KION GROUP (XTRA:KGX) Profit Margins Decline to 2%, Undercutting Bullish Growth Narrative

Reviewed by Simply Wall St

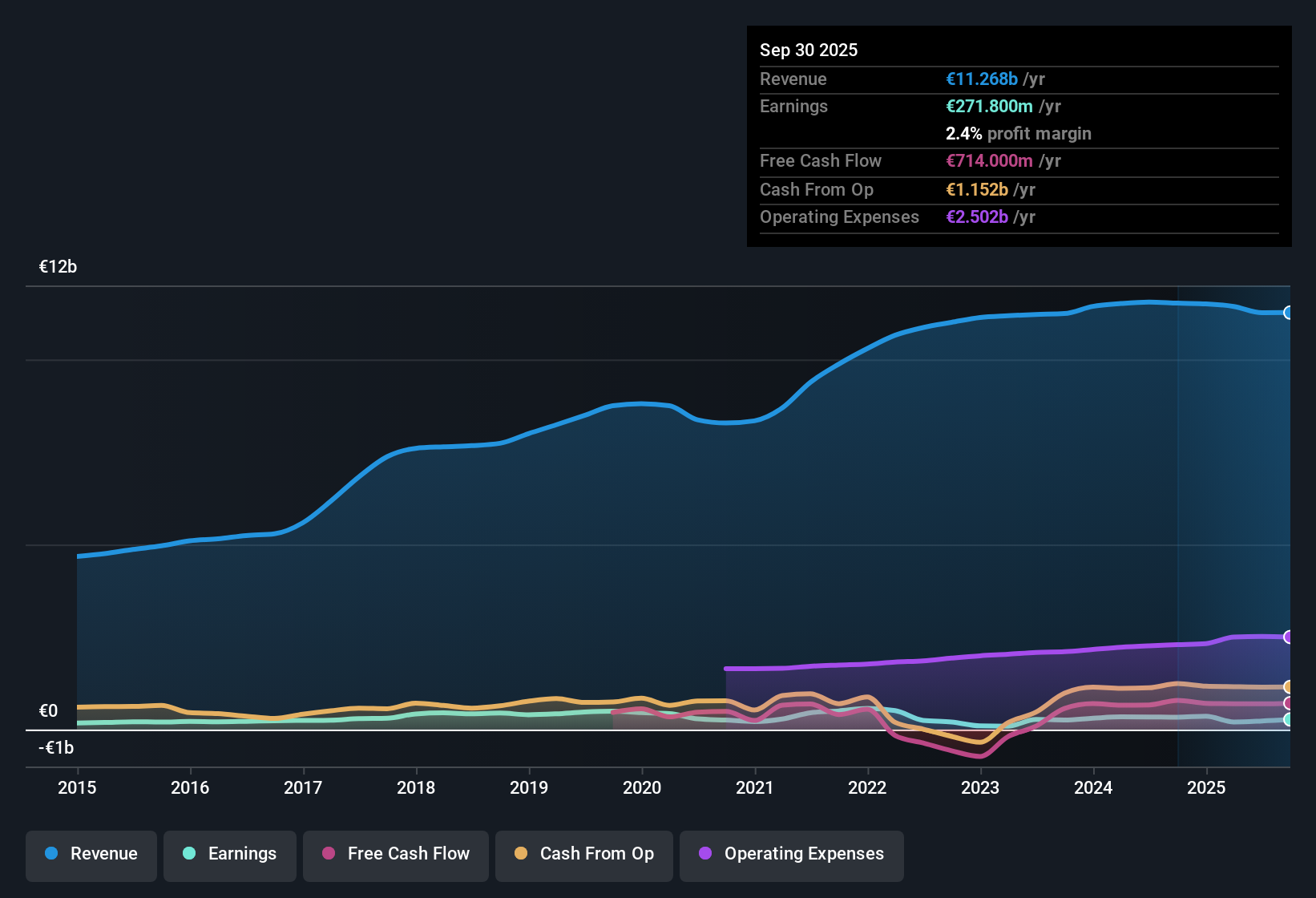

KION GROUP (XTRA:KGX) saw earnings decline by 6% per year over the past five years, with current net profit margins at 2% versus 2.9% a year ago. Looking forward, earnings are forecast to grow at a rapid 37.74% annually over the next three years, which is more than double the German market’s expected 16.7% per year. However, revenue projections of 5.6% trail the broader market. Investors are likely to weigh the recent contraction in profit margins and the multi-year decline in earnings against the upbeat growth forecasts and discounted share price.

See our full analysis for KION GROUP.Next, we’ll see how KION GROUP’s headline numbers stack up against the narratives shaping investor sentiment. Some expectations may be confirmed, while others are put to the test.

See what the community is saying about KION GROUP

Margin Expansion Hinges on Service Growth

- Analysts expect KION's profit margins to rise from 2.0% today to 6.2% within three years, signaling more than a tripling of margins if management can deliver on their stated targets and planned operational improvements.

- According to analysts' consensus view, a marked uptick in digital solutions and AI-driven automation, along with recovery in modernization and upgrade projects (up 57% year-on-year in the first half), is projected to drive higher-margin recurring revenues and sustained long-term earnings uplift.

- Consensus narrative highlights the company's ambition for double-digit EBIT margins by 2027, supported by margin tailwinds from strategic focus on service and efficiency gains in Supply Chain Solutions.

- This optimism is tempered by current reliance on e-commerce contracts, which made up 87% of Q2 orders and point to both opportunity and risk for margin durability.

- What’s interesting is how this anticipated margin surge aligns with KION's efforts in digitalization and global expansion, reinforcing the consensus that transformative projects could be a game changer for profitability.

📊 Read the full KION GROUP Consensus Narrative.

Valuation Looks Discounted Versus Fair Value

- Despite trading at a higher PE ratio than both its peer group (35.1x vs 33.6x) and the broader machinery industry (35.1x vs 20.8x), KION's current share price of €61.50 sits well below its DCF fair value of €99.09. This suggests potential undervaluation when future cash flows are considered.

- Analysts' consensus view draws attention to this valuation tension. The modest gap between the current share price and analysts' price target implies a balanced market verdict, while the much larger DCF-derived fair value signals greater upside if profit growth materializes.

- Analyst targets cluster around €61.60 (current: €61.50), with bullish projections up to €67.00 and bears as low as €36.00, indicating a wide divergence of opinion despite the stock's already high valuation by earnings multiples.

- Consensus sees the current level as broadly fair, but the deep DCF discount could sway sentiment if KION manages to deliver on its ambitious earnings projections.

Revenue Growth Relies on E-Commerce Orders

- 87% of Q2 orders in Supply Chain Solutions came from the e-commerce sector, highlighting substantial client concentration and direct sensitivity to trends in online retail and warehouse automation.

- According to analysts' consensus view, while strong demand from e-commerce and automation is supporting near-term growth, the lack of expansion across other customer segments elevates the risk that a slowdown in this single vertical could disrupt order visibility and earnings stability.

- Bears argue that sustained overreliance on e-commerce introduces risk, as delayed contract signings in non-e-commerce verticals could make recovery “lumpy” and expose KION to intermittent volatility.

- Consensus anticipates that as macroeconomic uncertainty eases, other segments may re-engage, paving the way for broader-based growth and reducing overdependence on a single sector.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for KION GROUP on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your perspective and craft a unique story of KION’s outlook in just a few minutes. Do it your way

A great starting point for your KION GROUP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

KION GROUP’s heavy dependence on e-commerce clients and volatile margins raise concerns about the consistency and reliability of its future growth.

If you’d prefer companies with steadier earnings and robust momentum across market cycles, check out stable growth stocks screener (2102 results) to discover those delivering reliable results even when trends shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KION GROUP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KGX

KION GROUP

Provides industrial trucks and supply chain solutions in Western and Eastern Europe, the Middle East, Africa, North America, Central and South America, China, and the rest of the Asia Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives