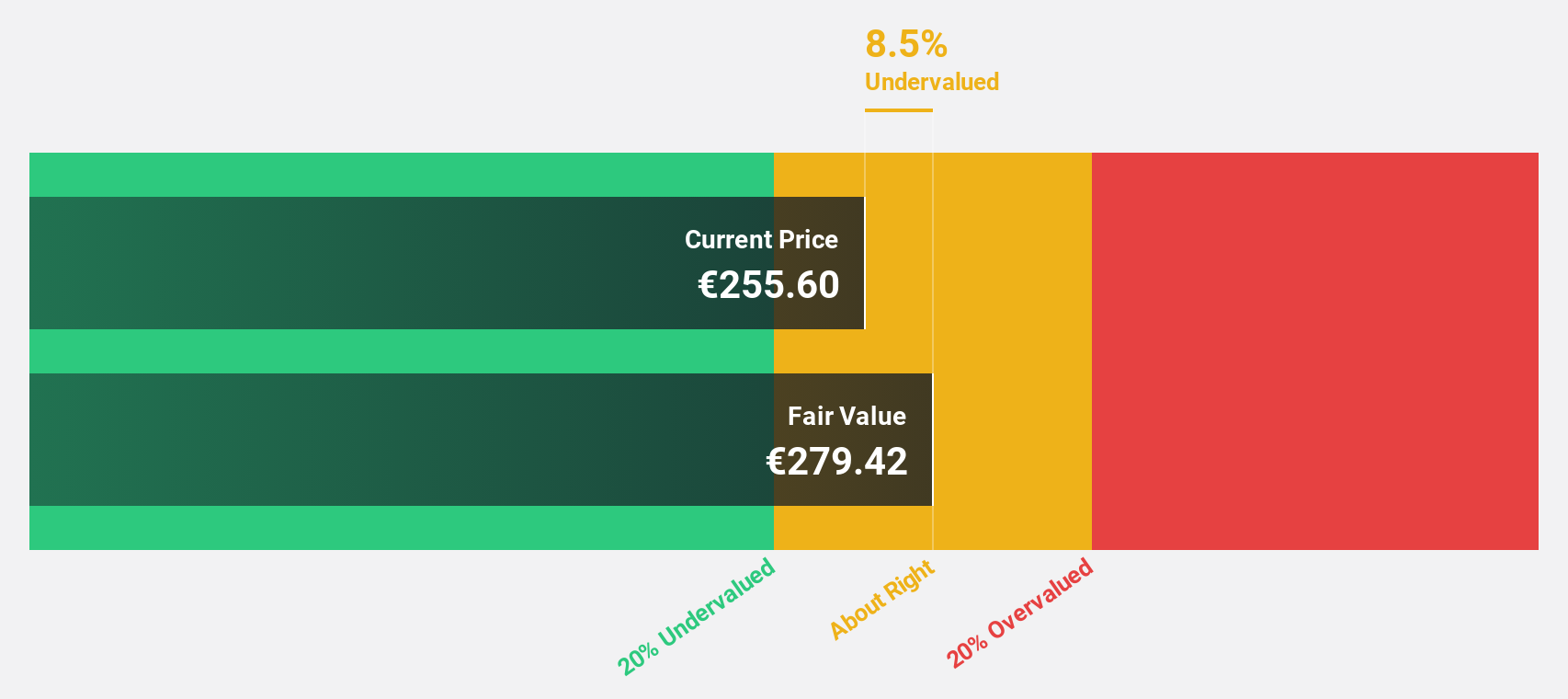

SAP (XTRA:SAP)

Overview: SAP SE operates globally, offering a wide range of applications, technology, and services through its subsidiaries, with a market capitalization of approximately €226.07 billion.

Operations: The company generates €32.54 billion from its Applications, Technology & Services segment.

Estimated Discount To Fair Value: 24.5%

SAP, priced at €193.82, trades 24.5% below its fair value of €256.86, reflecting potential undervaluation based on cash flows. With earnings growth anticipated at a significant rate annually over the next three years and revenue growth forecasted to outpace the German market average, SAP appears attractively positioned despite a recent drop in net income from €2.98 billion to €918 million in Q2 2024 and challenges like large one-off items affecting financial results. Additionally, strategic expansions like the Kyndryl partnership enhance its cloud solutions delivery capabilities.

- Insights from our recent growth report point to a promising forecast for SAP's business outlook.

- Navigate through the intricacies of SAP with our comprehensive financial health report here.

Make It Happen

- Gain an insight into the universe of 26 Undervalued German Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential.