- Netherlands

- /

- Construction

- /

- ENXTAM:HEIJM

European Dividend Stocks To Watch In February 2025

Reviewed by Simply Wall St

As European markets navigate cautious optimism amid U.S. trade policy developments and efforts to resolve the Russia-Ukraine conflict, the pan-European STOXX Europe 600 Index has seen a modest increase. In this environment, dividend stocks continue to attract attention for their potential to provide steady income streams and act as a buffer against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Mapfre (BME:MAP) | 5.95% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.85% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.31% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.30% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.51% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.39% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 7.29% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 6.58% | ★★★★★☆ |

Click here to see the full list of 215 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

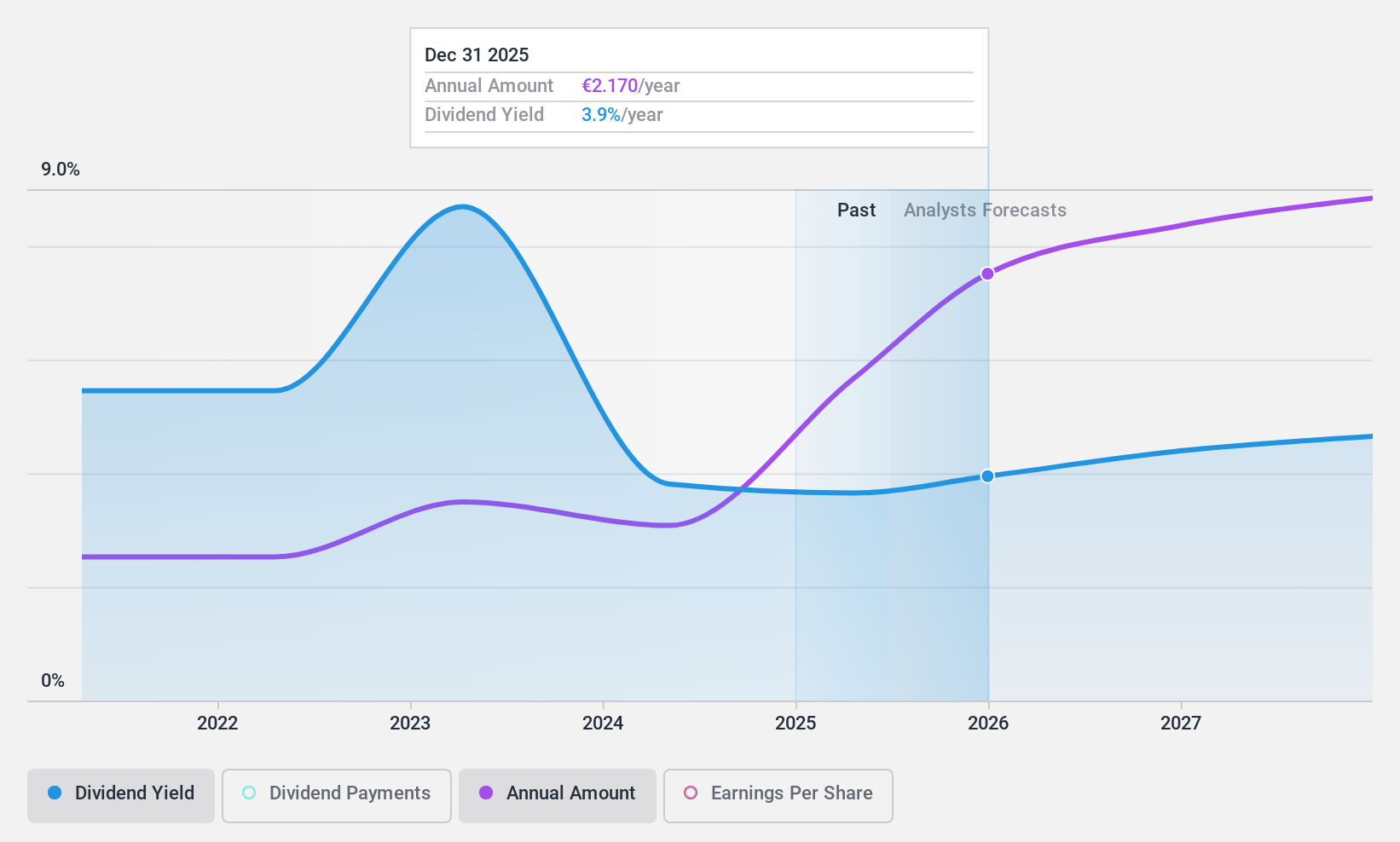

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €1.06 billion.

Operations: Koninklijke Heijmans N.V. generates revenue through its Living segment (€994 million), Working segment (€635 million), and Connecting segment (€997 million).

Dividend Yield: 4.1%

Koninklijke Heijmans offers a dividend of EUR 1.64 per share with strong coverage by cash flows, indicated by a low cash payout ratio of 20.1%. Despite past volatility in dividends, recent increases highlight growth potential. The company's earnings grew significantly last year, supporting the sustainability of its dividends with a payout ratio of 49.5%. However, its dividend yield is lower than top-tier Dutch payers, and share price volatility may concern some investors.

- Click here to discover the nuances of Koninklijke Heijmans with our detailed analytical dividend report.

- According our valuation report, there's an indication that Koninklijke Heijmans' share price might be on the cheaper side.

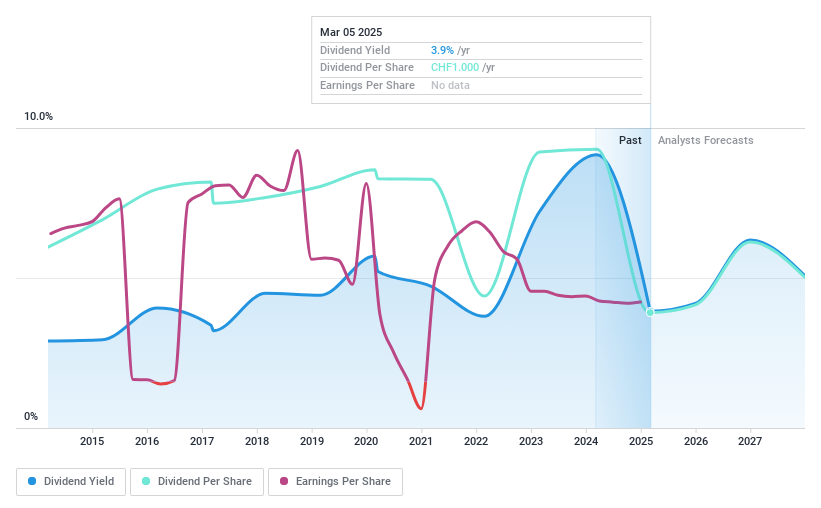

Adecco Group (SWX:ADEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Adecco Group AG, with a market cap of CHF4.10 billion, offers human resource services across Europe, North America, Asia Pacific, South America, and North Africa.

Operations: Adecco Group AG generates revenue through its provision of human resource services across various regions, including Europe, North America, Asia Pacific, South America, and North Africa.

Dividend Yield: 9.6%

Adecco Group's dividend yield of 9.63% ranks in the top 25% of Swiss payers, yet its high payout ratio of 149.1% indicates dividends aren't well covered by earnings, though cash flows provide some support with a 75% cash payout ratio. Recent earnings reported sales at €23.14 billion and net income at €303 million for 2024, both slightly down from the previous year, while an expanded partnership with Bullhorn aims to enhance profitability through AI integration across recruitment processes.

- Get an in-depth perspective on Adecco Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Adecco Group's current price could be quite moderate.

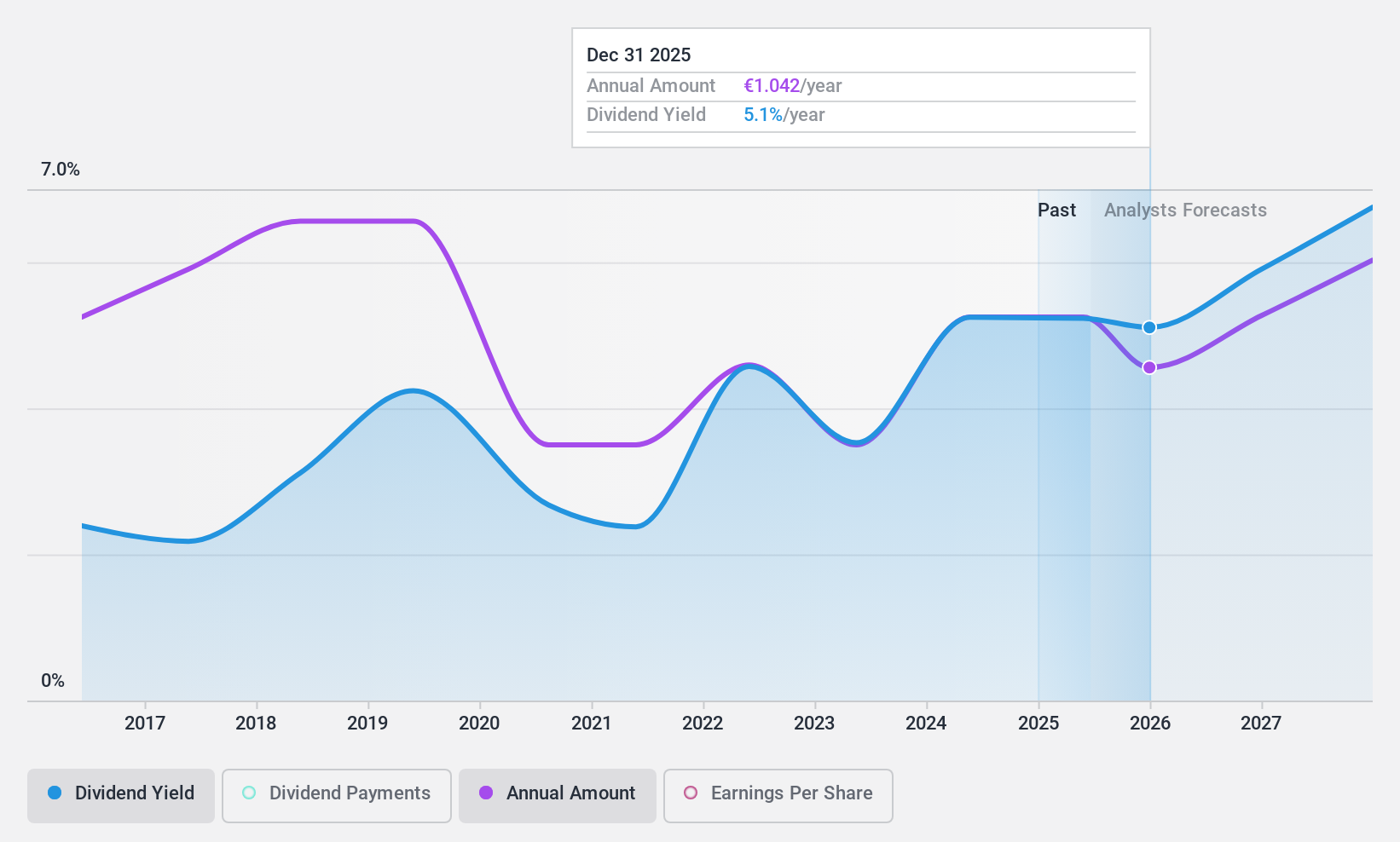

INDUS Holding (XTRA:INH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: INDUS Holding AG is a private equity firm that focuses on mergers, acquisitions, and corporate spin-offs, with a market cap of €607.49 million.

Operations: INDUS Holding AG's revenue is primarily derived from its Materials segment at €573.57 million, Engineering at €585.87 million, and Infrastructure at €562.75 million.

Dividend Yield: 5.1%

INDUS Holding's dividend yield of 5.06% places it among the top 25% in Germany, supported by a sustainable payout ratio of 51.1%. Despite this, its dividends have been unreliable and volatile over the past decade. The company's cash payout ratio is low at 24.6%, indicating strong coverage by cash flows, though profit margins have decreased from last year. Trading significantly below fair value and relative to peers offers potential value for investors despite high debt levels.

- Navigate through the intricacies of INDUS Holding with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of INDUS Holding shares in the market.

Turning Ideas Into Actions

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 212 more companies for you to explore.Click here to unveil our expertly curated list of 215 Top European Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Heijmans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIJM

Koninklijke Heijmans

Engages in the real estate, construction, and infrastructure businesses in the Netherlands and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives