Knorr-Bremse (XTRA:KBX) Margin Drop Reinforces Profitability Concerns Despite Robust Growth Guidance

Reviewed by Simply Wall St

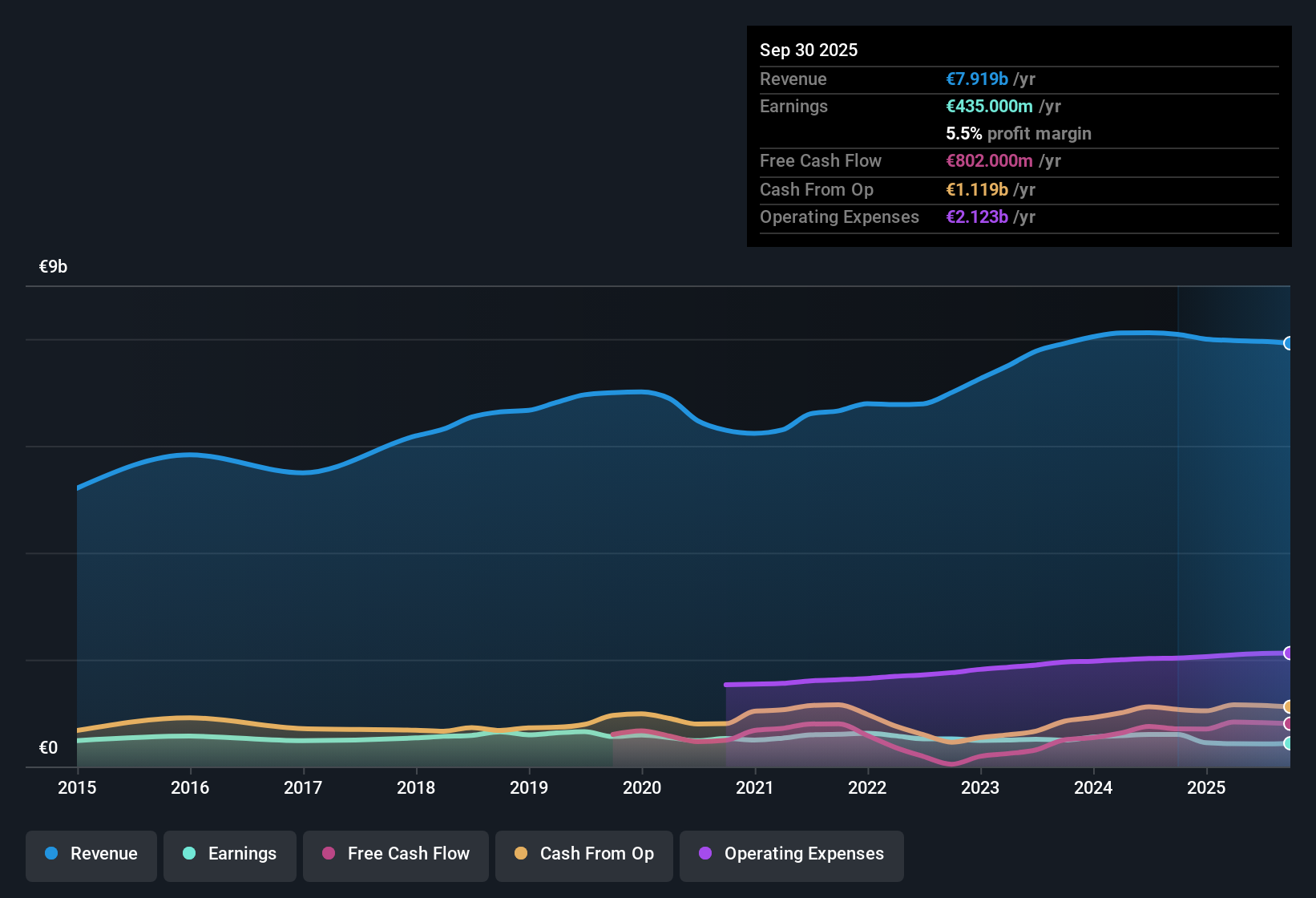

Knorr-Bremse (XTRA:KBX) is guiding for robust earnings growth of 15.55% per year, while revenue is forecast to increase 5.4% annually. Yet, the company’s net profit margin stands at 5.3%, down from 7.4% last year, reflecting a trend of earnings contraction with a 2.8% yearly decline over the past five years. Shares are currently trading at €80.7, well below the estimated fair value of €111.65, and the price-to-earnings ratio of 30.8x is lower than direct peers but higher than the wider German Machinery industry.

See our full analysis for Knorr-Bremse.The next section puts these latest results into context by testing them against the main narratives and expectations circulating in the market. Let's see where the numbers confirm or challenge common views.

See what the community is saying about Knorr-Bremse

Margin Expansion Targets Underpin Growth Narrative

- Analysts expect profit margins to grow from 5.3% today to 10.7% in three years, more than doubling the current level. This indicates a substantial structural shift in profitability rather than a short-term rebound.

- Analysts' consensus view highlights two reinforcing drivers behind these projected margin gains:

- Almost half of company revenues now come from aftermarket and digital solutions, with rail aftermarket contributing 59%. These areas generate higher, recurring margins that analysts see as providing much-needed earnings stability and margin resilience.

- Investments in automation and cost control, including relocations to lower-cost countries, are expected to lower the breakeven point and create significant earnings leverage when cyclical recovery kicks in. This directly strengthens the bull case for margin recovery.

- For those tracking long-term profitability, the projected margin lift substantially supports the market's expectation for a turnaround, even as recent history points to sustained contraction.

Want to see how analysts think Knorr-Bremse's margin story can reshape its long-term outlook? 📊 Read the full Knorr-Bremse Consensus Narrative.

Acquisition Strategy Sparks Debate on Core Strength

- Knorr-Bremse’s growth assumptions rely in part on successful acquisitions, with analysts projecting that earnings will rise from €422.0 million to €979.1 million by 2028. Achieving this forecast depends on both operational execution and M&A momentum.

- Analysts' consensus view flags a nuanced risk:

- The company’s heavy dependence on external growth, including the integration of deals like KB Signaling, means that core, underlying profitability may be flatter than headline gains suggest. If these deals underperform, revenue and margins could fall short of expectations.

- This structural issue leaves future returns exposed if M&A opportunities dry up or if the complexity of integrating new businesses undermines margin progression. This could keep a lid on organic earnings growth.

Valuation Anchored by Discount to DCF and Peers

- Knorr-Bremse trades at €80.7 per share, which is not only 27.7% below its DCF fair value of €111.65 but also at a price-to-earnings ratio (30.8x) that ranks cheaper than its direct peer average (34.1x), yet more expensive than the German Machinery industry (20.9x).

- Analysts' consensus view draws out the tension in this valuation:

- The current share price is just 3.9% below the analyst price target of €88.64, suggesting the market already prices in much of the anticipated margin and revenue recovery. Any misstep on execution or delays in digital expansion could limit upside.

- At the same time, the significant discount to DCF fair value shows that if growth catalysts and cost initiatives deliver as forecast, Knorr-Bremse could command a sharply higher valuation, particularly if margins track toward the 10.7% target and aftermarket revenue surpasses expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Knorr-Bremse on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your interpretation and craft a personal narrative in just a few minutes with Do it your way.

A great starting point for your Knorr-Bremse research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Knorr-Bremse’s reliance on acquisitions and uncertain organic margin recovery means core profitability may lag. This could leave future growth exposed to execution risks.

If you prefer companies delivering consistent revenue and earnings expansion, use stable growth stocks screener (2112 results) to target opportunities with steady momentum through all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knorr-Bremse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KBX

Knorr-Bremse

Develops, produces, and markets brake systems for rail and commercial vehicles and other safety-critical systems worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives